As expected the Bank of Canada (BoC) raised its overnight policy interest rate from 0.25% to 0.5% to fend off inflation. The BoC started tapering it’s QE program in April of 2021, a year ahead of the Fed.

In the accompanying statement the BoC acknowledged risks to inflation but also a strong economy.

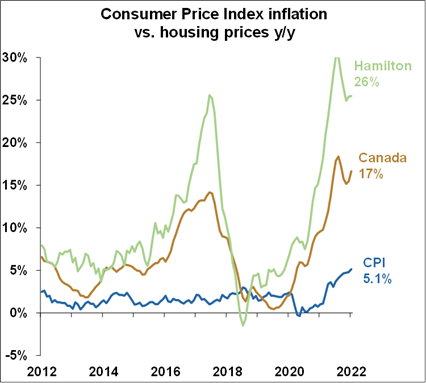

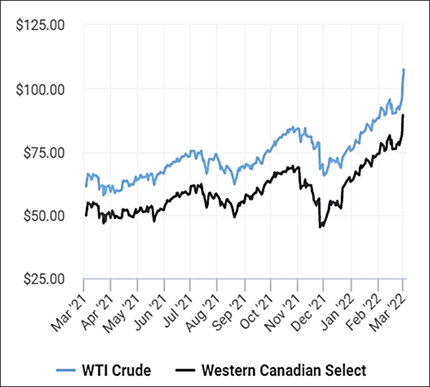

- “CPI inflation is currently at 5.1%, as expected in January, and remains well above the Bank’s target range. Price increases have become more pervasive, and measures of core inflation have all risen. Poor harvests and higher transportation costs have pushed up food prices. The invasion of Ukraine is putting further upward pressure on prices for both energy and food-related commodities. All told, inflation is now expected to be higher in the near term than projected in January. Persistently elevated inflation is increasing the risk that longer-run inflation expectations could drift upwards…. Economic growth in Canada was very strong in the fourth quarter of last year at 6.7%. This is stronger than the Bank’s projection and confirms its view that economic slack has been absorbed.”