Indeed, though President Biden will likely benefit from his inauguration momentum, his capacity to pass the American Rescue Plan remains uncertain as we expect some pushback:

- Slim majority: Although Democrats were able to clinch the senate majority from the Republicans, they are still far away from the 60-vote threshold to avoid filibusters and pass legislation without any Republican support. President Biden may use budget reconciliation to bypass a potential Republican blockade but this will involve losing his bipartisanship spirit and can only be used once in the year, meaning that further fiscal stimulus (infrastructure projects and his New Green Plan) would not escape the harsh reality of votes in the senate.

- Profligacy: Some Republican congressional representatives have already criticized the size and scope of the proposed bill, especially regarding its impact on the country’s national debt. Most of them may also argue that the stimulus bill voted in December is sufficient and that new stimulus is unnecessary. Nevertheless, most of them recognize the need to bring the economy back on track as well as the political cost of not voting a bill designed to help their constituents. Moreover, Republicans may not want to be considered as obstructionists right away.

- Congressional agenda: The congress is already busy with the impeachment proceedings and will also be concentrating on President Biden’s cabinet confirmation hearings. Debates around this new stimulus package are likely to wait for a couple weeks, especially if it is controversial. In current circumstances, the longer it takes to deploy this new stimulus, the higher the cost of the current restrictions on economic activities amid record high Covid-19 cases and deaths.

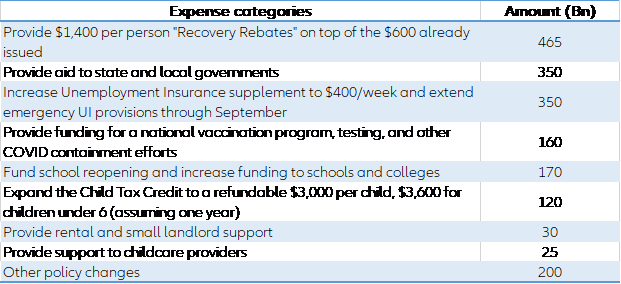

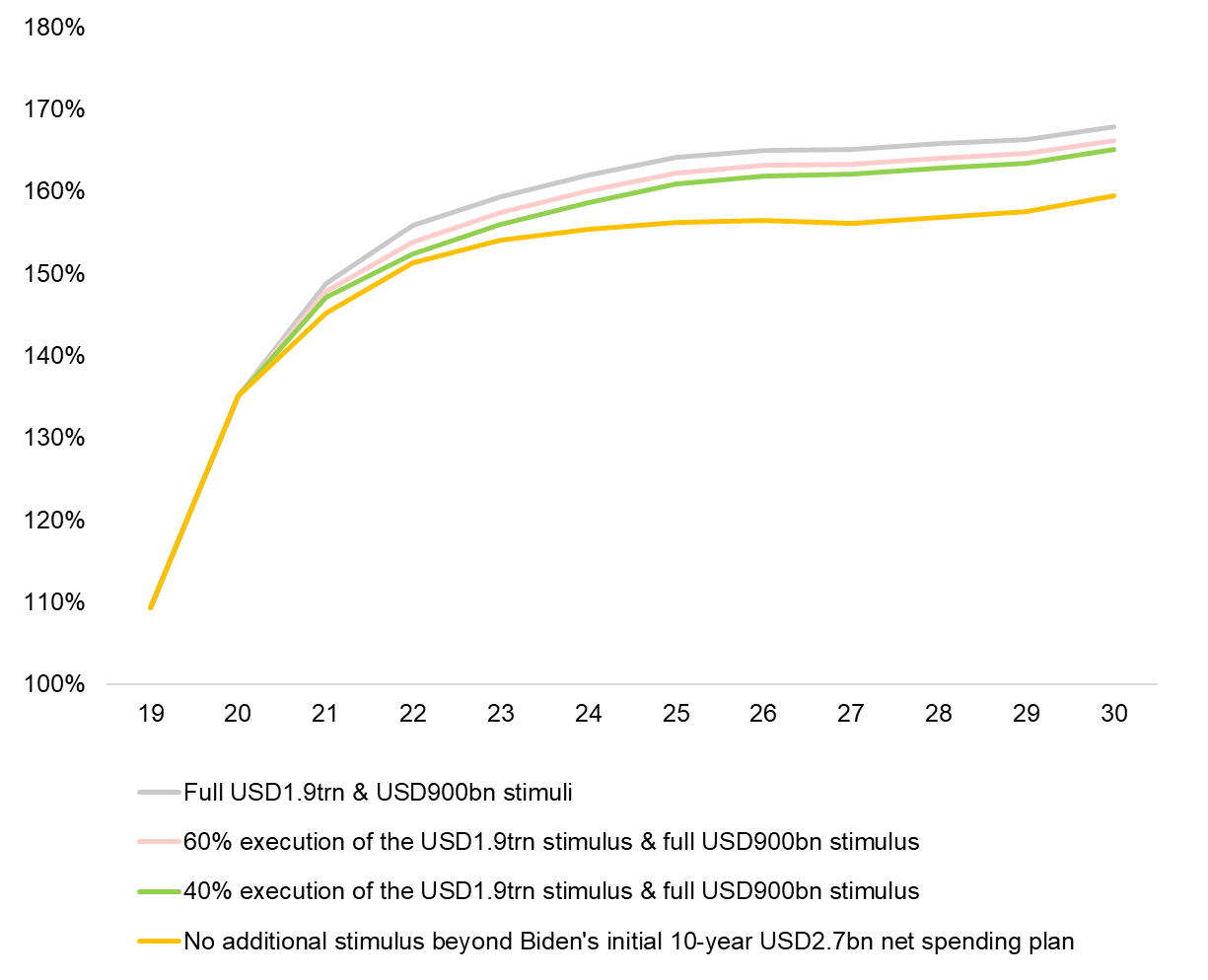

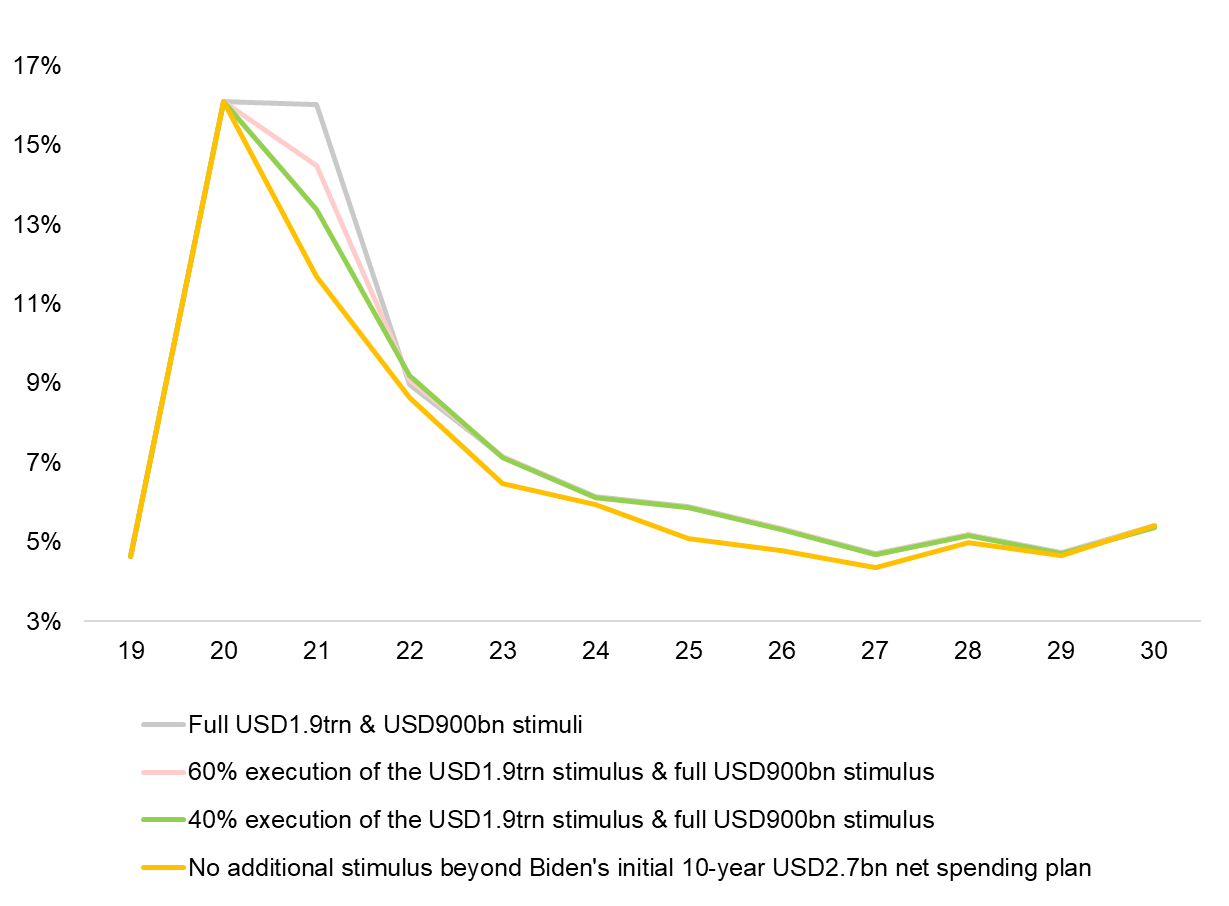

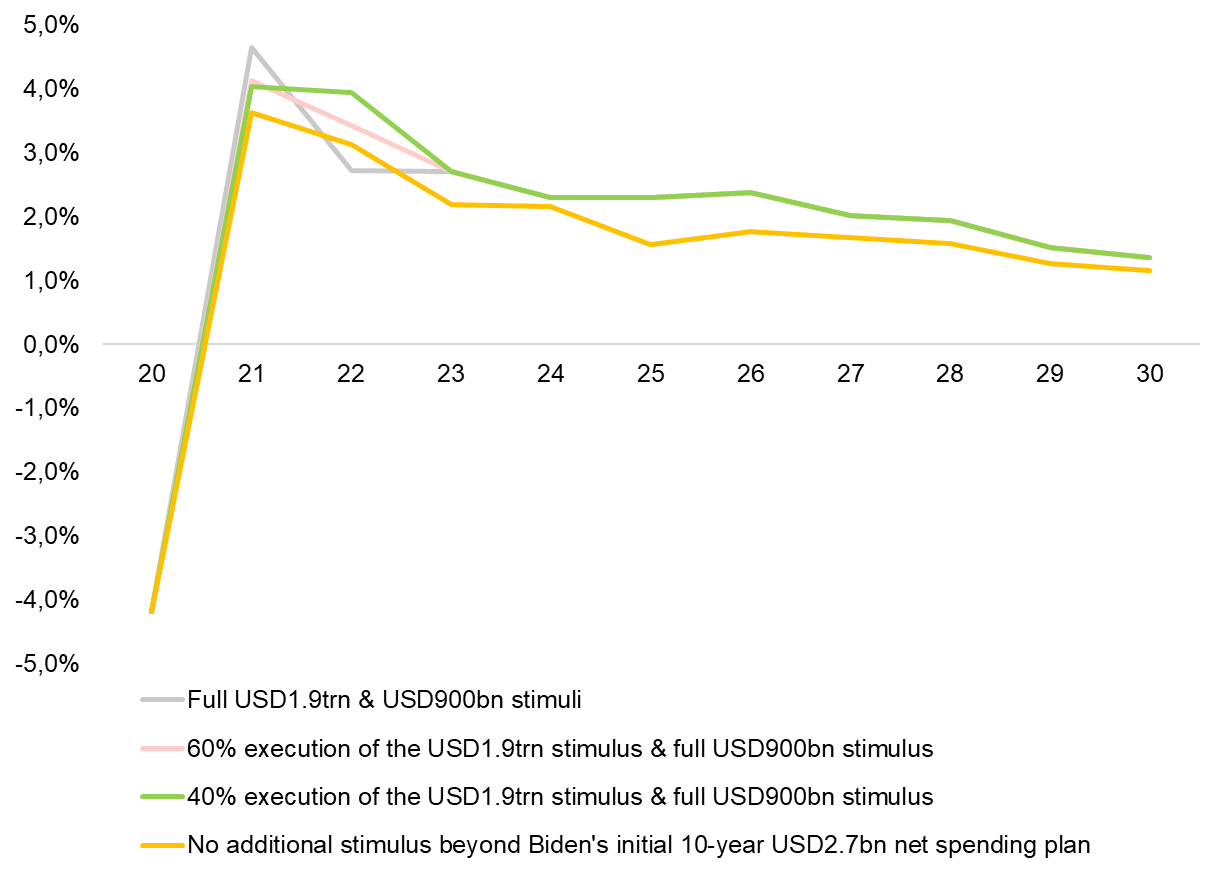

As a result, we defined three fiscal paths for the Biden Presidency:

1. High scenario: USD1.9trn, 30% probability

President Biden and the Democrats are able to pass their full stimulus proposal, either by garnering enough Republican support or through budget reconciliation. Although possible, this scenario remains unlikely given President Biden’s congressional challenges. The US public debt level would rise to 148.8% of GDP in 2021, compared to the 135% of GDP expected in 2020. Growth would reach +4.7% y/y in 2021 and +2.7% y/y in 2022, against +3.6% y/y and +3.1% y/y in our previous forecast, respectively. In this scenario, the Fed could have to envisage a rate hike as early as H2 2022 compared with our current scenario of a first move taking place in H2 2023.

2. Central scenario: USD1.2trn, 60% probability

In this scenario, President Biden would be able to secure sufficient support for most of his stimulus package, especially for the USD1,400 stimulus checks also demanded by Trump, but would have to compromise on other variables, especially local and state support, to gain sufficient Republican support. This scenario would spare the new president from using the reconciliation process, allowing him to pass a new stimulus dedicated to medium-term and long-term objectives such as infrastructure projects and the “Plan to Build a Modern, Sustainable Infrastructure and an Equitable Clean Energy Future”. This scenario seems the most likely as a compromise bill would allow both parties to claim a political victory (Democrats for a new stimulus and Republicans for the concessions obtained). In this context, US GDP growth would be lower in 2021 compared with the “high scenario” (+4.1 % y/y) but higher in 2022 (+3.4% y/y), thanks to the voting of another round of stimulus in the second half of 2022. In such circumstances, the Fed could have to start a tapering process from H2 2022 being followed by a first rate hike in the beginning of H2 2023.

3. Low scenario: USD0.7trn, 10% probability

In an adverse scenario, President Biden would only be able to secure a small share of his additional stimulus (less than 40%) via reduced supplementary payments to households and some financial support to fight against Covid-19 as Republicans would be only willing to accept the bare minimum to support the economy. However, even in this configuration, GDP growth and also public debt would outperform the trajectory of growth and debt that we have in our current scenario (yellow curve in Figure 2 below). In this scenario, the Fed would envisage a rate hike only from the end of 2023 onwards.

Given the accumulation of debt in the three scenarios, we remain convinced that the potential of growth of the US economy will be negatively impacted over the medium-term, declining from 2% y/y in 2020 to 1.4% y/y at the horizon of 2030.

Figure 4: GDP growth in alternative scenarios of Joe Biden’s new fiscal stimulus