Summary

Today’s policy announcements were geared in particular towards easing liquidity conditions but left the job unfinished with regard to boosting the ECB’s ability to backstop Eurozone debt markets. Hence, we think the ECB will soon be forced to pull another trick out of its hat to impress markets and calm growing debt sustainability concerns. In order to cap Italian risk spreads at 280-300bps, the ECB’s increasingly explicit policy objective, we expect an announcement as soon as June that it will (1) buy “fallen angels” i.e. bonds that have lost their investment-grade credit rating and (2) double down on PEPP in size as well as duration. Going down this route will see the ECB hold 50% of Eurozone government bonds by 2023. It is high time for the ECB to step up its game: our analysis shows that in its Covid-19 crisis response, it has so far only been half as proactive as the Fed.

ECB: Largely on hold today…

As we expected, the ECB remained on hold today, leaving all key rates unchanged at record lows and announcing no further step-up in asset purchases, albeit stating its readiness to do so. The ECB did, however, announce some measures geared towards further easing liquidity conditions, including (1) a new round of cheap long-term loans to banks (PELTROs) that is subject to a fixed rate tender with full allotment, at an interest rate 25bp below the main refinancing rate, and (2) more favorable terms on TLTRO III operations for the period June 2020-June 2021, with interest rates as low as -1.0% for banks that reach their lending threshold.

…but expect big moves in the coming months

As government bonds in Italy and Spain remain under pressure, the ECB will soon be forced to pull another trick out of its hat in an effort to impress markets and calm growing debt sustainability concerns. This is particularly true given that last week’s EU leaders’ summit produced no major break-through. While leaders in principle agreed on the need for an EU Recovery Fund, key questions around size, financing and the form of support remained unanswered. We expect markets to continue to test the ECB as the Eurozone’s last line of defense until they receive another strong signal of its commitment to act as a backstop to governments. By failing to come up with an adequate political solution, EU leaders have provided implicit consent for debt mutualization through the back door not only to be continued but even stepped up.

The job for the ECB has only just begun

However, make no mistake, the ECB’s task at hand as a guarantor of favorable sovereign and corporate refinancing conditions is enormous. After all, national safety nets spun by governments across the Eurozone in an effort to shield the private sector from more structural economic damage – including a spike in unemployment and corporate insolvencies – will lead to a dramatic rise in public debt. Compared to the new debt to be issued in the coming months by Eurozone governments – the four heavyweights Germany, France, Italy and Spain alone look set to issue about €1 trillion in long-term debt in 2020 – the ECB’s €750bn Pandemic Emergency Purchase Program is starting to look decidedly less mighty.

What does it take to stabilize the situation?

The ECB is essentially already engaging in a European form of yield curve targeting, with the objective of its monetary policy perhaps not to “close the spread” but to – increasingly explicitly – cap the spread. In fact, we believe the ECB will use all the tools at its disposal to shield the sovereigns of any strong overshooting of yields or spreads coming from rating downgrades or banking sector turmoil. We see the possible trigger at an Italian spread level at around 280bp to 300bp. In order to defend this line in the sand, we think the ECB will have to implement the following measures:

1) Buy fallen angels: Following up on last week’s decision to accept “fallen angels” i.e. bonds that lose their investment-grade credit rating as collateral, we expect the ECB to announce as soon as Q2 2020 that it will also buy “fallen angels”. This will calm market nerves, given the anticipation of an expected wave of sovereign and corporate rating downgrades particularly as far as Italy is concerned. This week, Italy was downgraded by Fitch to one notch above investment grade.

2) Double-down on PEPP: If the ECB continues to deploy its Pandemic Emergency Purchase Program (PEPP) envelope at the current pace, it will be fully used up by mid-October. Therefore, in an effort to reduce uncertainty and to calm any market concerns about a world without PEPP, we expect the ECB to announce an extension of its PEPP in size as well as duration as soon as June, when the next round of macroeconomic projections will be delivered, or at the latest at the July meeting. At a minimum we expect the ECB to opt for the necessary flexibility to keep up a monthly purchase pace of close to €100bn throughout 2021, with PEPP representing €75bn and the APP €20bn. Our model for the 10y BTP spread shows that with an extension of PEPP until 2021, the spread should indeed stabilize at around 230bp until end of 2022. In practice this will mean increasing the ECB balance sheet by a cool €2.2 trillion between March 2020 and December 2021.

2021 will not be the end of monetary policy stimulus

Even though the Eurozone economy looks set to recover to pre-crisis levels in the first half of 2021, we believe that monetary policy will have to continue to stimulate the Eurozone economy throughout 2023. The monthly pace of asset purchases should be reduced from close to €100bn to about €20bn in 2023, but low rates and extensive banking support will still be necessary given the legacy of the Covid-19 crisis, including elevated debt levels in the public and private sector and lingering NPLs on banks’ balance sheets.

ECB to hold 50% of outstanding government bonds by 2023

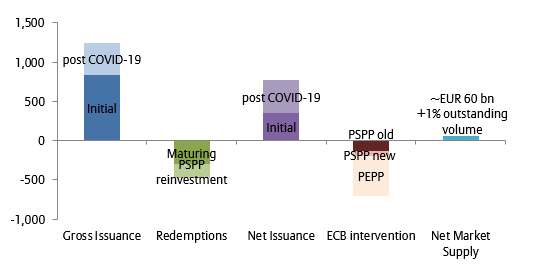

By supercharging PEPP as described above the ECB will neutralize most of the additional supply in Eurozone sovereign bond markets that stems from governments’ fiscal response to the Covid-19 crisis. In fact, net of ECB purchases, we estimate the market supply to increase by only about 1% in 2020.

Figure 1 – ECB removes supply pressure from gov. bond market in 2020

Estimated long-term government bond supply & ECB interventions (€ bn)

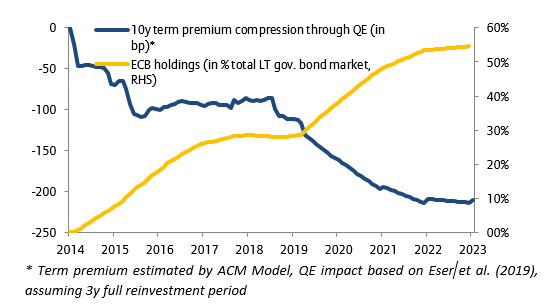

Moreover, in such a scenario, we expect the ECB to hold half of all outstanding long-term Eurozone government bonds by 2023. The implications for yields will be significant. Demand for safe assets will rise strongly as a risk-averse private sector (increasing financial savings in response to the crisis) and forced buyers (meeting regulatory requirement) enter into increased competition with a price-insensitive central bank for an at best steady supply of government bonds. This will further compress the yield premium i.e. the compensation for holding longer-term bonds, which in turn will put downward pressure on yields. Currently, we estimate the QE-induced term premium compression for 10-year German government bonds at -130bp. This effect could increase to over -200bp by end-2021. This means, even if the Eurozone returns to a higher growth trend and inflation expectations turn upwards (they are currently at the lower end of our fair range), benchmark yields can rise only very moderately in the next two years. The dampening effect will prevail even in the medium term, depending on the ECB’s reinvestment policy. If the ECB decides to fully reinvest its entire bond holdings (PSPP as well as PEPP purchases) for three years and thereafter lets its stock mature, the dampening effect could still add up to -90bp in 2030.

Figure 2 – ECB QE will have a sustained dampening effect on yields

There are limits to the ECB’s ability to cap the spread

The ECB can dampen the spread especially when it is driven by concerns of credit risk, removing the market’s fear of default.

Figure 2 – Italy: Extension of PEPP should keep spreads below 300bp

Spread vs Germany in bp

It may prove less powerful if the spread rises due to concerns of a Euro exit, i.e. when redenomination risk is priced in, as in this case the driver is political. Our calculations show that the redenomination risk currently contributes little to the spread (15bp for Italy versus over 250bp in 2012). But the heated debate on corona bonds shows that the old fault lines still exist.

The ECB has only been half as proactive as the Fed

How is the Eurozone banking system responding to the Covid-19 crisis?

To which extent is it part of the solution or part of the problem? Answering these questions, at least partially, is the subject matter of the present investigation, which is a sequel to a recent analysis of the US banking system.[1]

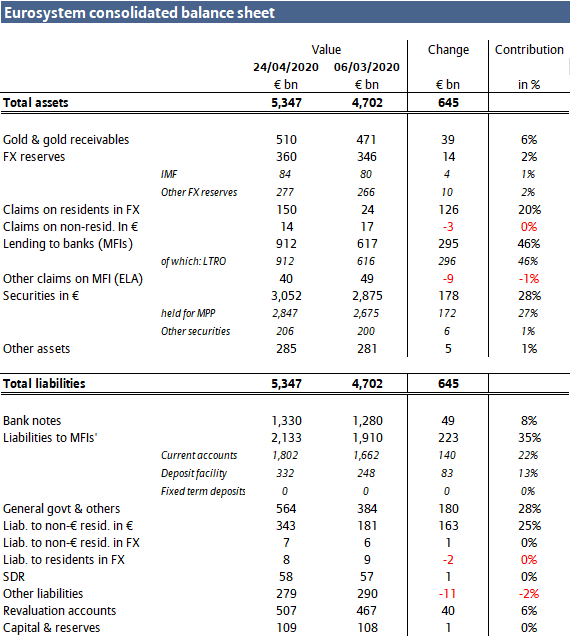

Between 06 March and 24 April, the latest weekly observation, the ESCB’s balance sheet has increased by €645bn from €4,702 to €5,347bn. Over roughly the same period (04 March to 22 April), the Federal Reserve’s balance sheet has increased by USD 2,332bn, that is, 3.3 times as much.[2] As the U.S. economy is only 1.6 times larger than the Eurozone one, it follows that, from a purely quantitative point of view, the ECB has been only half as proactive as the Fed.

As shown by the asset side of its balance sheet, the nature of the ESCB’s interventions has been different, too. The largest contribution to the increase in the ESCB’s assets comes from lending of euros to domestic banks through long-term refinancing operations, or LTROs (€ 296bn or 46% of the total). The next largest contribution (€178bn or 28% of the total) is attributable to securities purchases. The bulk of these purchases (56% or € 97bn) stems from the newly created pandemic emergency purchase program (PEPP), which is targeted to reach €750bn. At the current pace of €20 to 25bn a week, this target should be reached by the second half of October. The public sector purchase program (PSPP) has contributed another 33% or €56 bn. Next comes the corporate sector purchase program (CSPP) with 6% or € 11bn.

The €126 increase in lending of dollars to banks (6% of the total) is meant to address the dollar shortage experienced in the Eurozone. It is the counterpart to the currency swaps made by the ECB (and other central banks) with the Federal Reserve. As a reminder, over the same period, securities purchases and central banks liquidity swaps accounted for 70% and 18% of the increase of the Fed’s assets, respectively. Admittedly, these larger shares respectively reflect the greater role of capital markets in the U.S. and the global role of the USD. But, as regards securities purchases, the Eurozone’s institutional framework gives less of a free hand to the ECB than to the Fed.

On the liabilities side, the contrasts between the ECB’s and the Fed’s balance sheets are less pronounced. The liabilities to monetary and financial institutions, or MFIs, have been the largest absorber (€223 bn or 35% of the total) of central bank liquidity, followed by the governments deposits (€18 bn or 28% of the total) and liabilities to non-euro residents in euros (€163 bn or 25% of the total)[3].

Table 1 – ESCB consolidated balance sheet

As a reminder, over the same period, reserves balances (i.e. the U.S. equivalent to liabilities to MFIs) and the U.S. Treasury deposit accounted for 58% and 24% of the increase in liabilities, respectively.

Like for the U.S. two weeks ago, we now have to look through the banks’ balance sheets to gauge the extent to which this fresh central bank liquidity is reaching the non-financial sector of the Eurozone economy, where data on the commercial banks’ balance sheets are not weekly, like in the U.S., but monthly. Released on 29 April, the March data are the most recent available. During that month, the total assets of Eurozone MFIs have increased by €764bn from €33,857 to 34,621bn, or 2.2%. In relative terms, over roughly the same period, the assets of U.S. commercial banks have increased much more rapidly, i.e. by 10.1% or USD 1,811bn from USD 17,964 to 19,775bn.

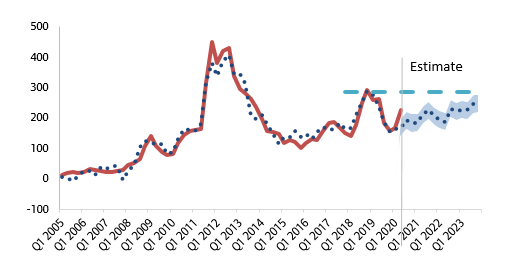

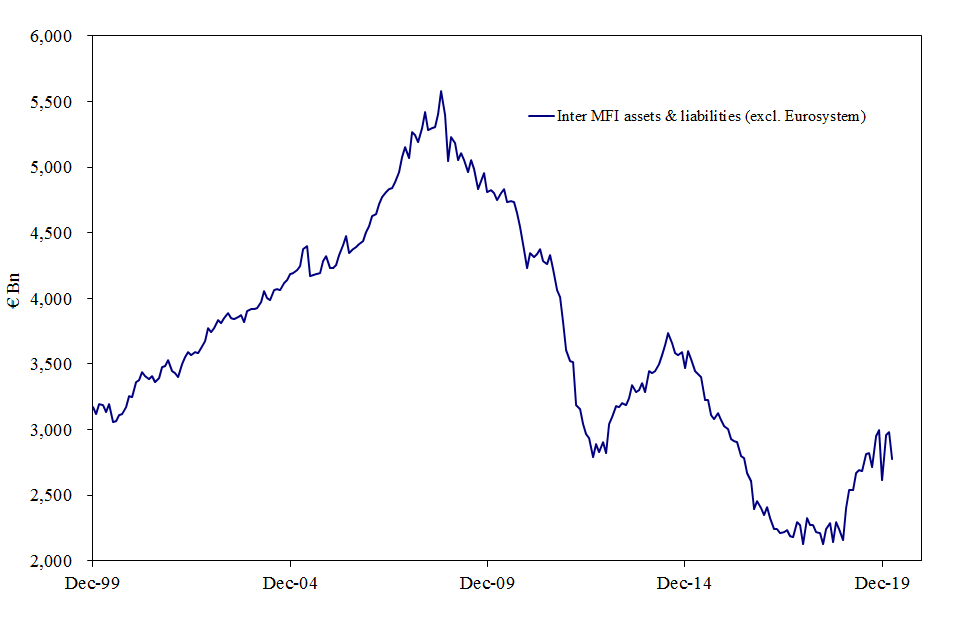

Notwithstanding these large differences in headline numbers, Eurozone commercial banks are behaving very much like their U.S. counterparts: accumulating reserves at the Central Bank (+ €250bn); cutting interbank lending (-€193bn, see Figure 3); extending – willy-nilly – loans to businesses pursuant to revolving credit facilities negotiated before the crisis started (+€ 114bn); cutting loans to households (-€8bn); buying government securities (+ €73bn), but selling other fixed income securities ( -€83bn).

In the Eurozone as in the U.S., it remains to be seen whether commercial banks can effectively contribute to finance the private non-financial sector in times of stress. But, while commercial banks’ assets stand at 90% of GDP in the U.S., they are equivalent to 290% of GDP in the Eurozone

Figure 4 – Eurozone interbank market - Inter MFI assets & liabilities (excl. Eurosystem), in €bn

Senior Economist

Senior Economist

Head of Capital Markets Research