Solid fundamentals will continue to drive housing in 2020. The housing market, which had been lagging through the first half of 2019, has enjoyed a recent rebound. Over the past few months, data on sales, construction and investment have all been strong. The fundamentals driving this recovery are expected to continue and, as a result, the housing market will remain vigorous and drive residential investment up +4.9% in 2020. This solidity of the real estate sector was a key element of our economic scenario for the U.S. in 2020, based in particular on an opposition between domestic-driven activities (construction and services) and externally driven activities (trade and industrial activities). Domestic-driven activities are expected to outperform because of expansionary monetary conditions and low unemployment, while activities depending on external demand will suffer from the ongoing trade dispute between the U.S. and China, as well as exogenous shocks related to widespread political instability and the recent coronavirus outbreak. All in all, we expect the U.S. economy to grow by +1.6% y/y in 2020, compared with +2.3% y/y in 2019.

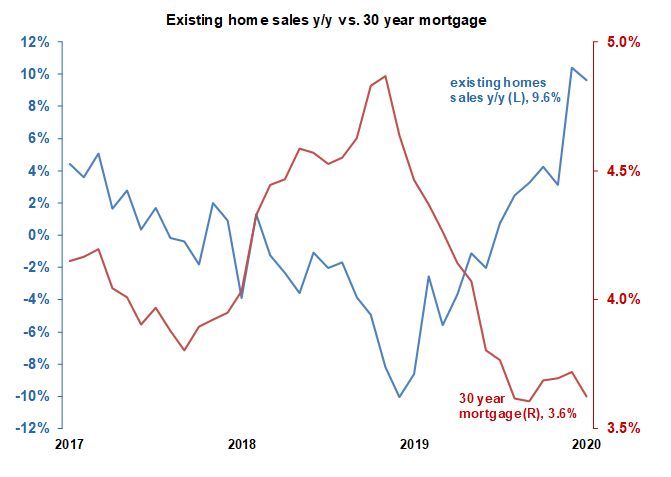

The Fed will continue driving the housing market. The housing market has received a substantial boost from very low mortgage rates. At the beginning of 2019, the rate on a 30-year mortgage was around 4.5%. After three cuts by the Fed, the rate currently stands around 3.6%. As a result, mortgage applications, and demand for housing, are at recent highs for this time of year. Purchases of existing homes are near a two-year high while purchases of new homes are at a 12-year high. More importantly, the Fed will cut rates at least once more this year, holding mortgage rates down through 2020. Recent “risk-off” markets are also driving yields lower but this could be more temporary. Therefore, Fed policy will support the growth of internal sectors such as housing, but will not be able to help industrials or multinationals, which are more sensitive to external demand, and are therefore expected to underperform in 2020.

A tight labor market also helps. Potential home buyers are being buoyed by a vigorous labor market and as a result are providing strong demand. Since the labor market is unlikely to erode rapidly, we expect it to continue providing support through most of the year.

Short supply is driving prices higher, but all markets are local. Price increases nationwide have accelerated recently, and while the aforementioned low rates and tight labor markets are partially responsible, so is a thin supply of homes for sale. A lack of construction workers has hampered the production of new homes and there is no doubt this condition will continue in 2020, keeping supply thin. The inexorable demographic of retiring baby boomers will drive up prices in retirement areas such as Florida and Arizona faster than the overall average, which we expect to be around 6% y/y.

What does this mean for companies? Clearly homebuilders and suppliers of building materials, furniture and appliances will all benefit this year, but an ongoing trade feud may continue to pressure margins. Banks will enjoy high mortgage demand but may have to endure narrower spreads.

But the coronavirus will temporarily disrupt things. All of the recent strong data was reported before the emergence of the coronavirus and no doubt consumer confidence and housing activity will come under pressure for a few months. At least one major homebuilder has already reported that the coronavirus has disrupted supplies of home furnishings from China, delaying new home sales. However these disruptions will be temporary and will be followed by a bounce-back later, leaving the full-year performance essentially intact.