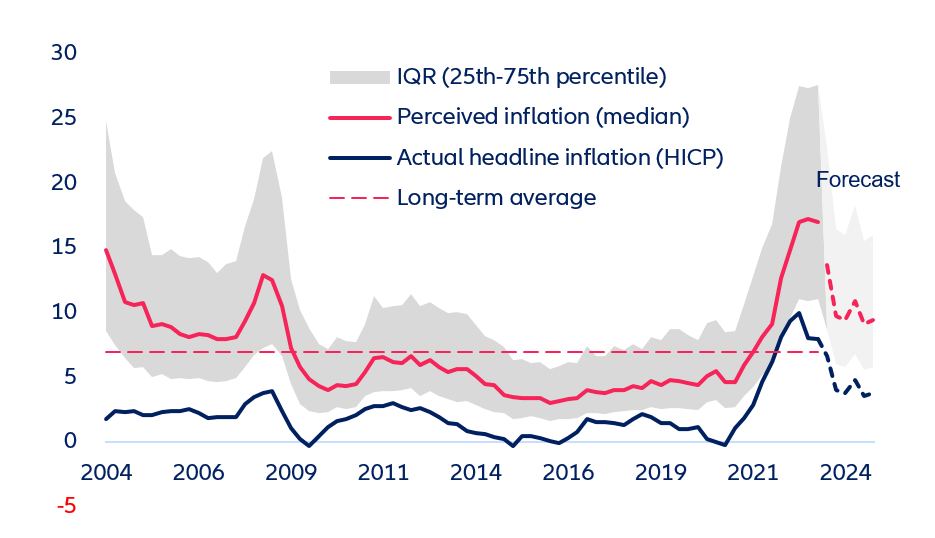

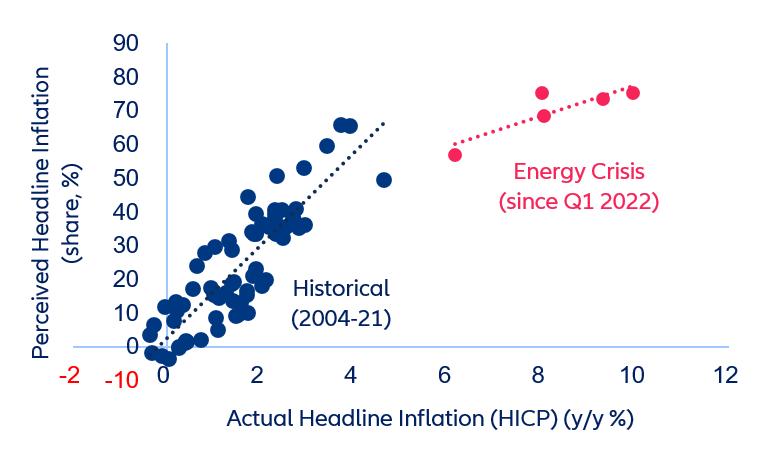

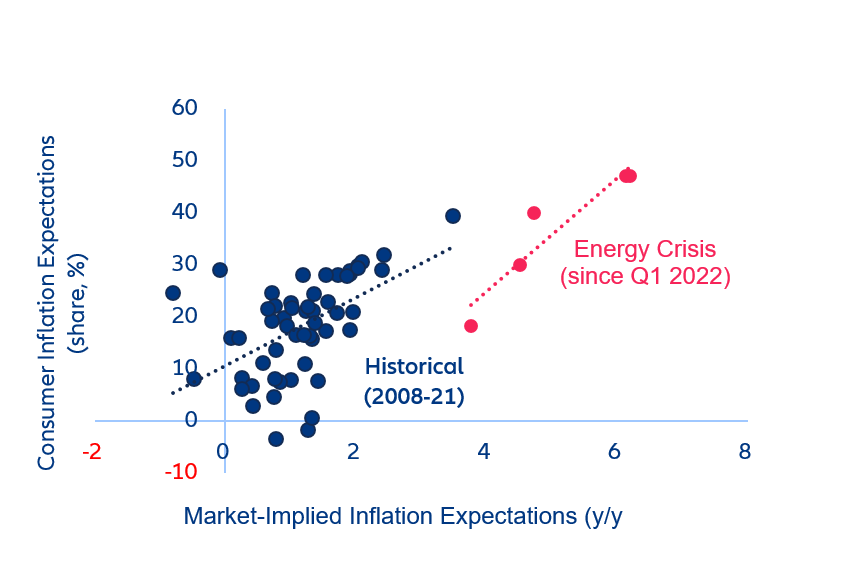

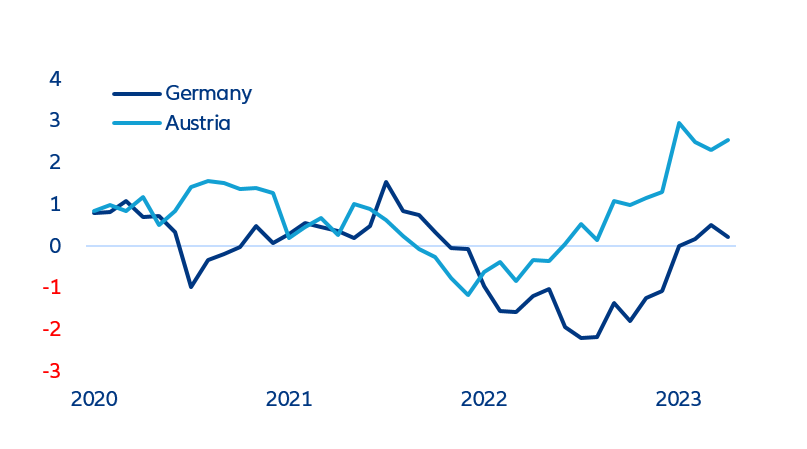

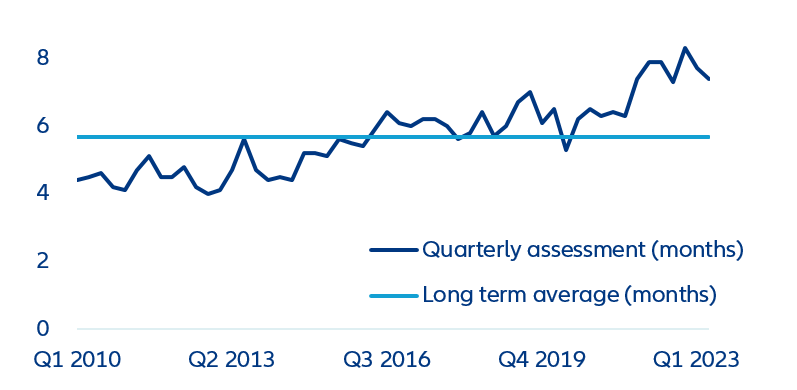

We expect perceived inflation to remain than double the rate of actual inflation (5.6% y/y in 2023), and structurally above the historical average of 6.8%, with persistent uncertainty over the medium term. The growing disconnect of perceived inflation is similar to that observed during the run-up to the global financial crisis (GFC) when rising asset and real estate prices pushed up overall price levels. However, there is also an important difference – the large share of households experiencing inflation to be higher for longer suggests that perceived inflation has become stickier (Figure 2). Thus, households will take longer to adjust their inflation expectations, which could impact the ECB’s capacity to keep high inflation from becoming embedded in the economy (Figure 3).

While official statistics provide a standardized framework for assessing inflation, several factors contribute to the perceived inflation being higher than the reported figures of actual inflation:Frequency bias: Consumers pay more attention to the change in prices for out-of-pocket purchases that occur frequently, such as convenience food and beverages, fuel and grocery errands. If these prices have increased above average, individuals tend to extrapolate a higher perceived inflation and overestimate actual inflation. Conversely, price changes of goods and services, which are purchased less frequently (such as cars and furniture) or occur automatically (via direct debits), such as rent payments, subscriptions or insurance fees, are likely to weigh less on our perceptions of the inflation rate.

Personal consumption bias: Individuals tend to have unique consumption patterns and preferences. If the prices of the goods and services they primarily consume increase at a faster rate than the overall inflation rate, they may perceive inflation to be higher. People tend to focus more on the prices of essential items such as housing, healthcare or education, which have experienced substantial cost increases in recent years.

Perception bias and anchoring: Psychological factors can influence how individuals interpret and remember price changes and create cognitive bias. People tend to focus on significant and/or more recent price increases or memorable instances of price inflation, which can contribute to the perception of higher inflation rates. Conversely, stable or declining prices tend not to be noticed but are included in the calculation of the average inflation rate.

Regional and demographic variations: Inflation rates can vary across regions, cities or even neighborhoods. Official measurements rely on national or regional averages, which may not accurately reflect the situation at a micro level. Individuals residing in areas with a higher cost of living or experiencing local supply shocks may perceive inflation to be higher than what is reported nationally.

Substitution bias: The official inflation rate is calculated based on a fixed basket of goods and services. However, as prices fluctuate, consumers often substitute their purchases for more affordable alternatives. This substitution bias is not fully accounted for in official measurements. As a result, individuals who observe substantial price increases in their preferred goods or services may perceive higher inflation rates.

Quality adjustments: The quality of goods and services can change over time, making direct price comparisons difficult. Official statistics attempt to adjust for quality improvements, but these adjustments may not always capture the true impact on individual experiences. If consumers perceive a decline in quality or reduction in features while prices remain constant or increase, they may perceive inflation to be higher.

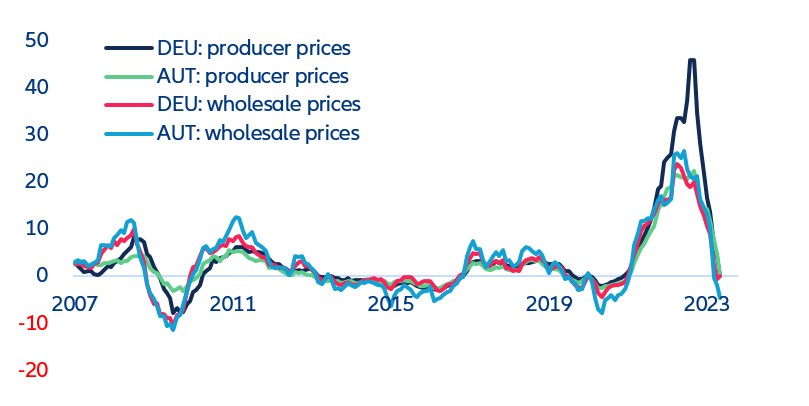

Limitations of official inflation measures: Official inflation measurements focus on consumer goods and services and often exclude asset prices such as the cost of shelter. Since real estate prices and rents have increased significantly in recent years, individuals may perceive inflation to be higher due to rising costs that actual inflation does not capture by design. In addition, inflation is not immediately felt by individuals as it takes time for price changes to trickle down through supply chains. By the time the effects of inflation become apparent, the official measurements may not fully reflect the current situation. This lag between price changes and official reporting can contribute to the perception of higher inflation rates.