The Fed announces new programs to provide liquidity

In response to the worsening of global macroeconomic conditions, increasing confinement measures taken by U.S. states, the uninterupted fall of the equity market and growing signs of liquidity stress, the Fed has announced a new round of measures to keep financial markets operating smoothly, and to provide lending more directly to those sectors most in need. The new round of measures will:

- Now include unlimited purchases of Treasury and mortgage-backed securities – they had previously been limited to USD500bn and USD200bn respectively.

- Provide USD300bn more in new financing to employers, consumers and businesses via a new program to be defined and capitalized by the U.S. Treasury, with USD30bn coming from the ESF (Exchange Stabilization Fund).

- Create two new facilities to support credit to large employers: the PMCCF (Primary Market Corporate Credit Facility), for new bond and loan issuance, and the SMCCF (Secondary Market Corporate Credit) to provide liquidity. Only investment grade companies will be eligible. They will be able to benefit from a four-year financing bridge.

- Ressurect the TALF (Term Asset-Backed Securities Loan Facility) to encourage the issuance of ABS (Asset-Backed Securities) backed by student loans, auto loans, credit card loans and loans guaranteed by the Small Business Administration.

- Make municipal bonds with variable rates and banks’ certifcates of deposit elligible for the MMLF (Money Market Mutual Fund Liquidity Facility)

- Extend the securities being targeted by CPFF (Commercial Paper Funding Facility).

- Create a Main Street Business Lending Program to support lending to small and medium-sized businesses.

Different signals from the market showed a multiplication of liquidity stress

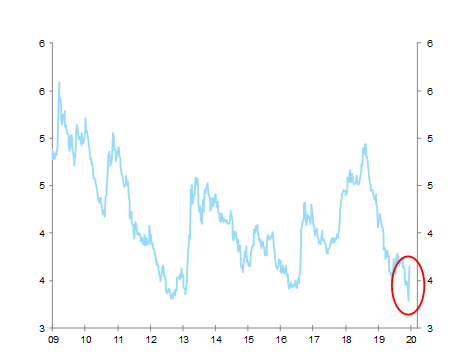

A series of indicators had showed that different markets were recently experiencing episodes of stress in terms of liquidity. The treasury market, the ABS market, the market of private debt and liquidity of derivatives all saw a significant widening of spreads scrtutinized by investors. This showed that there is currently no alternative to cash and that asystemic risk is at stake. We have to remember that the freezing of the money market in 2008-2009 was one of the most important triggers of the crisis. Recently, the most striking aspect of this drying-up process in liquidity was related to the MBS (Mortgage-Backed Securities) market. Despite huge amounts of liquidity injected into the economy, mortgage rates were increasing as the freezing of the MBS market (backed by mortgage assets) incited banks to significantly tighten their credit conditions. We have clearly here the illustration of an inefficient transmission of the monetary policy (see Figure 1). In order to avoid the current crisis escalating (a total freezing of monetary and financial conditions, which would have even more devastating and long-lasting consequences), the Fed decided to ramp up its arsenal to ring-fence the current liquidity crisis (besides the sanitary and economic crisis).

Figure 1 – U.S. mortgage rates (%)