In focus – Hungry for profits? What’s behind European food inflation

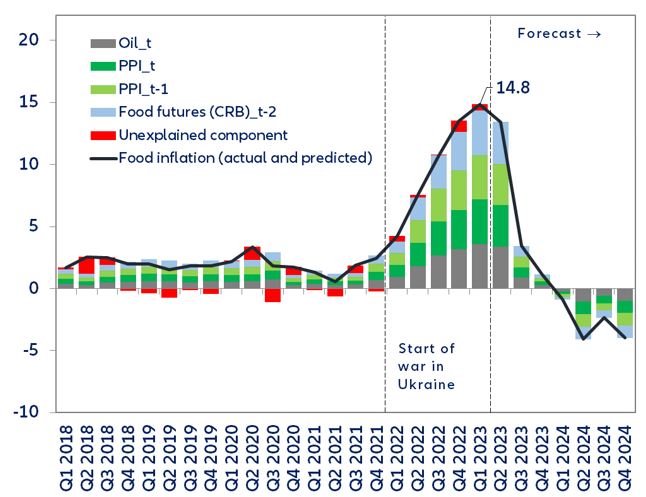

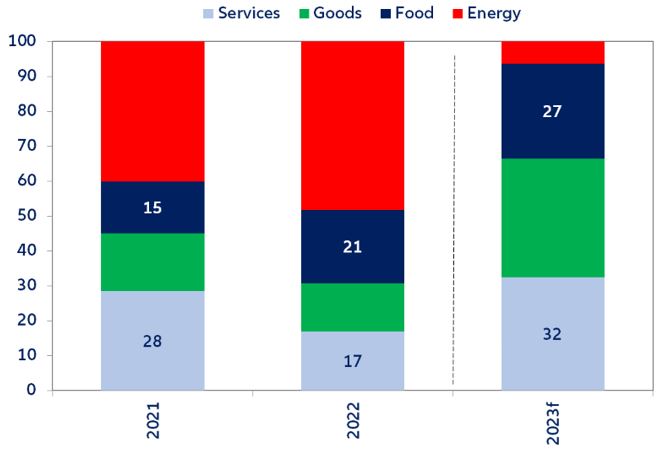

- Food prices in Europe remain high and will only decline later this year. In March, headline inflation in the Eurozone declined to 6.9% y/y (down from 8.5% y/y in February) due to a large drop in energy inflation to -0.9% (down from 13.7% y/y in February) as we mark the one-year anniversary of the jump in oil and gas prices after Russia invaded Ukraine. However, food, alcohol and tobacco inflation rose again to 15.4% and are likely to remain high until the end of the year.

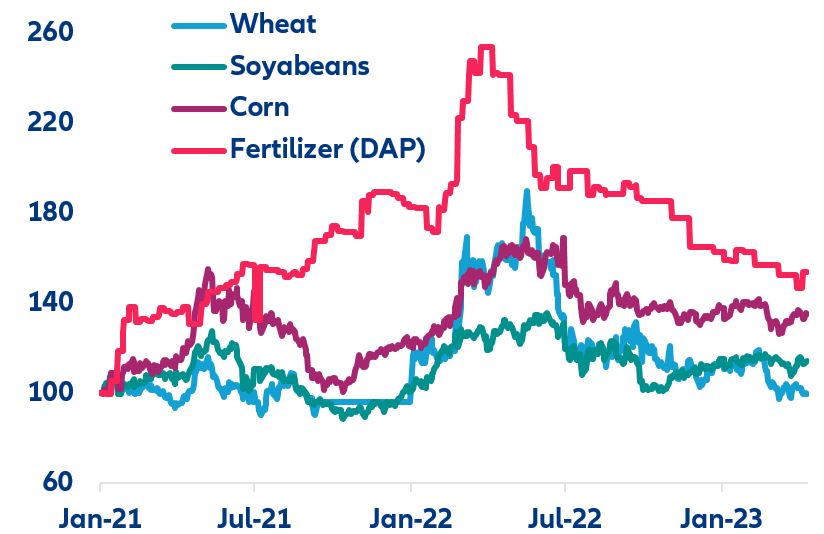

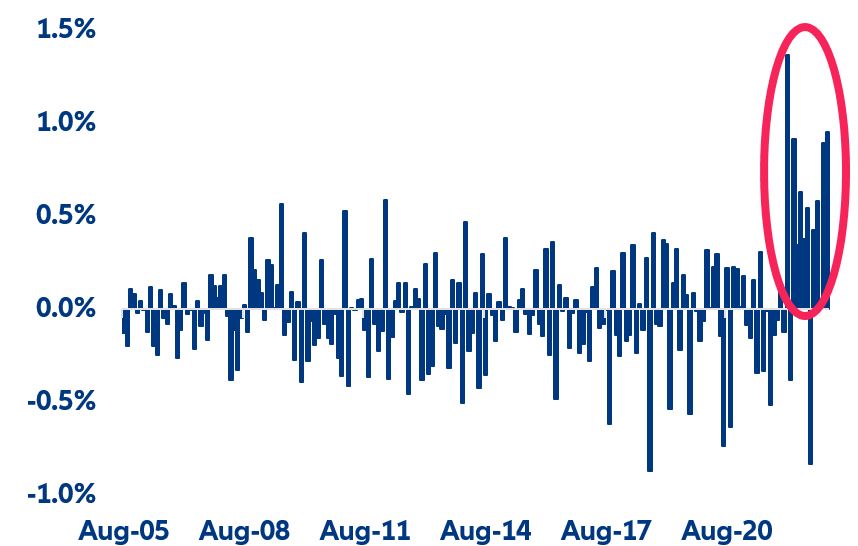

- Cooling commodity prices have not helped mitigate food price pressures in Europe. As of April 2023, most food commodities are trading at levels close to or slightly above those of 2021. Although some remain expensive, we saw similar prices in 2013-2014 without a large increase in food inflation. Packaged-food producers are behind most of the price pressures.

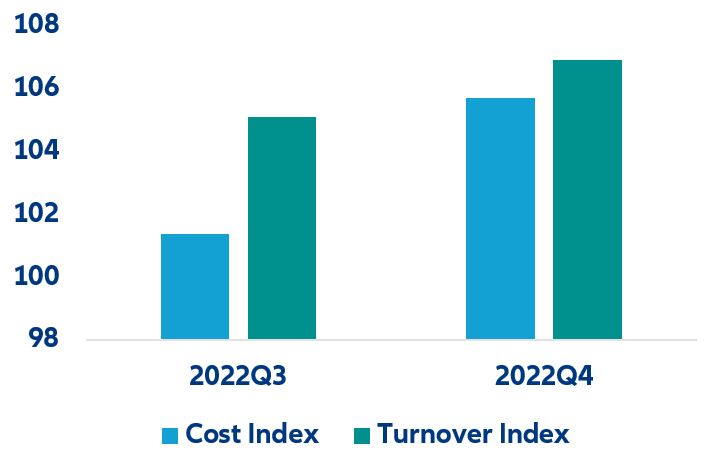

- Some food inflation remains “unexplained” due to catch-up profit-taking. This could stem from firms in the food sector making up for the difficult months between March and June 2022. We find that most firms have managed to increase turnover beyond costs since then.

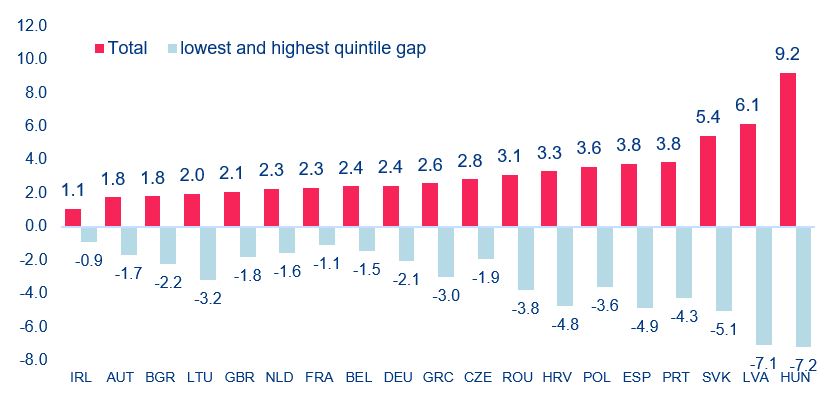

- Consumers will continue to pick up the tab. As PPI have just turned a corner, expect prices to continue increasing until the summer and remain at elevated levels. We estimate that households have lost between 1.1% and 9.2% of purchasing power over the past year, with Eastern European countries being hit the hardest. A further increase in food prices by +20% could lead to about 1-pp drop in consumption in the EU.