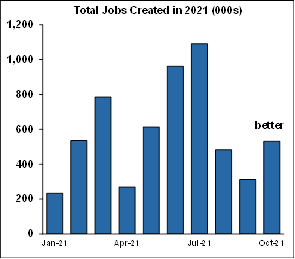

The October employment report was significantly stronger than expected. Expectations beforehand had been that the economy would have created 400-450k jobs. Instead the economy gained 531k jobs, substantially above those expectations.

In addition, there were big upward revisions to the prior two reports which had been rather dreary. Job growth in September was revised up from a tepid 194k to a warmer 312k, while August was revised up from 366k to 483k; overall the revisions added 235k more jobs than previously estimated.

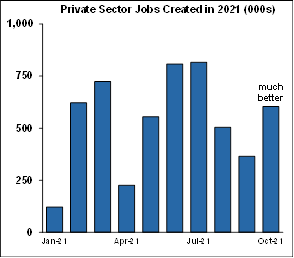

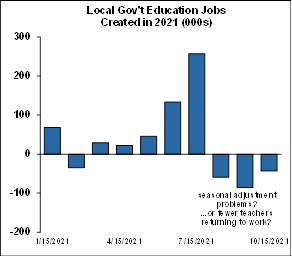

Government jobs fell for the third consecutive month, losing a total of -147k over that period. More than all of it was due to a category called “Local government educational services” which are basically public schools. Either the Bureau of Labor Statistics (BLS) seasonal adjustments haven’t been tweaked to account for new patterns in school openings, or there really are fewer teachers and staff returning to school. It’s impossible to tell just from this data.

Private sector jobs were a blowout, gaining 604k, far above expectations. Gains were widespread across virtually every industry.