What Does DSO Mean, and Why is it Important?

Days Sales Outstanding, abbreviated as DSO, is a key measure to track a business's healthy cash flow. DSO represents the number of days it takes for a company to convert its accounts receivables into cash. Since cash flow is the lifeblood of any business, the sooner the company gets that cash, the stronger its cash flow and financial position is likely to be.

Low interest rates and easy credit allow companies to take their eye off the ball when it comes to DSO management. If the company can easily borrow money at low interest rates, there is less need to worry about DSO increasing by a few (or more) extra days.

Using the DSO and DPO Formulas

How to Calculate DSO

The DSO formula works as follows, for a given period:

DSO = (accounts receivables / total sales) * number of days

For example, let's say that last month, Example Enterprise sold $50,000 worth of goods, with $35,000 in accounts receivable on its balance sheet at the end of the month. Its DSO is: (35,000 / 50,000) * 31 = 22.3 days.

This means that on average, it took Example Enterprise 22 days to collect payment after a sale had been made.

How to Calculate DPO

The DPO (Days Payable Outstanding) is your mirror indicator: it allows you to see how many days you take on average to pay your invoices.

DPO = (accounts payables / cost of goods sold) * number of days

For example, imagine that in the fiscal year 2020, an Example Enterprise spent $280,000 worth of COGS, with $30,000 in accounts payables on its balance sheet at the end of the year. Its DSO is: (30,000 / 280,000) * 365 = 39.1 days. This means that on average in 2020 it took Example Enterprise 39 days to pay its bills and invoices to its creditors (suppliers, vendors, etc.).

Another vital metric that complements DSO in assessing a company's financial efficiency is the Accounts Receivable Turnover. This ratio measures how often a company collects its average accounts receivable within a period, indicating the effectiveness of its credit and collection policies. A higher turnover ratio suggests more efficient collection practices and a healthier cash flow. To improve this ratio, companies should focus on enhancing their invoicing accuracy, streamlining payment processes, and fostering better communication with customers to ensure timely payments.

Average DSO Benchmarks by Country & Industry

While North American businesses fare better than most European and Asian countries, a 2019 study of Days Sales Outstanding conducted by Allianz Trade found that it still takes an average of 51 days for US businesses to be paid, while Canadian businesses have an average DSO of 52 days. Additionally, it took over 65 days for 25% of North American businesses reviewed to receive payment.

The study also showed a great variance in DSO from industry to industry. The electronics, machinery, and construction sectors continued to suffer from the longest DSO with 89 days, 86 days and 82 days, respectively, on a yearly average, well above the global average of 65 days.

Not surprisingly, the 2016 Hackett Group Working Capital Survey found that 1,000 public companies included in the sample had a collective $316 billion tied up in DSO.

Understanding and optimizing the Collection Period is critical for maintaining a healthy cash flow. The Collection Period, closely related to DSO, measures the time taken to collect receivables from sales. A shorter Collection Period signifies a quicker cash conversion cycle, enabling businesses to reinvest in operations, reduce debt, and improve their financial health. To optimize this period, companies should streamline their invoice and collection processes, employ strict credit policies, and proactively manage customer relationships to encourage timely payments.

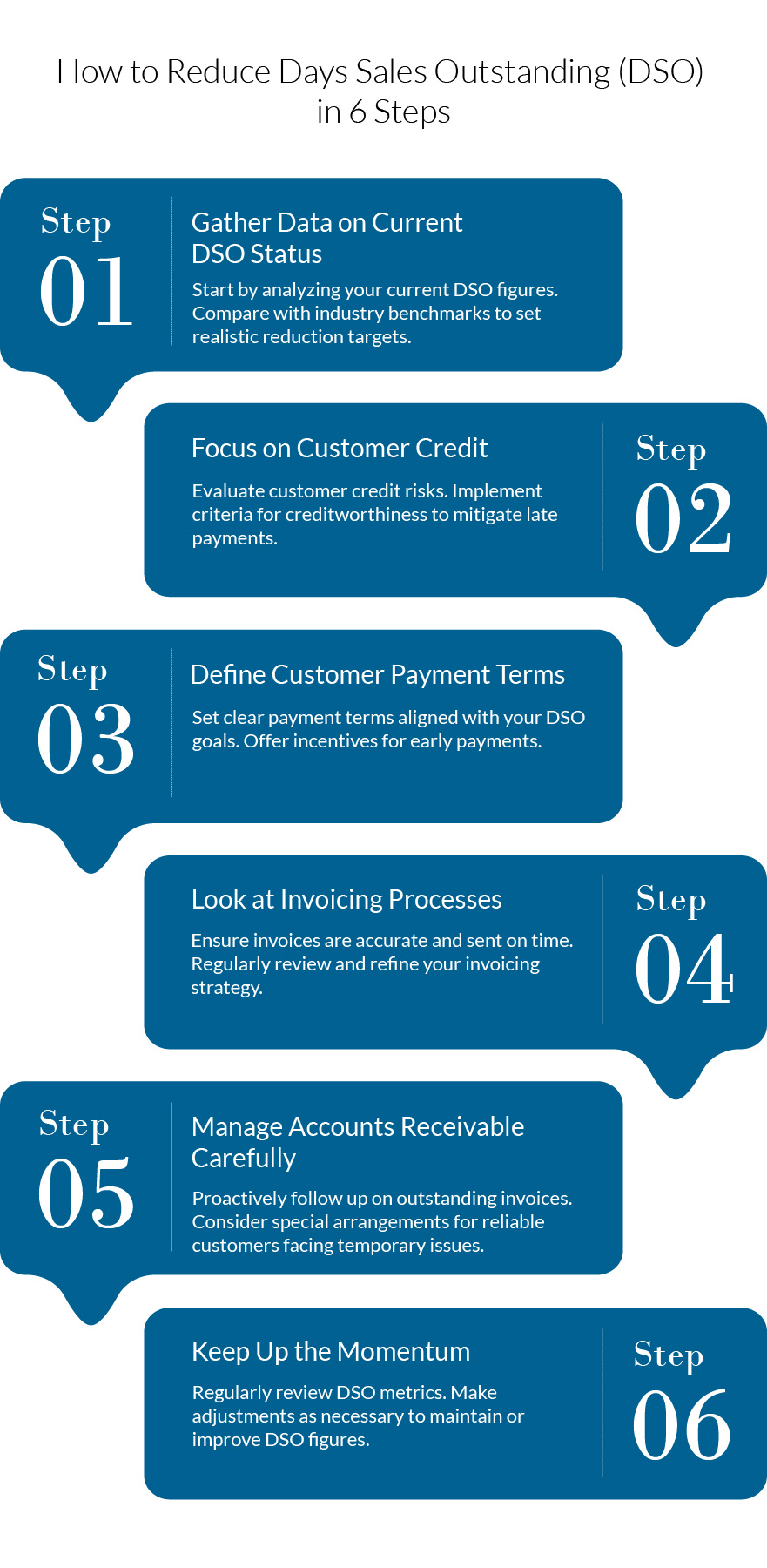

How to Reduce DSO in Accounts Receivable

Reducing DSO is not completely within the control of your company's finance and accounting departments. Other parts of the company also have an impact on this metric. Therefore, reducing DSO requires not only a focused effort on the part of finance executives, but the cooperation of various departments in the company as well. Below, we outline six simple steps to begin reducing your company’s days of sales outstanding in accounts receivable.

1. Gather data about current DSO status

Any effort to reduce DSO must begin with gathering data on a company’s current DSO status and creating a benchmarking analysis that shows how that level of DSO compares to peers and competitors. This insight not only provides a starting point for the effort, but also provides a sense of what DSO ratio is attainable for the business. To compare your business's status to others, the Hackett survey offers some basic data by industry. For greater detailed data, consider other industry surveys or private benchmarking studies.

Accounting and finance executives can also use this data to make the case for reducing DSO to senior management and the various departments whose cooperation is necessary. By making DSO reductions a strategic priority, executives can more readily justify the resources they devote to the project and incorporate DSO improvement metrics into the individual performance objectives and incentives of those driving the effort.

Overall, companies should focus on DSO reductions that are both attainable and sustainable based on the realities of the business. For example, companies may be able to reduce DSO by, say, 20 days by significantly tightening customer credit approvals, but that will not be worth much if customer acquisition and retention suffers as a result.

2. Focus on customer credit

DSO is often driven by your customers' ability to pay their invoices on time. Therefore, any effort to improve DSO must address customer credit risk. A good first step is to determine appropriate parameters for acceptable customer credit risks. A company can then use that criteria to ensure that all new customers do not represent an unacceptable risk of slow payment or non-payment. Companies can also extend these criteria to existing customers, starting with those that have been slow to pay.

The sales function of a business must be on board with this renewed focus on customer credit risk. Salespeople do not want to lose a sale because a customer has credit problems. Therefore, companies may need to implement specific incentives and penalties to make sure salespeople and sales managers adhere to the company’s customer credit requirements. In some cases, companies can strategically deploy tools like credit insurance to help mitigate these risks without losing an otherwise attractive customer.

3. Define customer payment terms

DSO metrics are heavily influenced by the payment terms a company extends to its customers. Those payment terms must carefully balance the company’s own DSO goals against common industry practice, as well as customer needs and expectations. This means identifying under what circumstances the company will offer customer incentives for faster payment or require deposits or upfront payments, supported by a clear approval process when making these decisions.

Invoices must clearly and visibly state payment terms to reduce the chances of confusion over when payment is expected. The company should also be regularly communicating with customers about outstanding invoices and how the company can make it easier for customers to pay them. For example, some customers may be moving to electronic payments or prefer their employees use payment cards for certain purchasing.