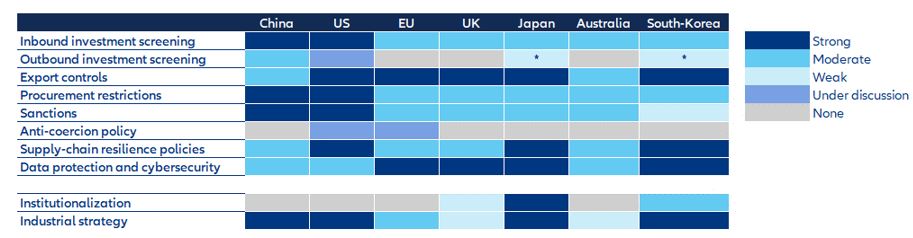

Full implementation will take time given potential loopholes, but the private sector is already reducing its exposure. As pointed out by the PIIE, outbound investment restrictions would be tricky to implement and probably create many loopholes. For instance, Western firms could still invest in prohibited critical sectors in China through their foreign-based subsidiaries, or through Hong Kong.

For now, governments are still balancing their desire to curtail technology transfers to China against the concerns of the private sector, which has a high stake in Chinese investments. The US is likely to go ahead first with its own regime to review outbound investment to China later on this fall (the so called “reverse CFIUS”, referring to the Treasury Department’s Committee on Foreign Investment, which reviews inbound investments) but other G7 countries are likely to follow suit. In the US, a bipartisan bill (China Competition 2.0 Bill) has a good chance of being passed by Congress as soon as September or October (after a few failed attempts in previous years). The major industries considered would be microchips, some type of AI related to military and surveillance and quantum computing, but the biotech and clean energy sectors could also be included. The EU faces some constraints with respect to the existing fragmented FDI screening landscape among its member states and will thus likely move more slowly.

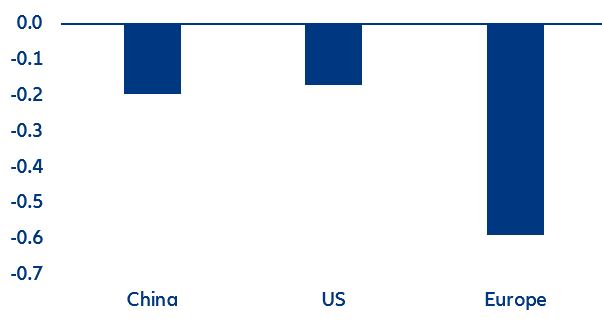

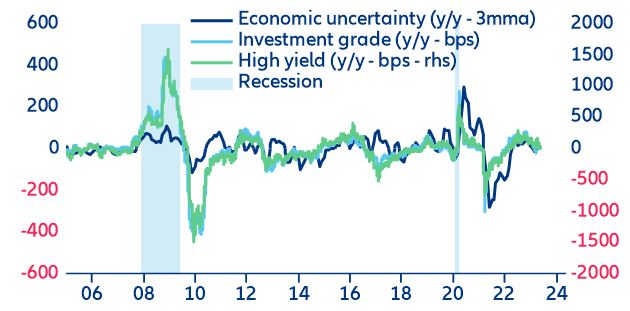

Two-way investment flows between China and the West are already on a downward trend. Despite some acceleration in 2021, inbound FDI from China dropped by -77% vs its 2016 peak to EUR46bn due to the increased investment screening in largest European countries. Up until 2020, close to 60% of inbound investments in Europe from China were made in Germany, the UK and France, with the Netherlands gaining traction since 2021 following a large Chinese acquisition. Central and Eastern Europe accounts for around 10% of total Chinese investments in Europe. Most of the inbound Chinese investments are made in the automotive sector and consumer products, but ITC, biotech, pharmaceuticals and the health sector are also gaining traction.

The trend for inbound investments from China in Europe is likely to remain on the downside, not only because of new European regulations (incl. on procurement and foreign subsidies) but also due to reinforced screening by the individual countries. In 2022, Germany, Italy and the UK already blocked several Chinese investments in the so-called strategic industries.

The majority of EU states have already enacted laws to protect their national security. In Germany, the Foreign Trade and Payments Act (Aussenwirtschaftsgesetz) and the Foreign Trade and Payments Ordinance (Aussenwirtschaftsverordnung (AWV)) are in place and concern sectors such as personal protective equipment (PPE), AI, quantum technology, robotics and autonomous driving. In France, FDI control rules are set out in the Code monétaire et financier, and concern sensitive sectors including energy, critical infrastructure, food security, transport, print press, defense, space, AI, robotics, cybersecurity and public health. In Italy, inbound FDI is controlled by the Golden Power Law. In the Netherlands, the Cross-Sector Foreign Direct Investment Screening Act (Wet veiligheidstoets investeringen, fusies en overnames) was adopted by the Dutch Senate in 2022 and targets investments the field of (very) sensitive technology. The UK amended its foreign investment review regime by passing the National Security and Investment Act (NSI Act) 2021. There are 17 sectors within which foreign investments are controlled, mainly concerning high-tech products.

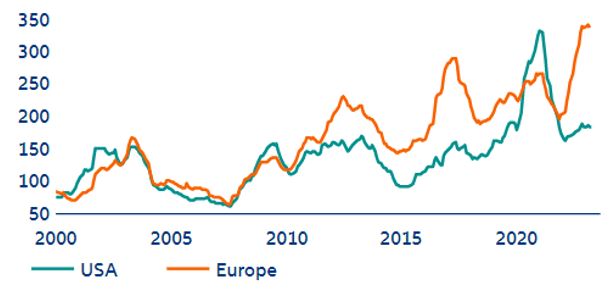

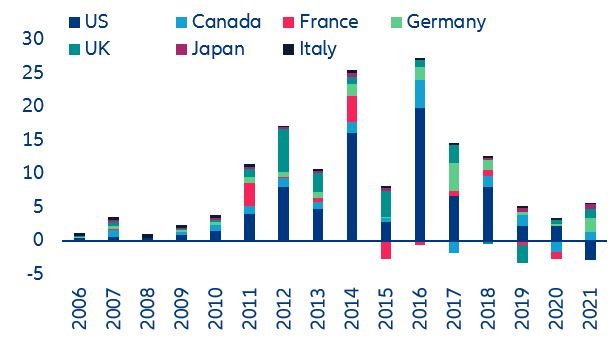

Similarly, outbound investment to China has been on downward trend since 2016 (Figure 12), led by a sharp pull-back from the US. For instance, the outward stock of FDI from the UK in China stood at close to GBP11bn in 2021 (-15% compared to 2018), or 0.6% of total UK outward FDIs. On the other side, inward FDIs in the UK from China stood at only GBP5bn, or 0.3% of the total UK inward FDI stock.