EXECUTIVE SUMMARY

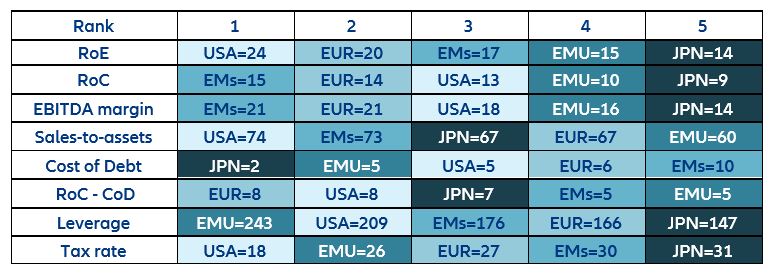

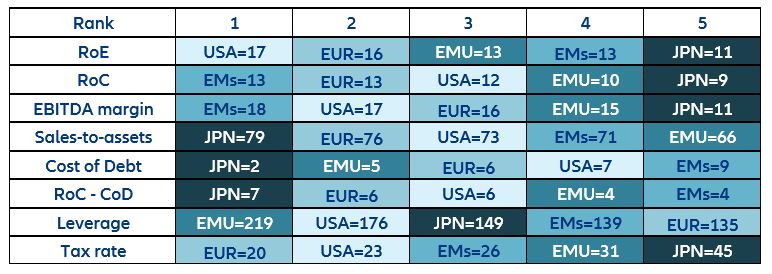

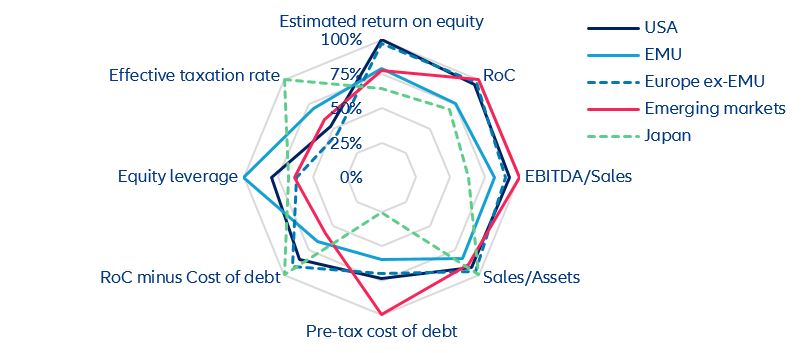

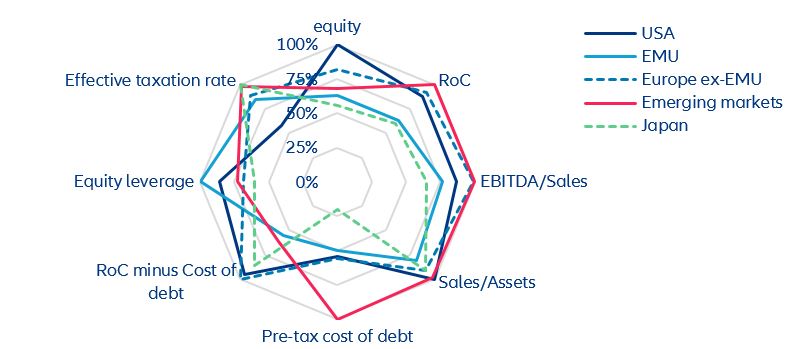

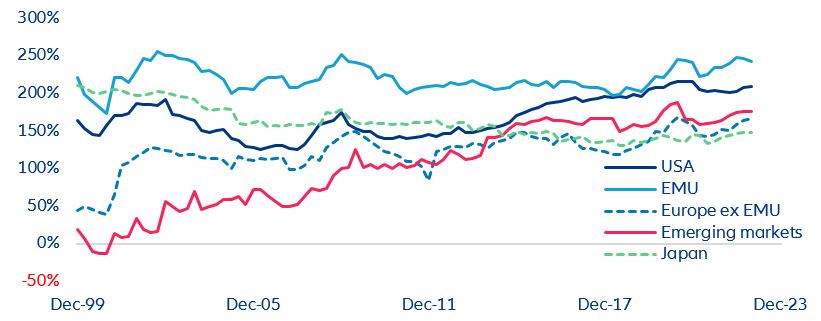

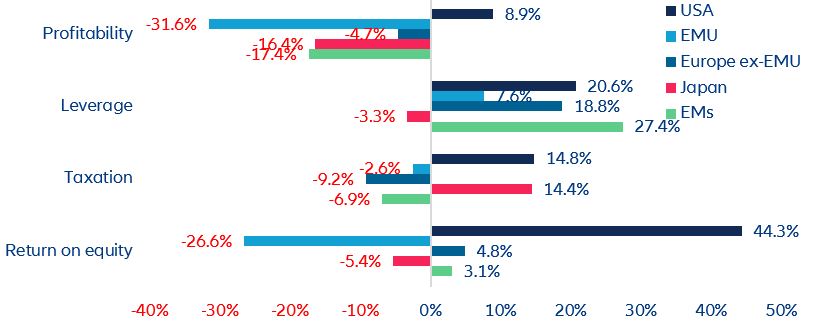

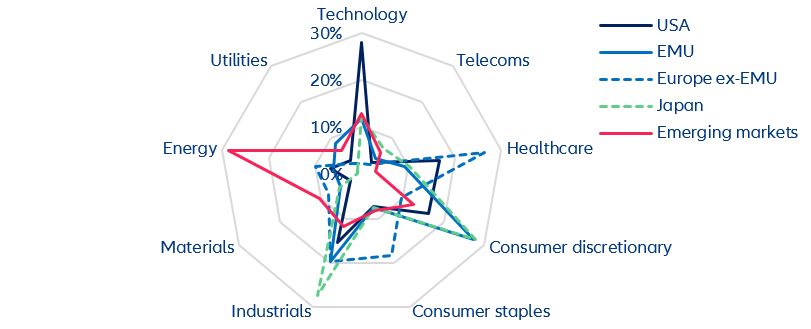

- In a context of higher inflation and financial instability on the one hand, and a just transition and deglobalization on the other, the drivers of Return on Equity (RoE) across geographies help identify risks and opportunities in equity markets. The US (high leverage, low taxation) and Europe outside the Eurozone (high Return of Capital employed or RoC and low cost of debt) recorded the highest RoE at the end of 2022, as well as on average between 2007 and 2022.

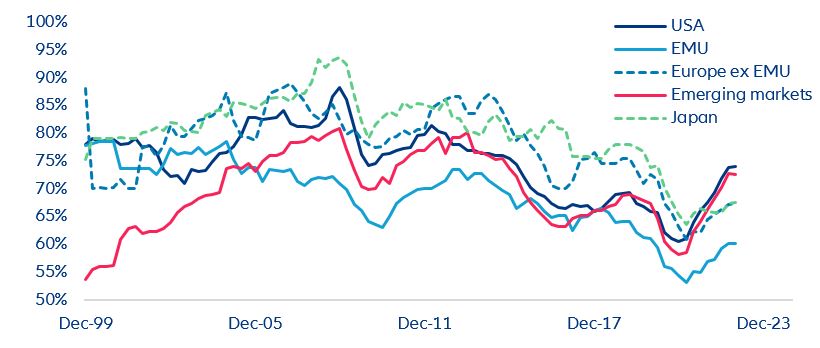

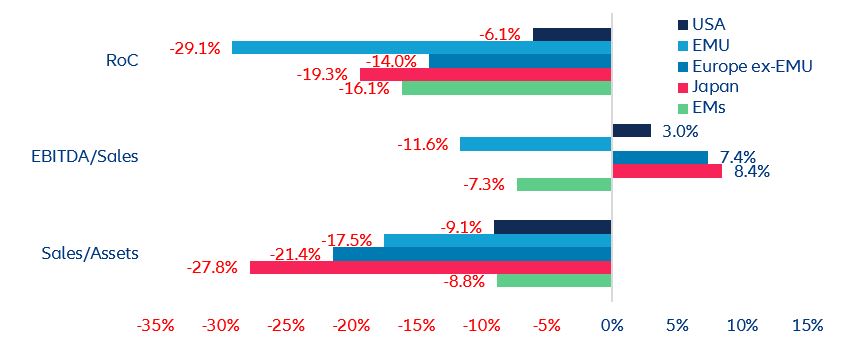

In contrast, we find the lowest RoE in Japan (low RoC, low EBITA margin) and the Eurozone (lowest sales-to-asset ratios). - Except for Japan, increasing leverage has been the key driver of returns on equity, especially in the US. Except for the US, profitability (RoC and its spread over the cost of debt) has declined. Taxation has had a second order and opposite effect. The RoC has declined in all countries or regions, driven by a general decline in the sales-to-assets ratio. By reducing shareholders’ equity, share-buyback programs have also contributed to the recent rise in companies’ debt-to-equity ratios.

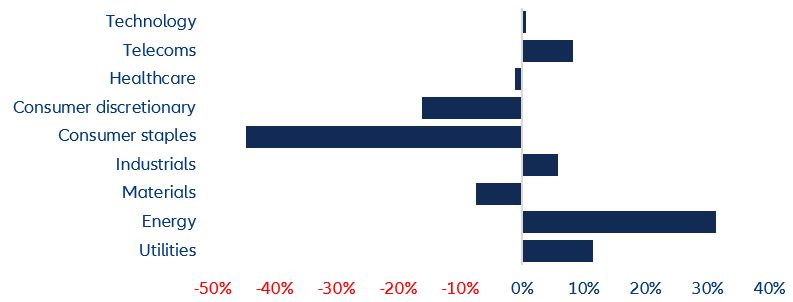

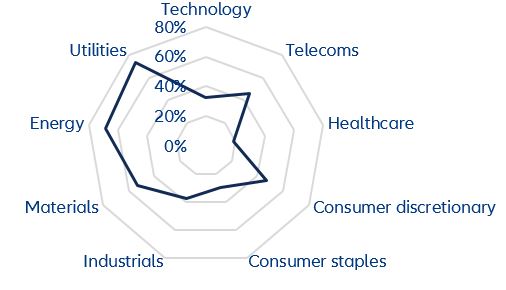

- Sector specialization affects capital intensity and funding needs. Similar cyclical (e.g. tighter financing conditions, slower growth) and structural (e.g. decarbonization, deglobalization) challenges could weigh further on economic performance through the return on capital employed. The technology services sector in the US (lowest capex and financing needs),the Eurozone’s consumer discretionary and industrials sectors (record leverage, low taxation) or the emerging world’s energy and upstream supply sectors (low RoC, limited leverage available) are good examples of increasing cyclical and structural vulnerabilities already largely offset by corporate finance tactics, and now more at risk.

What can companies’ RoE tell us about equity returns?

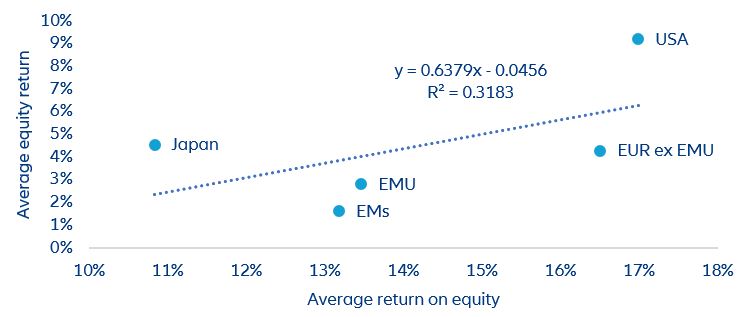

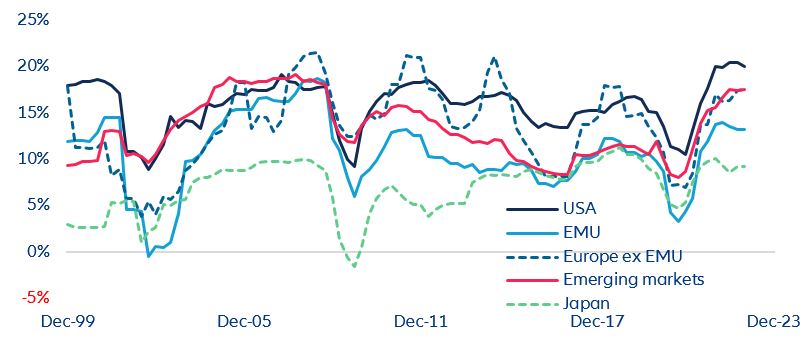

Equity returns, the market performance indicator, and Return on Equity, the accounting concept, are not independent of each other, neither theoretically, nor empirically. The Return on Equity (RoE) of a listed company is a financial performance ratio calculated by dividing the net profit of a company by its shareholders’ equity. First, stock markets do anticipate variations in RoE with a lead time of about two quarters. Second, stock markets with high RoEs tend to deliver higher equity returns than markets with low RoEs (Figure 1, opposite).

In a context of fresh cyclical and structural challenges – inflation and financial instability on

the one hand, climate mitigation and deglobalization on the other – identifying the drivers of RoE around the world may help to identify risks and opportunities in equity markets.

We know that RoE increases with:

- The return on capital employed (RoC). The RoC is the ratio of EBITDA (earnings before interest, taxes, depreciation and amortization) to total assets. It can be broken down into two intermediate ratios: the EBITDA margin (EBITDA-to-sales ratio), which is an indicator of economic profitability, and the ratio of sales-to-assets, which is a capital-intensity indicator.

- The spread between the RoC and the cost of debt (Cod)

- The company’s leverage level as measured by gross debt to shareholders’ equity … and decreases with:

- The effective taxation rate.