While rapidly easing US headline inflation in the next few months is baked into the cake, there is much more uncertainty for the end of 2023 – and beyond. The NFIB survey of businesses’ salary plans suggests that wage growth will not fall much below 5% before the end of the summer – a level clearly inconsistent with underlying inflation sustainability at 2%.

However, we think the evolution of aggregate demand vs aggregate supply – what determines inflation in the medium-term – will push inflation down close to 2% by Q4 2023. Aggregate demand is expected to fall in 2023 (-0.3% GDP drop), while the recovery should remain quite subdued in 2024. The Fed is committed to keeping rates high for long. Its powerful channel of influence on inflation is through property prices, which lead rent inflation by roughly 12 months. Property prices are set to decline more than -10% peak-to-trough, as we have shown in an earlier publication[1]. On the fiscal front, the federal government is unlikely to loosen the purse strings amid political infighting in Congress. State governments face deteriorating public finances prospects and will likely embark on tightening before long. Meanwhile, on the supply side, the US economy seems to have withstood the pandemic shock relatively well, albeit with lower labor force participation. The combination of weak demand and resilient supply means that inflation will move back to close to 2% in a context of anchored medium-term inflation expectations.

Eurozone inflation—sharp drop, thanks to energy subsidies, but sticky core inflation this year

In December, Eurozone headline inflation fell for the first time since the beginning of 2021 to 9.2 % y/y, down from 10.1% during the previous month. A key driver was the declining contribution of energy prices, especially in Germany, where inflation slowed to 8.6% y/y (not seasonally adjusted), thanks in large part to government gas and heating subsidies. This brings annual inflation to less than 8% y/y (and below our initial forecast of average inflation of 8.5% in our last economic outlook in December. However, inflation dynamics remain strong, especially for services. In addition, Inflation may well rise again in January since the German measures were a one-off. Nonetheless, inflation will remain uncomfortably high during this quarter before falling from Q2 onwards, when the German gas and electricity price caps kick in.

Core inflation will likely stay at 4% until the end of the year due to continued (albeit abating) wage pressures. Survey measures of hiring intentions, including the employment component of the PMI, point to only a modest increase in the unemployment rate this year. In addition, the latest activity and sentiment data suggest a milder recession in H1 2023, with activity declining at a slower pace in the last month of 2022.

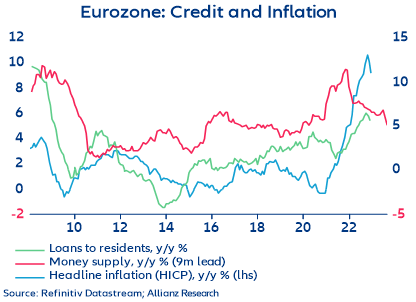

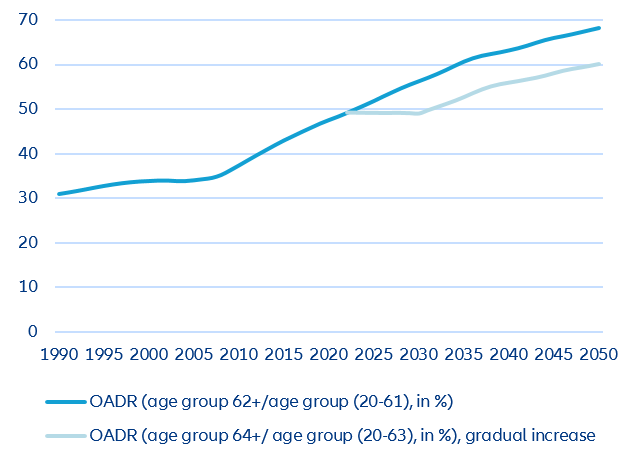

Weaker nominal growth of monetary supply could become a more prominent driver of slowing inflation (Figure 2). Underlying credit growth, albeit weaking slightly m/m, remained positive, and banks are still lending to corporates and households at a healthy rate. Real M1 in November fell further below zero to

-7.7% y/y from -6.8% in October, the lowest since records began in 2001. The underlying message remained more positive, with the credit growth to non-financial corporates, which remained strong at 7.3% in November, slightly lower than the 8.1% in October. Loans to households adjusted at a more modest pace to 3.9%, down from 4.1% a month earlier.

Strong core inflation and economic surprises will make it easier for the ECB to maintain a hawkish stance, suggesting further euro appreciation. Energy concerns that loomed large as a euro-negative in mid-2022 are beginning to ebb. The structural resilience of labor markets will delay a pivot in monetary policy until next year and keep financing conditions tighter for longer. The ECB has made it clear that its big fear is entrenched inflation, which is more likely to be reflected in rising core inflation.

Figure 2 – Eurozone: credit, inflation and money growth