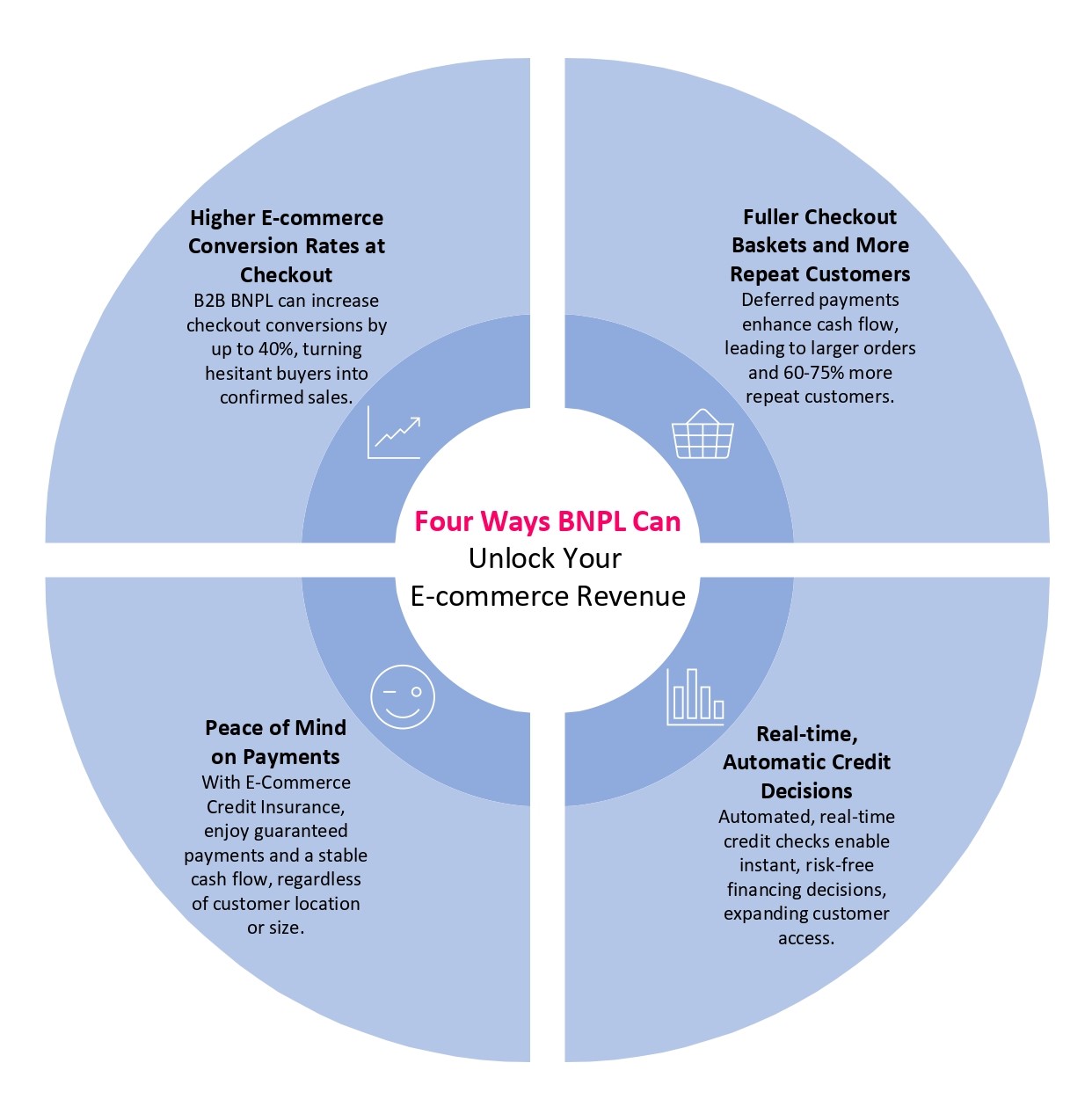

To date, most e-merchants have shied away from providing purchase financing simply because it seems too risky. Their caution is understandable: in many cases, their online channels draw in a much wider set of customers, many of whom they’ve never dealt with before. That’s in sharp contrast to the wholesalers who they have built trusted trading relationships with in more traditional, offline business settings.

As a result, when considering the option of offering payment-on-invoice or other terms, they have had to weigh the higher risk of non-payment – and the administrative overheads that accompany those – against the benefits of offering BNPL.

The good news is that the challenge is now being addressed by the market leader in trade credit insurance, Allianz Trade. By combining real-time checks on the creditworthiness of B2B customers with robust E-Commerce Credit Insurance API, e-merchants can offer BNPL with confidence.

While embracing BNPL solutions can significantly enhance sales and customer loyalty, it's crucial to consider bad debt protection. Imagine this protection as a shield or safety net, guarding your business against the fall of unpaid invoices and bad debts. In the dynamic landscape of e-commerce, where customer interactions are quick and numerous, the risk of non-payment is a serious concern. Trade credit insurance steps in here, offering this very shield. It ensures that even if a customer fails to meet payment obligations, your business's cash flow remains secure. This protection is not just about preventing losses; it's about instilling confidence in your B2B e-commerce strategy, enabling you to offer flexible payment terms without fear.

Here’s how that looks in practice. As a customer adds items to their basket on your website, their financial health is analyzed in real time by connecting to our global databases of business creditworthiness, which contain financial, strategic and commercial information on more than 80 million companies worldwide. The speed of that analysis provides automated trade credit decisions so you can instantly offer the most appropriate credit terms to your customer – with confidence. Should you need to receive instant payment to ease your cash flow, Allianz Trade is partnering with BNPL providers that can provide the financing as well.

The good news is that the challenge is now being addressed by the market leader in trade credit insurance, Allianz Trade. By combining real-time checks on the creditworthiness of B2B customers with robust E-Commerce Credit Insurance API, e-merchants can offer BNPL with confidence.

Here’s how that looks in practice. As a customer adds items to their basket on your website, their financial health is analyzed in real time by connecting to our global databases of business creditworthiness, which contain financial, strategic and commercial information on more than 80 million companies worldwide. The speed of that analysis provides automated trade credit decisions so you can instantly offer the most appropriate credit terms to your customer – with confidence. Should you need to receive instant payment to ease your cash flow, Allianz Trade is partnering with BNPL providers that can provide the financing as well.

-(2).jpeg)