Executive summary

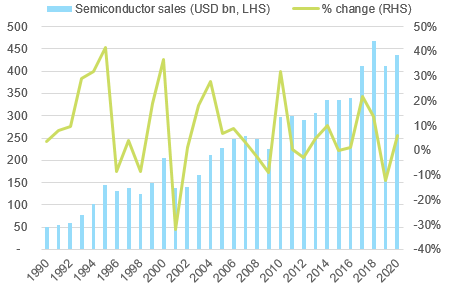

- The recent shortages of chips used in the automotive industry highlight the growing ubiquity and critical nature of semiconductors, which are the essential components that power the USD3,000bn IT industry.

- Semiconductors have been identified as a priority target for China’s Dual Circulation strategy introduced in 2020. Drawing on the Made in China 2025 plan introduced in 2015, the country’s 15th five-year plan (2021-2026), due to be presented in March, will seek to accelerate its transformation into a major high-tech manufacturing hub.

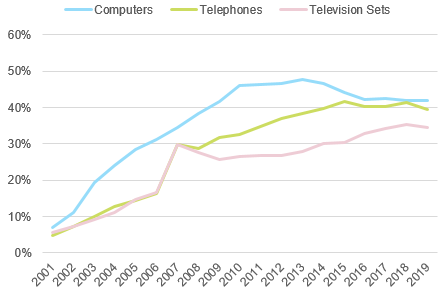

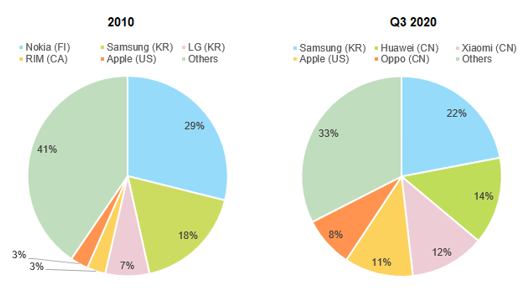

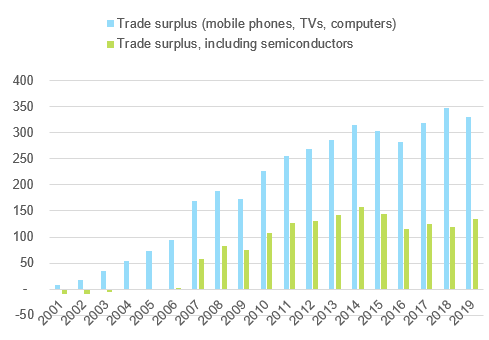

- China’s ambitions are the continuation of a successful strategy initiated decades ago that saw it emerge as the world’s factory for consumer electronics goods in the 2000s. After joining the WTO in 2001, China generated a cumulated USD3,700bn trade surplus from computers, televisions sets and telephones over the next two decades. Chinese brands then emerged in the 2010s as strong challengers to well-established US, South Korean and Japanese consumer electronics brands, featuring prominently across all major product markets. More than 60% of the 1.3bn smartphones sold in the world in 2020 were designed and marketed by China-based companies.

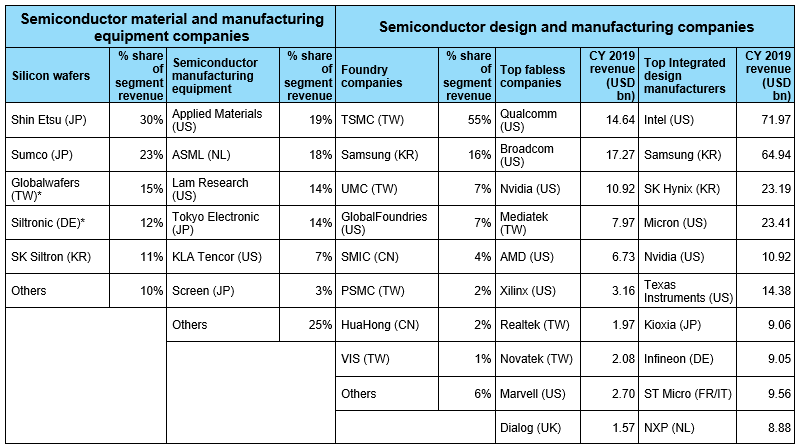

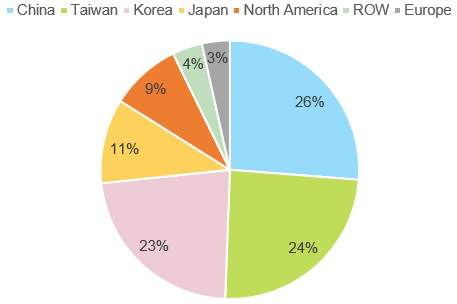

- China’s rise as a top assembler and designer of consumer electronics has come along with a trade deficit oscillating around USD200bn per year for semiconductors. The country has fallen short of its objective to cover 40% of its domestic semiconductor needs by 2020 and cannot realistically hope to reach the 70% target assigned for 2025. No Chinese company has yet emerged as a strong challenger to the American, South Korean and Taiwanese companies that dominate the semiconductor value chain.

- However, it would be misleading to judge China’s progress by only looking at its capacity to reach targets that were puzzling from the start. The past examples of South Korea and Taiwan show that strong positions in key segments of the semiconductor industry take decades to build.

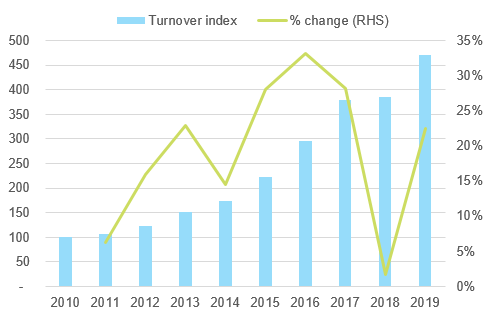

- Quite the contrary, Chinese semiconductor companies have broadly outperformed global competition in terms of growth in the past few years. Because they started from a too distant position, with a very significant technological lag, and because progress has been patchy across segments, they do not show up yet in the leaders ranking. Very tangible progress has also been made in the acquisition of more advanced capabilities in semiconductor design and manufacturing or the US would not have taken measures aimed at slowing down China’s emerging champions in the first place.

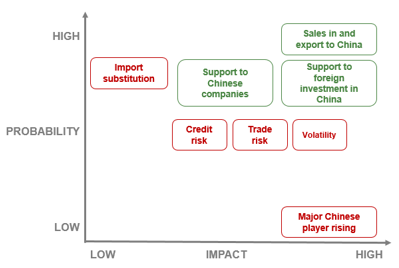

- The Chinese market for semiconductors and semiconductor manufacturing equipment will generate opportunities close to USD1,000bn by 2025. While Chinese authorities will double down on efforts to promote domestic companies, we also anticipate renewed incentives aimed at stimulating foreign investment in the semiconductor sector – China is just not in a position yet to rely exclusively on homegrown technologies.

- Irrespective of its exact outcome, China’s strategy will create a risk of import substitution by local production for countries exporting chips relying on mature technologies and serving well-established industries. It is also likely to create additional significant credit incidents among Chinese companies because of the high stake, high risk nature of breakneck expansion in such a R&D and capital-intensive industry. Because China’s strategy is intended to boost both supply and demand, it could also reinforce volatility in an industry seeing one recession every four to five years on average. Last, there is also higher risk of the US starting a new trade dispute with China over worries of the use of advanced chips in critical industries (defense, aerospace etc.) and the idea of its leadership in semiconductor technology being threatened.