Eurozone March PMIs are “old news” for financial markets but they reiterate the historical proportions of the economic setback currently underway, with many survey components reaching all-time lows. While a dramatic setback in Eurozone manufacturing was widely expected amid the COVID-19 crisis and already largely priced in by financial markets, today’s release still underlines the swiftness and severity of the resulting economic downturn. The composite PMI for the currency area fell to 31.4 points – a historical low and comparable to the decline in Chinese PMIs in early 2020. Similarly, the magnitude of the March decline of 20.2 points was unprecedented. Within a month’s time, the Eurozone PMI went from signaling a gradual recovery to a full-fledged economic setback à la 2008/9. The decline was particularly pronounced for the services sector PMI, which reached an all-time low of 28.4, declining by 24 points. Record falls in new orders and expectations of future output, as well as the sharpest decline in employment since July 2009, suggest that there will clearly be more pain ahead.

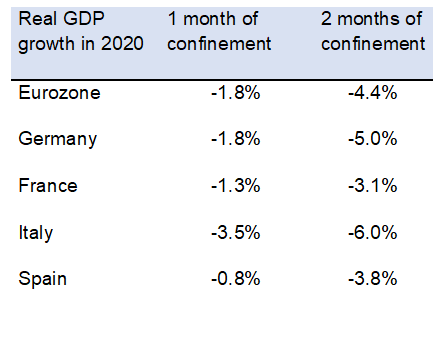

Eurozone recession a forgone conclusion, with GDP set to decline -1.8% in 2020. Drawing on the experience of China, we modeled a three-month shock with a one-month full lockdown and a partial, u-shaped recovery thereafter, in our baseline scenario. We also took into account the mitigating effects of policy bazookas. Overall, we expect a negative Q1 (-0.9% q/q) in the Eurozone, driven by the impact of confinement measures on economic activity in China and the first containment policies also implemented in most European economies. We expect the trough to be reached only in Q2, with real GDP down by close to -3% q/q. Assuming containment measures are successful, we expect a partial u-shaped rebound in economic activity in H2 2020. Overall, we expect Eurozone GDP to contract by -1.8% in 2020.

Could it be worse? Downside risks continue to loom large. A more protracted health crisis with possible reinfections cannot be ruled out. This would also mean borders stay closed and intermittent domestic confinement prevails. As Italy and Spain have already announced a lockdown extension, we have calculated the negative impact of a two-month lockdown period on key Eurozone economies. In this case, the contraction in 2020 Eurozone GDP growth could exceed -4% in 2020.

Figure 1: Length of confinement period & real GDP growth in 2020