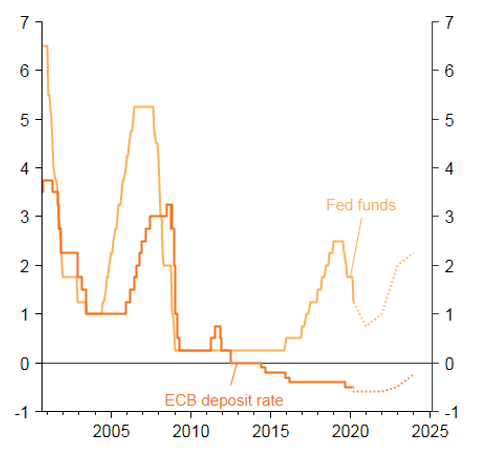

The Federal Reserve decided to cut interest rates by half a percentage point in an emergency move designed to bolster the U.S. economy amid risks posed by the Covid-19 outbreak. This is the first emergency cut since the financial crisis of 2008-09. The move follows a significant tightening of monetary conditions, which required a rapid intervention of the U.S. central bank. We expect a further rate cut of 25bp in June to 0.75%.

Besides the extremely high level of uncertainty over the real impact of Covid-19 on growth, the rate cut confirms that the Federal Reserve is driven by volatility suppression and has become very market-dependent. Our policy reaction function (read our report here) with time-varying parameters shows that the Fed has increasingly attached a larger weight to the stabilization of market volatility, to the detriment of its targets on growth and inflation. Did the Tylenol rule replace the good old Taylor rule?

Beware the longer-term credibility risks of the Fed put. The fact that the Fed decided to cut right after a G7 statement calling for scrutiny shows that the Fed may be the Central Bank with the more room to maneuver but also adds to the credibility of a politicized Fed going forward. Other requests will follow by President Trump and overreacting markets: more cuts, more QE, less regulation. In addition, other policy responses such as measures to promote health access or temporary support to vulnerable households, support to firms at risk to avoid non-payment, and more fiscal profligacy will matter as much as market reactions over the past week have shown over-dependency on crisis management measures.

Other central banks from Australia to Europe are following suit or cornered to do so : Global easing on its way as the only game in town? Today, the Reserve Bank of Australia cut interest rates to record low 0.5% amid coronavirus concerns. In an emergency statement, Bank of Japan decided to inject JPY500bn (USD4.6bn) in government bonds to avoid a liquidity squeeze and left the door open for additional future support. The Bank of England has also left the door open for a rate cut (-25bp) by the end of the month, given recent statements. These announcements come on top of an already strong response by the People’s Bank of China — including liquidity injections (RMB1.7 tn), and a -10bps for the one-year loan prime rate. This rapid reaction of Central Banks around the world show that they are the last man standing among collaborative tools when fiscal measures are often late to be enacted when faced with such a rapid shock.

The ECB will have to respond on its own terms though its monetary policy ammunition is more depleted, particularly with regard to the interest rate room for maneuvering. At the upcoming March meeting, we expect the ECB to cut the deposit rate by another 10bps to -0.6%. Moreover, measures to support financing are likely to be stepped up, which could include more favorable TLTRO terms, as well as targeted liquidity support for companies affected by the Covid-19-related economic fallout. A further increase in the monthly rate of QE purchases is likely to be saved for later this year, as the ECB will want to keep some powder dry for now. In Europe, we showed (read our report here) with selected augmented Taylor Rules that sovereign risk premia, financial stress and volatility indicators, measures of economic policy uncertainty and banks’ stock market performance all appeared relevant to the ECB’s decision-making over the past ten years.

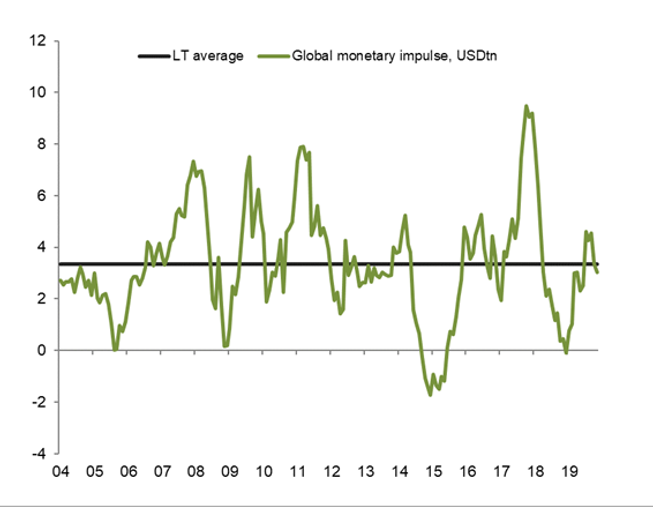

There may be a role for monetary policy as the Covid-19 outbreak shaves off between -0.5 and -1.5 points of GDP growth depending on the economy, and creates a liquidity risk. Global money supply fell to USD3 trillion in February 2020, below its long-term average of USD 3.4 trillion and from a high of USD 4.6 trillion in October (see Figure 1). Global easing is the only collaborative game in town as sporadic fiscal stimuli are enacted in a non-cooperative way by the most affected countries (China, Italy e.g.).

Yet, as a V-shaped recovery is still likely, corporate default risks should be high on the watch list as the situation normalizes as Covid-19 and very reactive monetary policy may have exacerbated existing vulnerabilities (read our report here).

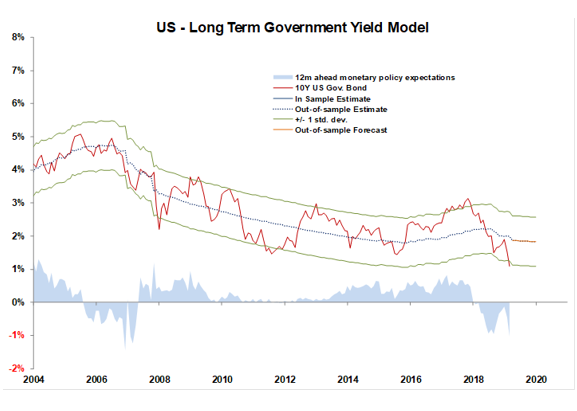

What does this mean for bond markets? According to our U.S. Treasuries valuation approach, the two rate cuts implicitly set a 1% floor on the U.S. 10y yield trajectory. However, lower yields remain a possibility subject to the Fed cutting further. A gradual re-steepening of the U.S. yield curve towards year-end is to be expected while remaining within the 1.0/1.2% range in the short-run.

Similarly to the U.S. Fed, if the ECB was to deliver the already priced in 10bps rate cut, it would implicitly set a fundamental -0.9% floor on the 10y Bund yield. Going forward, the shape of the German yield curve is expected to follow the U.S. re-steepening move while remaining within the -0.5/-0.9% range in the short-run.

What does this mean for equity markets? The risk of disappointment is high as expectations were high. Short-term volatility will prevail as epidemiological information and credibility of policy response give contradictory signals.

Figure 1 - Global M2 (incl. Eurozone, China, U.S., Japan, South Korea, Australia)