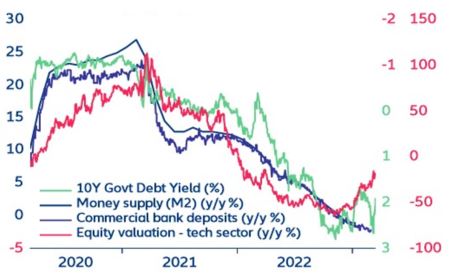

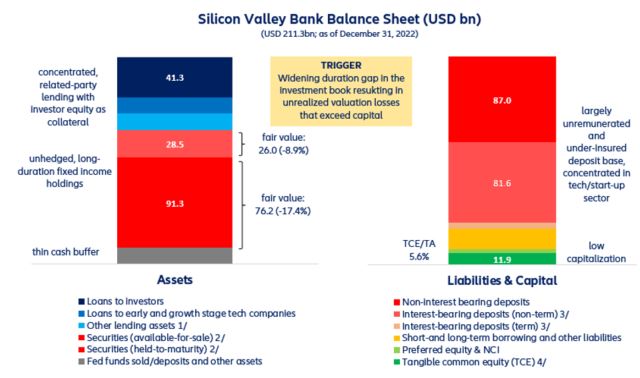

SVB’s widening duration gap has built up over time against the background of aggressive balance sheet growth. With total assets of USD209bn at the end of 2022, SVB was the 16th largest bank in the US. Even though it accounted for slightly more than 0.9% of the total banking sector assets, it catered to more than half of US venture capital (VC) funds and offered a vast array of tech and health start-ups a broad range of services. Over the last three years, SVB’s balance sheet tripled (against a 39% increase for the whole US banking system). During this period, SVB received massive deposit inflows from these start-ups, which parked the excess capital they raised as deposits. At the end of 2022, 96% of its USD173bn deposits were not insured by the FDIC, because they exceeded the USD250,000 threshold. In parallel, SVB built up a sizeable portfolio of long-dated Treasury securities and mortgage-backed securities (USD120bn), which was valued with unrealized losses of USD17 bn (or 14.8%) and would have absorbed the bank’s entire capital. After December 2022, the portfolio was left unhedged against the risk of further rising interest rates.

The collapse was triggered by a deposit run of a concentrated investor base. Once SVB started experiencing some deposit withdrawals, the forced liquidation became a likely scenario: selling USD21bn of bonds was contemplated at the risk of realizing a USD1.8bn loss. To recapitalize itself, SVB tried to raise USD2.25bn of fresh capital but failed to do so, perhaps because – among other things – SVB’s top managers had sold their shares two weeks earlier. Last Friday, news of SVB’s financial stress fostered an online bank run, which was compounded by the poor diversification of funding sources. Several firms failed to diversify their banking partners, with some having reportedly kept all their excess liquidity with SVB as deposits. During that single day, SVB lost 25% of its deposits (USD42bn). Some VC backers encouraged their start-ups to jump ship. Eventually, US regulators decided to withdraw SVB’s license and shut down the bank. Yet, with very few exceptions, they wasted no time arguing that the US leadership in tech was at stake, should SVB’s uninsured depositors lose money. It is also true that, under California law, company founders are personally liable for unpaid wages.

US regulators seems to prefer firefighting over preventing fires. After another large bank failed (Signature Bank, USD110bn), the Fed, Treasury and FDIC acted swiftly to prevent contagion risk and preserve financial stability. Under the systemic risk exception, Treasury Secretary Janet Yellen instructed the FDIC to make whole all depositors with both banks out of its Deposit Insurance Fund (DIF), i.e. not just those with deposits under the USD250k threshold. In addition, under a new Federal Reserve facility, the Bank Term Funding Program (BTFP), banks can access liquidity without selling securities at a loss: to get funding up to one year, they just need to pledge securities valued at par (i.e. above market prices) as collateral. In a replay of previous stress episodes, policymakers asserted that the US banking system remains healthy; the trouble is that this could have also been claimed before the demise of SVB put the spotlight on some significant regulatory shortcomings.

These significant regulatory shortcomings amounted to benign neglect of SVB’s poor risk management. SVB was a state-chartered bank, with the Federal Reserve as primary supervisor. But the bank was also supervised by the state of California. The division of labor between these two institutions may not have been optimal. For instance, SVB’s increasing reliance on funding from the Federal Home Loan Bank of San Francisco (from 0 at the end of 2021 to USD15bn one year later) seemingly went unnoticed. Yet, it is well-known that this lender to US regional banks is a lender of second-last resort (incidentally, the FHLB system has just sold USD88.7bn of short-term notes to increase its firepower).

In 2018, in a rollback of the Dodd-Frank Act, banks with assets under USD250bn were exempted from the Fed’s stress tests and capital and liquidity requirements. In 2019, considering that large regional banks (or medium-sized banks) were not systemic, the Fed approved lighter regulations for all but the largest banks. More generally, supervisors seemed to have paid insufficient attention to interest-rate risk despite a large amount of unrealized losses in the banking sector (USD620bn). Much has already been said about the wrong incentives given by the extended deposits guarantee and the BTFP. Such policies are likely to increase moral hazard.

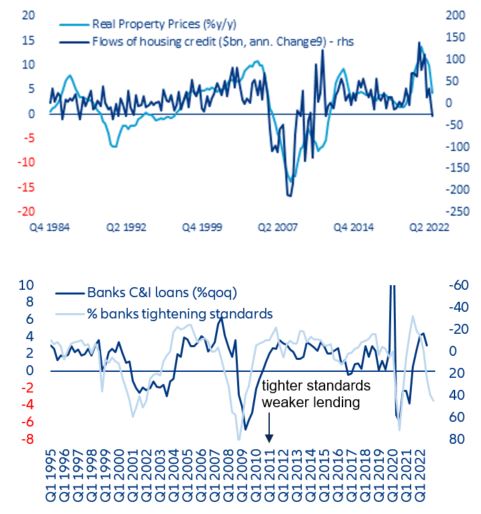

In the wake of SVB’s failure, banks will become even more conservative in their lending. The planned resolution of the SVB imposes direct costs on other US banks, which will foot the bill for making all depositors whole (though higher FDIC fees). But more critically, the indirect effect will be rising moral hazard in the banking sector as the Federal Reserve seems to be still willing to backstop failing banks. Over the near term, financing conditions are bound to tighten further in the US economy (and other countries) as banks raise lending standards and carefully safeguard their liquidity positions, further retrenching credit.

Declines in bank asset values significantly increase the fragility of the US banking system to uninsured depositor run. According to simulations by a SSRN study, SVB was far from being the worst capitalized and having the largest unrecognized losses amongst US banks. SVD stood out in having a disproportional share of uninsured funding. However, if only half of uninsured depositors decided to withdraw their funds, almost 190 banks would be a potential risk of impairment to insured depositors.