Regional scenarios

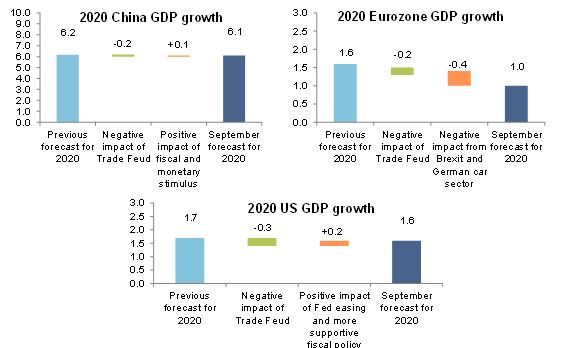

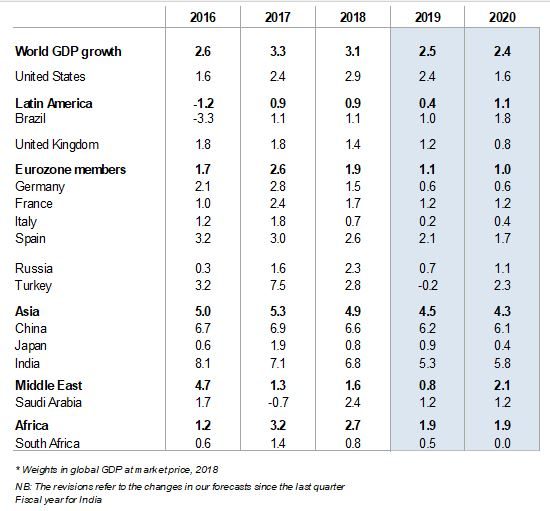

No escape from the trade shock in the US, as a trough of activity is still expected in H2 2020. In Q2 2019, the U.S. economy grew by +2% q/q annualized compared with +3.2% q/q annualized in Q1 2019. As we expected, this deceleration reflected an impairment of the investment cycle alongside much lower performances on the exports side. We expect this trend to continue in the coming month as the manufacturers’ confidence level has significantly declined. In particular, the accumulation of inventories in previous quarters calls for a lower contribution of investment over the next coming months, with a trough of activity expected in H2 2020. Thereafter, the easing of monetary policy should produce its first tangible and positive impact on growth. All in all, we expect U.S. GDP growth to reach +1.6% in 2020 compared with +2.4% in 2019 and +2.9 % in 2018.

The bi-partisan agreement reached on the debt ceiling issue has reduced the probability of a disorderly adjustment of U.S. debt. But the probability of a U.S. recession is still non-negligible, albeit lower than before, because of two other fundamental changes: (i) the expected continuation of the Fed’s accommodative monetary policy and (ii) the tightening of trade policy, with the latest protectionist initiatives likely to lead to higher prices of imported consumer goods. In 2020, we expect a significant increase in core inflation, which should remain well above +2% y/y. This in turn will induce an erosion of real disposable incomes and a progressive deceleration of consumption.

Shock absorbers are at play in China, but not enough to avoid a stronger deceleration in growth. China’s economy further decelerated in Q2 as its GDP came out at +6.2% y/y compared with +6.4% y/y in Q1 2019. Stagnant producer prices and industrial profits in July don’t bode well for investment in Q3, and consumption’s contribution to growth was smaller in Q2, showing no sign of improvement in Q3.

We expect new fiscal initiatives in the coming months in China, ranging from higher targets of bond issuances to lower controls on local government leverage and more infrastructure spending (we expect supplementary spending of 2% of GDP, compared with the 5% of GDP stimulus already announced). We also anticipate further easing on the PBOC side. Two additional 50bp cuts are planned for 15 October and 15 November for banks directly distributing loans to small and private firms. The PBOC is also likely to implement other cuts in the RRR before the year’s end, new cuts in the medium-term lending facility (TMLF) rate and, therefore, cuts in the Loan Prime Rate (LPR), as well as envisaging letting RMB depreciate further. Despite this, we expect the Chinese economy to grow by +6.2% in 2019 and +6.1% in 2020, mirroring a downward revision by -0.1pp due to rising tariffs and uncertainty, as well as the longer time needed to see a full transmission of the ongoing stimulus.

Europe should avoid recession as services and construction are saving the day amid a prolonged recession in the manufacturing sector. The manufacturing sector entered a technical recession in Q2, mainly due to the strong contraction in Germany (-5.1% y/y in June). We expect this to continue in H2 given (i) the escalating trade dispute, (ii) a higher likelihood that the U.S. imposes 10% tariffs on its car imports in November and (iii) the rise in uncertainty in May, which triggered a rebound in the level of company inventories. However, growth in disposable income and low interest rates will continue to support consumer spending. In addition, we have observed positive substitution effects from the U.S.-China trade dispute since the start of the year, which allows for a lower negative impact on Eurozone GDP growth despite its intensification: -0.2pp on average in 2019 and 2020, bringing our Eurozone forecasts down to +1.1% and +1.0% in 2019 and 2020, respectively.

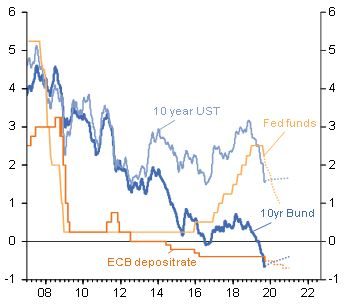

Following September’s comprehensive policy package, we expect the ECB to up the doses of monetary policy stimulus again in Spring 2020 (cut of the deposit rate by 20bp to -0.7% and increase of the QE pace to EUR30bn per month) in the context of subdued macro prospects in the Eurozone and further policy loosening by the Fed. This, alongside more fiscal stimulus (notably in Germany) will help economic activity to an extent, but we believe monetary policy has reached its limit in the Eurozone.

Germany goes from Eurozone growth-motor to laggard. After +1.5% last year, the German economy will expand by only +0.6% per year in 2019 and 2020. Even if a recession is avoided for now, the subdued growth outlook suggests that the threat of it will remain acute in the coming quarters. At best, amid global uncertainty, mini-growth rates can be expected in the coming quarters, with private consumption and construction investment keeping the German economy afloat. The private sector’s low indebtedness and high savings will help cushion the negative impact. However, a fiscal stimulus may not have much of a positive impact (+0.2pp of real GDP growth).

France is expected to outperform Eurozone peers. We expect GDP growth at +1.2% both in 2019 and 2020 as a result of a fiscal stimulus (~10 bn EUR in 2019, then 7bn EUR in 2020). Along with low rates, this stimulus is primarily beneficial to residential investment, which is again above 10% of household disposable income. Private consumption is also benefitting but with two laggards: cars (as elsewhere in Europe) and food (as a result of food inflation, +3.2% y/y in August). Overall, corporates are still enjoying favorable turnover growth (+5.2% in the manufacturing sector), but their order books decreased (-1 month during the last year), mainly as a result of lower demand for the car value chain domestically and abroad, leading us to expect a sudden stop for French exports in H2 2019 after a favorable performance (+13bn EUR) in H1.

The Italian risk under control. The Italian economy has now treaded water for the past year, with external headwinds and elevated domestic political uncertainty weighing on economic momentum. Going forward, with the political outlook improving as the incoming PD & M5S coalition is likely to tone down Italy’s fiscal spending plans and pursue a more conciliatory approach towards EU relations, domestic demand will start to show some signs of life again. Lower political uncertainty, coupled with the superdovish ECB, should keep bond spreads below 200bp. External headwinds will meanwhile continue to test the resilience of Italian exports until next year, so that overall we expect GDP growth to accelerate only slightly to +0.4% in 2020 after +0.2% in 2019.

While we see an extension of Article 50 as the most likely scenario for Brexit, the risk of a no-deal remains high (40%). Both chambers of the UK Parliament have approved a law seeking to block a ‘no-deal’ if PM Johnson doesn’t reach an agreement with the EU by 19 October. In theory, this should block a hard Brexit. However, given that he lost his majority in a kind of ‘no confidence’ vote, the only way forward seems to be early elections. The UK economy will enter a technical recession in Q4 2019- Q1 2020 on the back of the absorption of contingency stockpiling. We expect GDP growth to slow down to +0.8% in 2020 from +1.2% in 2019.

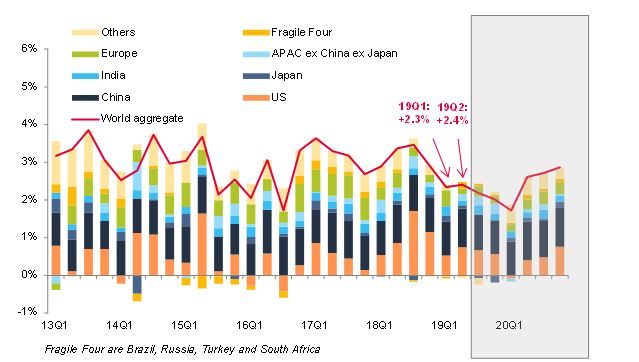

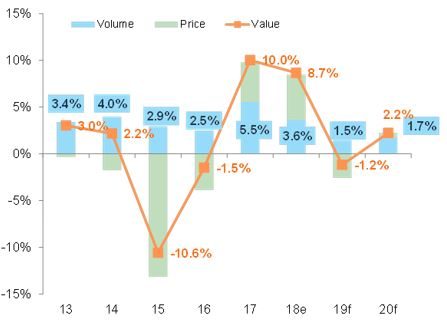

Emerging Markets: Political risk prolongation. In Emerging Markets (EMs), the growth slowdown observable is quite strong (+3.8% in 2019, after +4.4% in 2018). Export hubs (Mexico, Emerging Europe, and Emerging Asia) are experiencing spillovers from growth downturns in their key trade partners (U.S., Germany and China), as well as the impact of the global trade recession in goods observed in H12019. Many of these economies experienced borderline recessions (e.g. Mexico, Singapore, and Korea) and avoided them as a result of the fiscal and monetary buffers they have. The leeway for rate cuts, along with the fiscal space many EMs have accumulated, should help growth to recover partially in 2020 (+4.1%). However, it should come with increasing divergence. First, some EMs are not benefitting from lowering yields, mainly since they have accumulated imbalances and do not benefit from the same fiscal space (Argentina, Brazil, South Africa). In these countries, the repetition of capital flow reversals has the potential to have stronger consequences on the non-payment risk, as evidenced by the Argentinean default in August, and credit events are more likely in this environment.

In the Asia-Pacific region, weaker global demand along with persisting trade tensions has already led to a deceleration of economic growth in H1 2019 which we expect to continue for a few more quarters as most economies in the region are highly trade-dependent. Regional growth is forecast to slow down from +4.8% in 2018 to +4.3% in 2019 and +4.1% in 2020.

The trade hubs Hong Kong and Singapore have been particularly impacted by the US-China trade feud and are on the brink of recession after real GDP contracted in Q2 vs. Q1. As a result, annual growth will drop to +0.4% or so in 2019-2020.

South Korea has been affected by the global semiconductor downturn – exacerbated by the trade conflict with Japan. A recession was avoided so far thanks to strong fiscal stimulus but a marked growth slowdown is in the cards. Meanwhile, Taiwan has surprised on the upside so far as unexpectedly strong exports and investment boosted GDP growth in Q2 because higher tariffs have prompted Taiwanese companies to move investment and production back home from mainland China. Yet, growth should ease going ahead, especially in 2020.

Australia and New Zealand have been less affected by the weaker global demand so far, being able to maintain sound export growth thanks to healthy commodity prices and continued steady demand from China (Australia) and a surge in dairy exports (New Zealand, unlikely to be sustained). Yet, Australia is set to see a slowdown ahead as the export boom will fade while (construction) investment is contracting sharply and consumer spending remains subdued.

Meanwhile, India and the ASEAN-5 (Indonesia, Malaysia, Philippines, Thailand, Vietnam) economies have also experienced faltering exports, except for Vietnam which has benefited the most from trade diversion as corporates look for cheap alternative hubs of production. India’s growth is set to fall below +6% for the first time since 2012 as weak consumer spending and investment add to the trade woes. The main risks stem from potential pressures on the currencies of markets with twin deficits (India, Indonesia and Philippines).

In the Asia-Pacific region as a whole, economic policies is set to mitigate the impact of the global uncertainties on most of the economies. A loosening of monetary policy conditions is underway after the US Fed began easing. And because inflation is in check (or even very low) in the region, all countries have monetary policy leeway and most have begun lowering interest rates. Fiscal policy support is also underway in China, South Korea, Hong Kong, Singapore, Australia, Indonesia, Thailand, the Philippines as well as India, though the latter has to be cautious due to its high public debt burden.

Annual GDP growth in the Emerging Europe region as a whole is forecast to decelerate from +3.1% in 2018 to +1.7% in 2019, before picking up to +2.3% in 2020, mirroring the performances of the largest economies, Russia and Turkey. Emerging EU has benefited from substitution effects from the U.S.-China trade dispute. Looking ahead, these substitution effects are likely to fade as the U.S. economy is expected to slow. Moreover, the important automotive sector went into contraction across Central Europe in mid-2019, and it could be faced with U.S. tariffs by the end of the year. Monetary policy is already loose in the Emerging EU and there is little leeway in the near term as inflation has picked up in 2019 to date and is above respective targets. However, there is fiscal policy leeway in most of the region and several countries have already announced fiscal stimulus measures such as increases in public sector wages and social benefits. Yet, caution is warranted in Romania (high fiscal deficit), as well as Hungary and Croatia (high public debts).

Latin America might as well wait for Godot before going through a sizable growth recovery (+0.8% growth this year, +1.3% in 2020 - excluding Venezuela - after +1.4% in 2018), as it embraces key features of the illiberal cycle: further monetary easing, prioritization of household purchasing power and interventionism amid persistently high political risk. In H1 2019, the two largest economies (Brazil and Mexico) avoided recession by a hair’s breadth as reality checks occurred. We expect central banks to prolong their accommodative cycle to weather the regional slowdown. The Brazilian economy should grow slowly this year (+1% after +1.1%in 2018). Yet the cycle could be moderately boosted in 2020 (+1.8%) by the final adoption of a watered-down pension reform and the first privatizations starting to bear fruit, somewhat propelling business and consumer confidence and helping investment recover. In Mexico, we still expect a low-growth regime (+0.4% in 2019, +1% in 2020) with policy uncertainty (both domestically and externally) driving off foreign investment flows. Argentina’s default and predicted election result mean an additional year of deep economic contraction in 2020, and heightened political risk for companies. Colombia stays on our watch-list as its vulnerabilities keep increasing, with a widening of its current account deficit (-4.2% of GDP).

In the Middle East, political risk is not abating, while oil output cuts and lower-than-expected oil prices will take a toll on growth in the GCC. The Hormuz strait tensions between Iran on the one side and the U.S. and partners on the other side are dragging on. In our baseline scenario we still do not expect an outright war between the two sides, but the risk of policy miscalculation leading to war, as well as new proxy wars e.g. in Lebanon, remains elevated. Economic growth in the region as a whole is projected to slow down to +0.4% in 2019, before moderately recovering to +1.3% in 2020 (reflecting downward corrections by -0.2pp and -0.6pp, respectively).

In Africa, growth is expected to slow down again to +1.9% both in 2019 and 2020 (+3.2% in 2018), not far from the low experienced in 2016 (+1.2%). The strongest disappointment is coming from the main export hubs of the region, such as Morocco (+2% in 2019 and 2020), Tunisia (+1.2% in 2019, +0.5% in 2020) and South Africa (+0.5% in 2019 and +0% in 2020). The imbalances still existing in key economies of the region and the poor ability to implement reforms are also a key bottleneck, particularly in Nigeria and South Africa, Algeria and Angola (all these economies exhibit negative growth per capita). Poor crops in the region and the low ability to generate enough power (as a result of water shortages) are also key bottlenecks, particularly in Southern economies (South Africa, Zambia, Zimbabwe). Debt sustainability is not a region-wide issue, but some pockets of vulnerability are rising. South Africa is a case in point, since shortages of cash in State-Owned Enterprises are putting an upside risk to public debt.