The changing face of retail showed up in the numbers. Retail jobs, mostly brick and mortar, fell by -35k, the first loss since the end of the pandemic. Where did they go? Why to Amazon of course, and the related warehousing and transportation jobs. That industry gained a huge 145k which was the second-largest increase ever since records started in 1972, and it accounted for more than half of the total gains for the month.

That pattern was confirmed on Black Friday, and according to one report, holiday retail sales at brick and mortar stores that day were down -52.1% from last year. That’s not a misprint, that’s not down -5% which would have been bad, that’s not down -15% which would have been catastrophic, that’s down -52.1%. By a marked contrast, on the same day, online sales surged a dramatic 21.6% as expected.

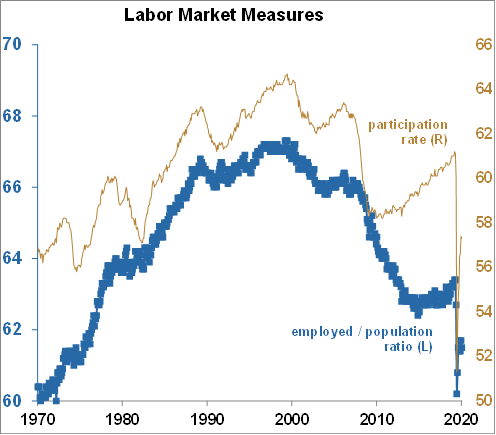

Returning to the employment report, the unemployment rate fell from 6.9% to 6.7%, which is fine, but really the participation rate (the percentage of the population working or looking for work) and the employment / population ratio (the percentage of the population actually working) are in this case more important indicators of labor market health. Both of those collapsed in March and April and have recovered, but the participation rate is the lowest it’s been in 37 years, and the employment / population ratio is the lowest it’s been in 43 years.

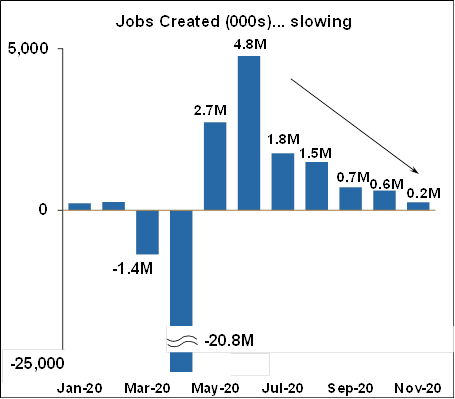

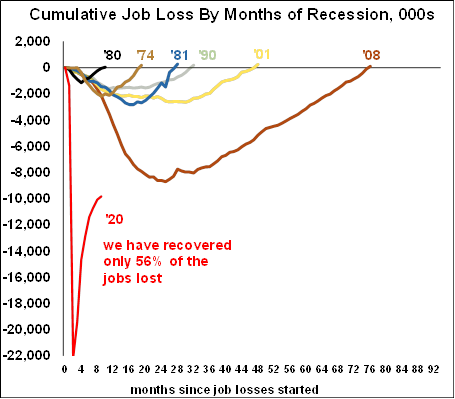

Overall it was a pretty disappointing report. But December looks even worse. With all of the shutdowns which were put into place since the data for this report was collected, and with all of the shutdowns to come (see below), there are whispers that we could actually see job losses in December.

As noted in a previously, part of the CARES act created two new unemployment benefit programs, the Pandemic Unemployment Assistance (PUA) program, and the Pandemic Emergency Unemployment Compensation (PEUC) program. The latest data as of November 14th shows 8.9 million people on the PUA and 4.6 million people on the PEUC. That’s a total of 13.5 million people. By comparison, there are only 5.5 million people on the usual state programs. Unfortunately, both the PUA and the PEUC are set to expire on December 26th.

The timing couldn’t possibly be worse.

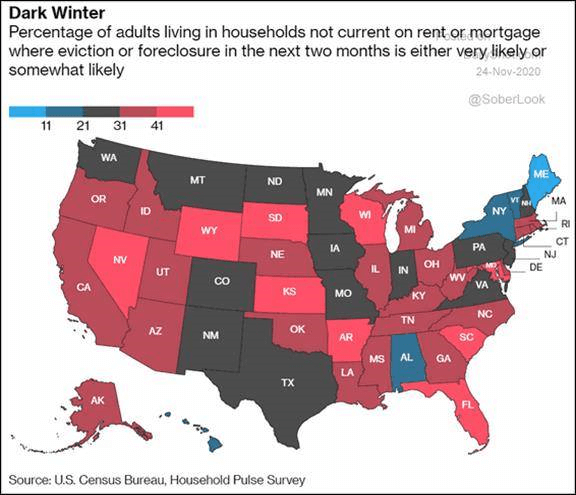

One might suspect that if you are one of the 13.5 million people who are going to lose benefits on December 26th, you are probably not going to spend a lot, if anything, on gifts for the 25th, and that will be a drag on consumption. More importantly, the moratorium on evictions is also up at the end of the year, and there are now 30 to 40 million people facing the possibility of eviction. I can’t really imagine that would happen, but it’s an utterly shocking number. A relief package is needed, it’s as simple as that, despite my strong aversion to government spending in general. The headlines change every few hours, but it’s time for government officials to act. I really try to avoid political statements, but one suspects that if Mnuchin, Pelosi, Schumer, and McConnell were facing eviction, a deal would get done.

Speaking of government, there are several important dates coming up:

- December 10th: House adjourns

- December 11th: Federal government spending expires, potential government shutdown

- December 18th: Senate adjourns

- December 26th: Pandemic Unemployment Assistance (PUA) runs out

- December 26th: Pandemic Emergency Unemployment Compensation (PEUC) runs out

- December 31st: Moratorium on evictions expires

- December 31st: Treasury to end emergency Fed lending programs

- January 3rd, 2021: House and Senate return

- January 5th, 2021: Georgia Senate runoff elections

- January 20th, 2021: Biden takes office

First, note the possibility of a government shutdown on the 11th. It’s happened 21 times since 1976. Several were for one day only, some were for just a few days, but the longest one was in 2018-2019 for 35 days. We could do without more chaos but I couldn’t possibly guess what’s going to happen.

Much more importantly, however, the Georgia Senate races are truly critical. If the Democrats win both of them they will have the majority in the Senate and it will make it much easier to pass Democratic legislation. If the Republicans win just one of the elections, then they will hold the majority and will be able to block Democratic legislation. Historically, the combination of a Republican Senate with a Democratic President has been very positive for the stock market (and to a certain extent the economy) since it provides some degree of certainty. It helps block the passage of major legislation and thus helps maintain the status quo. In this case, it would make it harder to increase taxes and regulations, both of which the stock market dislikes. These elections will therefore have a profound effect on the first half of Biden’s term and on policy affecting the nation.

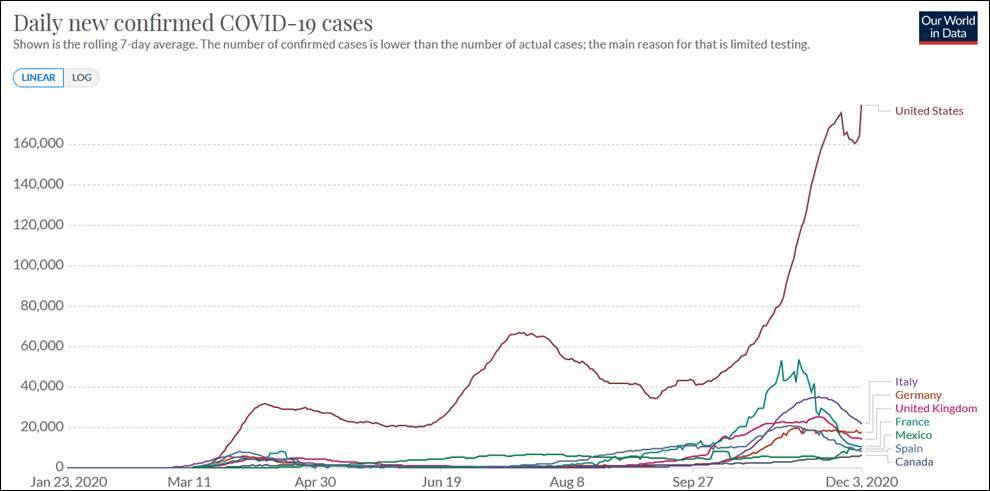

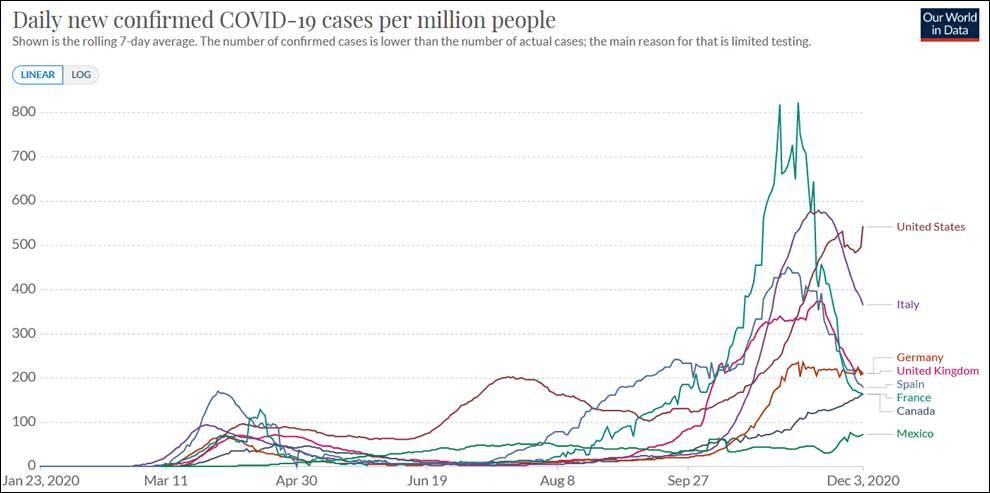

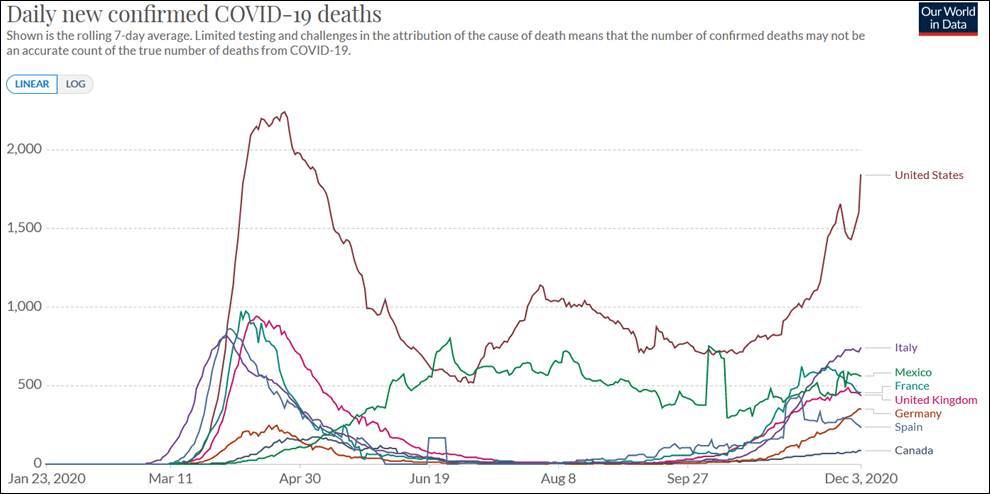

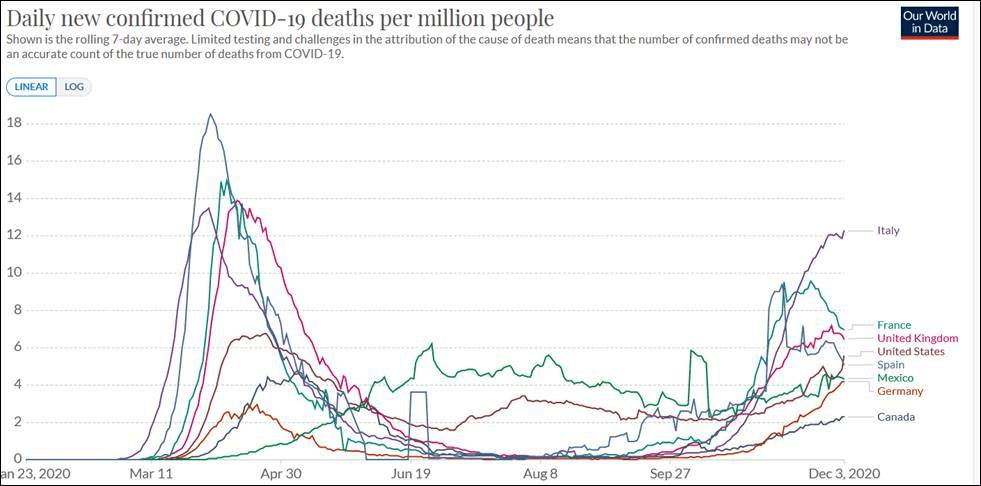

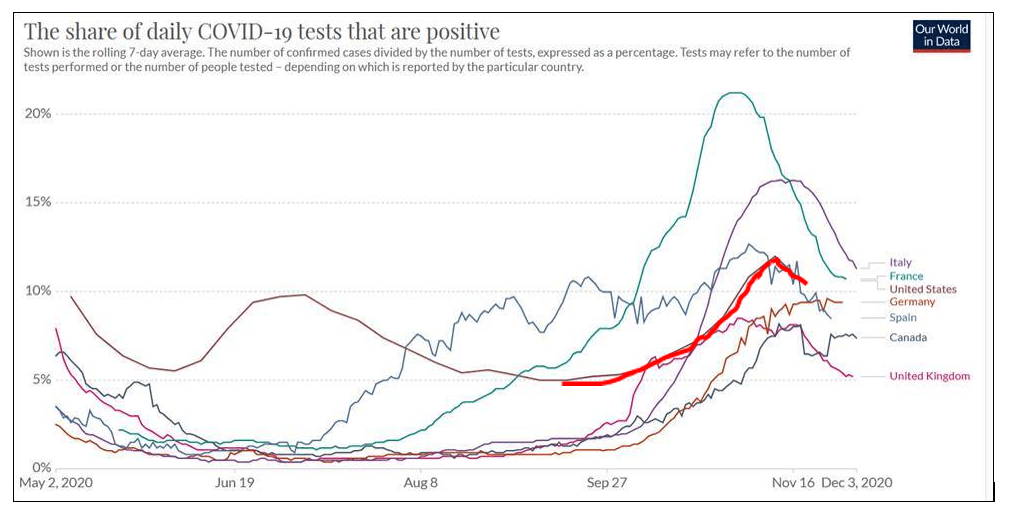

One of the other major features of the economic landscape is COVID-19 of course, I have provided several charts here since I think it’s important to get a good understanding of the situation.

Daily new cases: no doubt that more shutdowns are coming.

In addition to the shutdowns coming, many States have already started making more restrictions and shutdowns, once again putting people out of work. That’s why, as I mentioned above, it’s possible we could actually see a negative employment report in December.

Okay, that’s a lot of grim news, but that’s not all of the news. It’s only part of the story, and it’s not all bad:

- Both the manufacturing and services ISM indexes are well into expansionary territory

- The yield curve is positive

- The housing market is on fire

- Corporate earnings growth has been quite strong, due in part to a low base

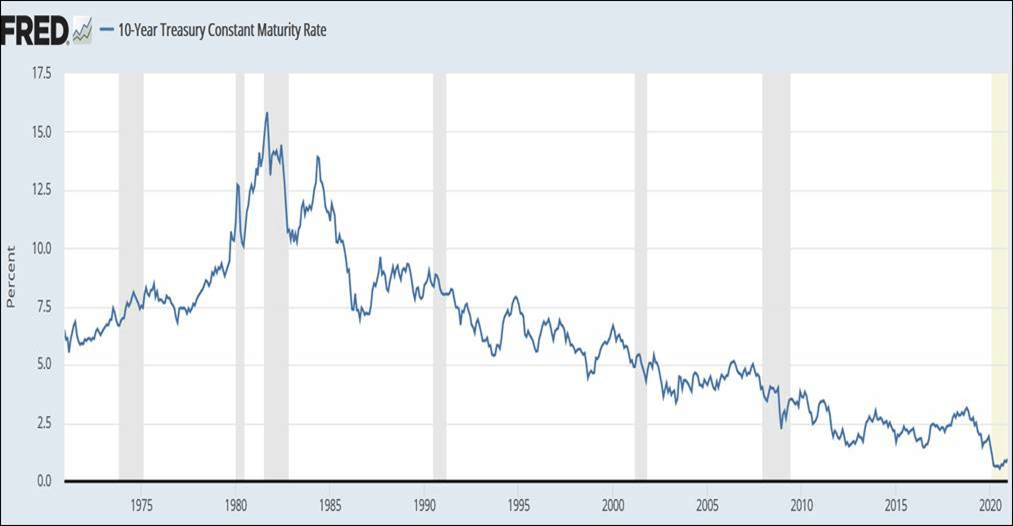

- Interest rates are incredibly low. Pundits are wringing their hands that the 10 year Treasury note might actually soar through 1%. Goodness. A little history shown by the chart provides some perspective. Look at the numbers – it was over 15% in the 1980s

- All of these factors are driving a white hot stock market

Get economic & trade content in your inbox

Sign up for our newsletters to make sure you don't miss anything.