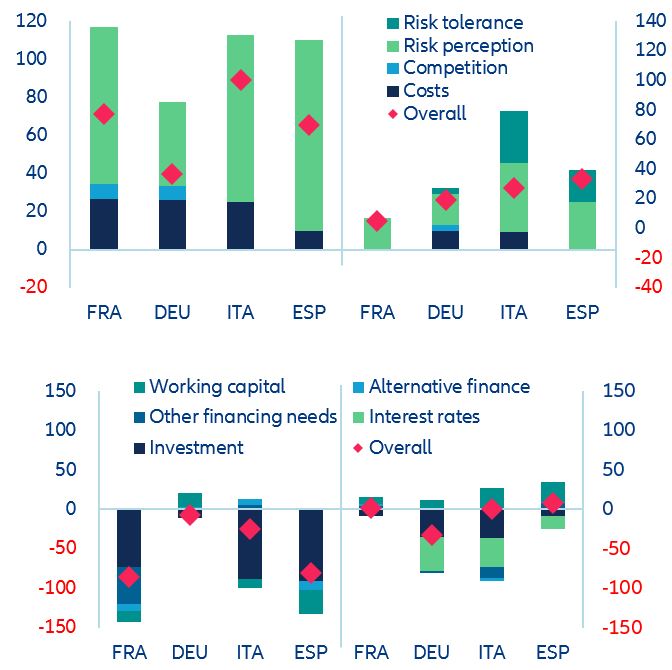

Deteriorating money and credit dynamics are already suggesting that the ECB’s policy hikes are having real bite, with potentially more pain potentially ahead. We expect annual growth of money supply and loans to the private sector in the Eurozone (to be published on Monday) to have decelerated further in February. Protracted uncertainty denting investment decisions and higher interest rates clearly impacted firms’ and households’ borrowing. The latest ECB Banking Lending Survey already confirmed that the decline in net demand for both housing and corporate loans will persist (Figure 12). In parallel, credit conditions have tightened significantly. We expect the CS-UBS episode to exacerbate the recent trends and banks to tighten significantly their lending criteria.

Insurers are affected by the interest-rate implications of the current market volatility rather than direct exposures to banks

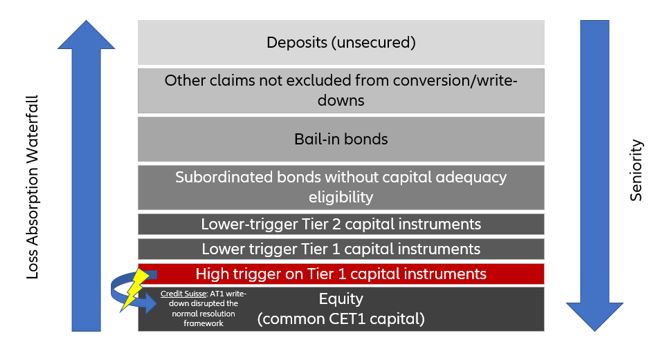

A major difference between insurers and banks is their resilient funding via premium income. Insurers could see their liquidity deteriorate due to policy surrenders and lapses but cannot suffer deposit runs to the same degree as banks. Insurers are also much less likely to have to conduct a fire sale of underwater assets. The risk of an increase in life surrenders should not be overdone as a review of product literature reveals that there are significant penalties for early redemption. More broadly, there is considerable resilience with respect to asset risk, given the investment-grade weight of insurers’ asset exposure. Insurers own very little bank AT1, given onerous regulatory capital treatment. The vast majority (~90%) of financial exposure is to senior debt.

In general, insurers mainly worry most about the current uncertainty about the level and future direction of interest rates, alongside high levels of volatility. Given the lower downside solvency sensitivity to interest rates, reinvestment rates would have to fall a long way (>100bps) for the investment-income tailwind to earnings to be materially damaged. However, the current accounting transition to IFRS 17 and 9 is not ideally timed, and the impact of capital market volatility on the new regime is hard to tell. The accounting transition will generate better insight into the stock (and stability) of life cash flows and a more accurate reflection of the economic impact of interest rate levels on both assets and liabilities (a timely reminder of matching).

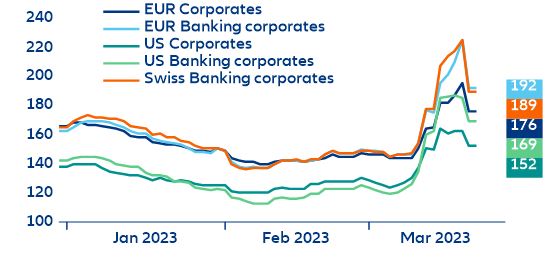

Markets will now have to balance the reduction of systemic risk with the likely higher financing costs and tighter lending conditions

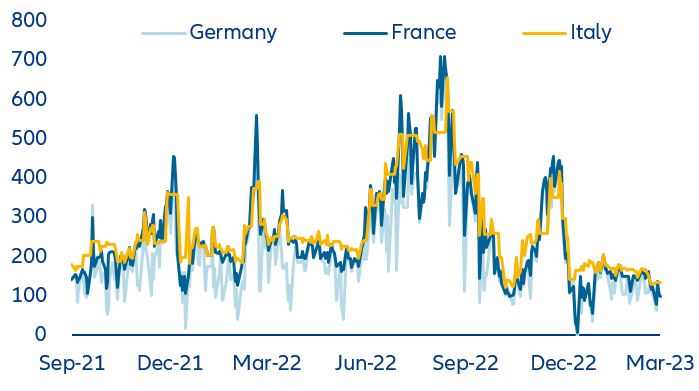

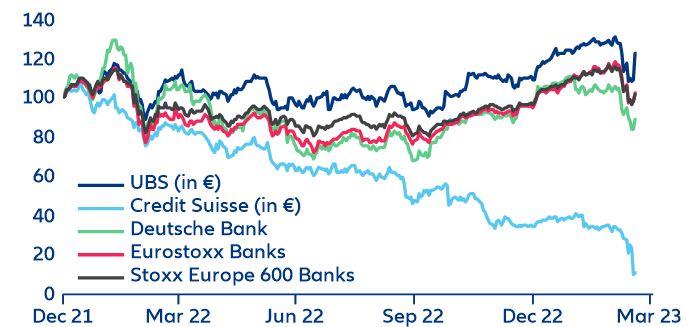

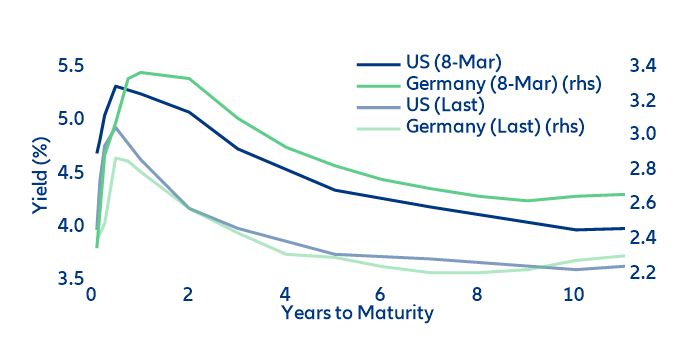

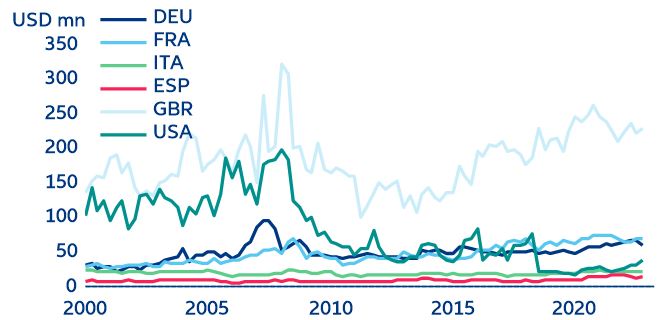

Going forward, the rescue of Credit Suisse has certainly elevated concerns about the health of the global banking sector and raised the risk of adverse spillover effects, resulting in a higher cost of capital for the banking sector and for non-financial corporates alike. Currently, markets do not seem overly concerned, but less resilient banks may face challenges in the future. Overall, we anticipate markets to remain turbulent, with all asset categories experiencing relatively high volatility in the short term due to mounting market and economic uncertainty. Following the initial sell-off and rush to safe-haven assets last week, markets are now triaging the banking sector into safe and risky names while figuring out how the current stress on banks will impact central banks' policy stance and the economic outlook. The prevailing ambiguity on the policy rate path in the US and Europe will result in increased market volatility over the near term. The downward adjustment in current sovereign yield curves suggest that central banks will stop hiking sooner than initially predicted, and that a more severe recession is imminent. We believe that the fundamental value for the long-end of the curve lies somewhere between the most hawkish point reached in the first week of March and the most dovish point reached in the past week. But we also acknowledge that short-term volatility will continue to prevent a smooth anchoring of both the short and long ends of the curves (Figure 13).

Figure 13: US and German sovereign curves (in %)