Executive Summary

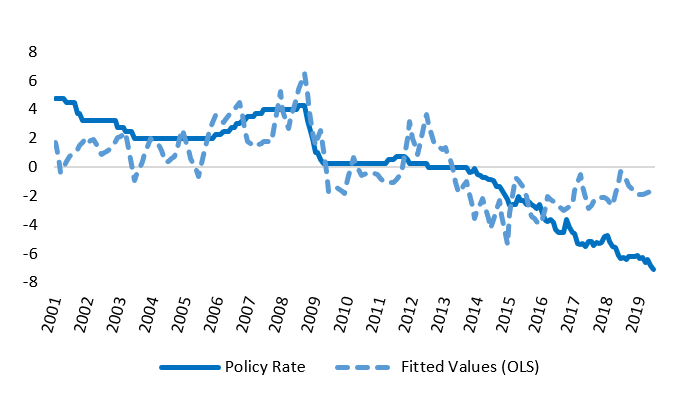

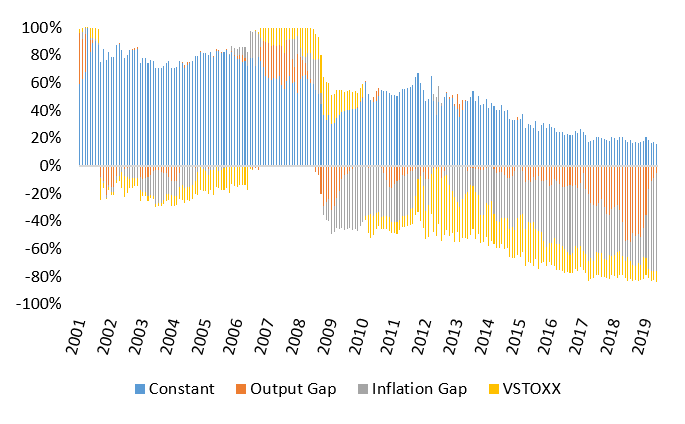

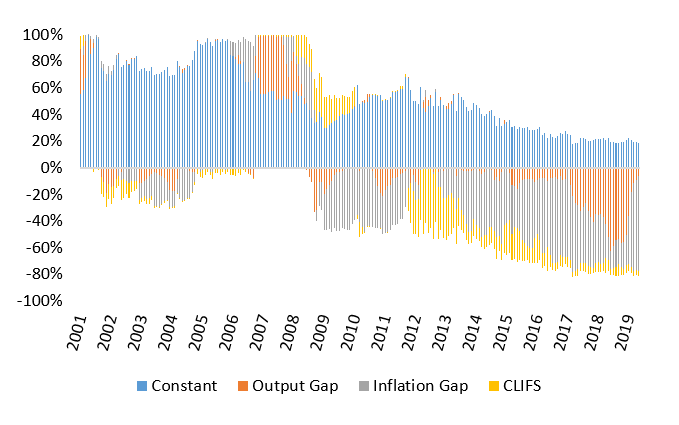

- Price stability: Half of the ECB story? The European Central Bank’s primary task is the pursuit of price stability, which is defined as inflation rates below, but close to, 2% over the medium term. Our analysis shows that inflation and output gap considerations explain half of the ECB’s monetary policy stance over the past decade. However, from 2016 onwards, output and inflation gap measures alone struggle to explain the ECB’s increasingly accommodative monetary policy stance in a standard Taylor Rule.

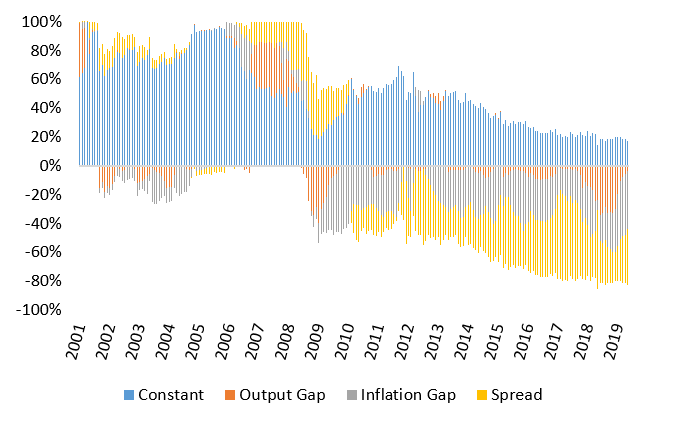

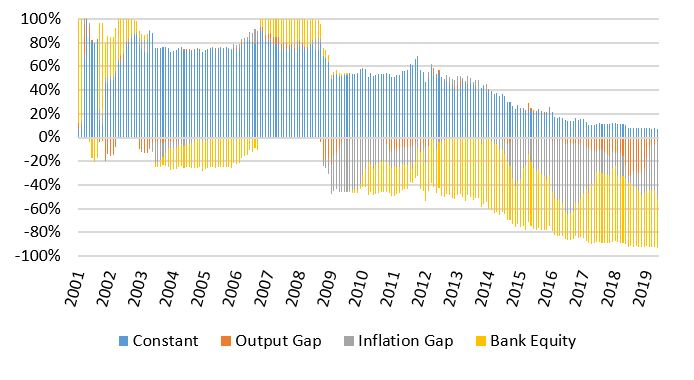

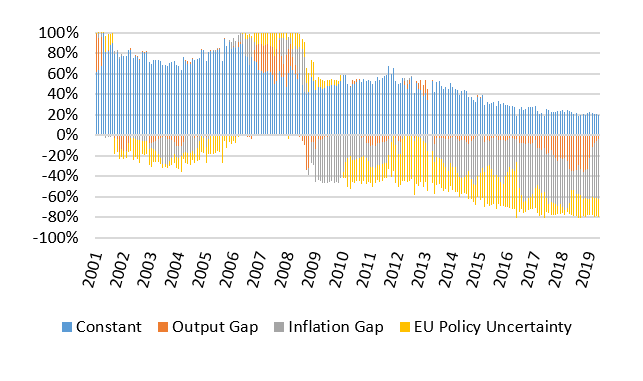

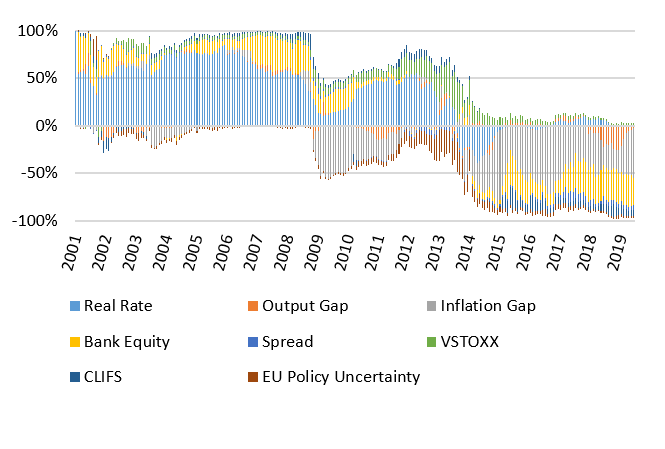

- The rise of implicit targets. To test the importance of other motives, we ran selected augmented Taylor Rules, adding explanatory variables and looking at their contributions over time to explain the ECB’s policy stance. Sovereign risk premia, financial stress and volatility indicators, measures of economic policy uncertainty and banks’ stock market performance all appeared relevant to the ECB’s decision-making over the past ten years. Their significance, especially in the case of peripheral spreads and financial stress indicators, peaked at the time of the Euro sovereign debt crisis.

- Inflation matters (again): From 2018 onwards, inflation has made a comeback in explaining most of the accommodative monetary policy stance. However, our results suggest that banks’ stock prices continue to feature high on the ECB dashboard in recent years, especially when compared to other stress indicators.

Introduction

Estimating an augmented Taylor Rule for the ECB

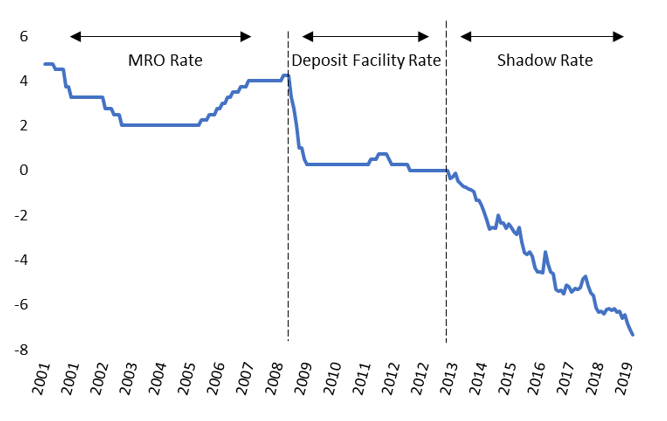

Before we can estimate a monetary policy reaction function, we first require an indicator that describes how tight or loose monetary policy has been over time. However, measuring the effective stance of monetary policy has become more complicated in recent years. After all, as the ECB ran into the zero lower bound on short-term interest rates in 2013 and increasingly resorted to unconventional policy measures, the main policy rate no longer accurately reflected the overall monetary policy stance. To construct an unconstrained measure of the overall stance of ECB monetary policy, we use the ECB’s main policy rate until September 2013 only. Thereafter, we switch to a shadow rate estimate from Wu and Xia (2016) that also reflects unconventional policy measures such as negative rates, explicit forward guidance and asset purchases. Figure 1 shows the combined time series of the ECB main policy rate and the shadow rate. As can be seen, our constructed proxy of the monetary policy stance is not constrained by a zero lower bound. In fact, ever looser monetary policy in recent years has seen the shadow rate drop below -7%.