Updated on 24 December 2025

The trade war initiated by the Trump administration's sweeping import duties (an effective rate of 11% by August 2025) has reshaped global trade flows without yet triggering the mass insolvency wave many feared in the US. However, the reprieve is temporary, and the risk has simply been delayed, not dodged. This deep dive explores the mechanism that shielded the US and reveals the significant financial burden now shifting to export-driven economies, particularly in Europe.

Summary

Key takeaways

- US Shield: Foreign exporters' price moderation and widespread trade rerouting (via countries like India and Vietnam) helped keep costs in check and prevented a surge in US insolvencies.

- Delayed Impact: As foreign exporters reach their limit to absorb costs, the tariff pass-through is expected to increase, contributing an extra +0.6pp to US inflation by mid-2026.

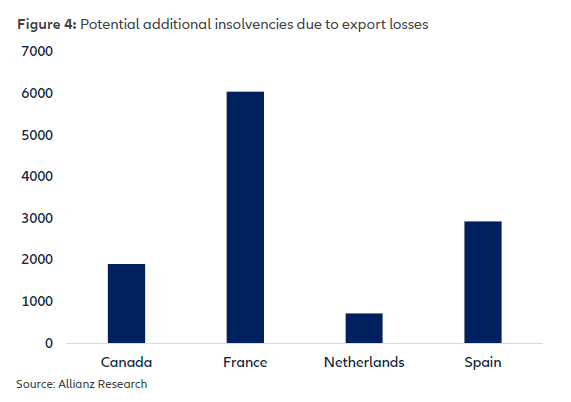

- Highest Export Risk: Countries whose economies lean heavily on exports are most exposed. France, Canada, Spain, and the Netherlands are found to be most vulnerable to rising insolvencies due to decreasing exports.

- Case Count Risk: In a worst-case scenario, export losses could lead to 6,000 additional insolvencies in France and 1,900 in Canada.

Mitigation: How the US dodged the initial blow

The effective tariff rate on US imports reached 11.2% by August 2025. Yet, the surge in US insolvencies was milder than expected. This resilience was achieved through two main factors: foreign exporters slashed prices to stay competitive, absorbing the tariffs themselves , and the widespread rerouting of goods through third countries like India and Vietnam. We estimate that overseas suppliers and end-consumers bear 77% of the burden. Furthermore, tariffs have also acted as a shield for US domestic firms, curbing foreign competition.

The delayed risk: Tariffs set to hit US prices

The US reprieve may be temporary. As the ability of foreign exporters to absorb costs reaches its limit, more tariffs will inevitably be passed through to US prices. We expect that by mid-2026, this pass-through will contribute an extra +0.6pp to US inflation. This delayed impact will combine with cooling domestic growth and tight financial conditions to squeeze US firms from both sides , leading to a projected +9% increase in US insolvencies in 2025.

Export-driven economies face the catch-up risk

The fallout from the trade war is ultimately hitting the hardest outside US borders. If global trade volumes stagnate, export-driven economies will feel the squeeze on corporate financials. We find that decreasing exports lead to rising insolvencies in countries such as Canada, France, Spain, and the Netherlands. For instance, in a worst-case scenario, France could face an extra 6,000 insolvent companies, and Canada up to 1,900.

Sectors under threat: Automotive, Machinery, and more

The impact is sector-specific. In Europe, the Automotive sector (HS 87) faces the highest effective tariff rate, particularly in Germany (25.0%) and the UK (10.9%). The Machinery and Mechanical Appliances sector (HS 84) also faces significant risk, with high export exposure in Germany (19.5% of total exports) and the Netherlands (23.2%).

Conclusion

The global trade environment is riskier than the initial US insolvency data suggests. The true cost of the trade war is being shifted and delayed, creating significant credit risk exposure, especially for European export-oriented businesses.

Protect your cash flow against bad debt and late payment.

Our expertise and commitment

Allianz Trade is the global leader in trade credit insurance and credit management, offering tailored solutions to mitigate the risks associated withbad debt, thereby ensuring the financial stability of businesses. Our products and services help companies with risk management, cash flow management, accounts receivables protection, Surety bonds, business fraud Insurance, debt collection processes and e-commerce credit insurance ensuring the financial resilience for our client’s businesses. Our expertise in risk mitigation and finance positions us as trusted advisors, enabling businesses aspiring for global success to expand into international markets with confidence.

Our business is built on supporting relationships between people and organizations, relationships that extend across frontiers of all kinds - geographical, financial, industrial, and more. We are constantly aware that our work has an impact on the communities we serve and that we have a duty to help and support others. At Allianz Trade, we are strongly committed to fairness for all without discrimination, among our own people and in our many relationships with those outside our business.