In focus – Past the peak for corporate profit margins

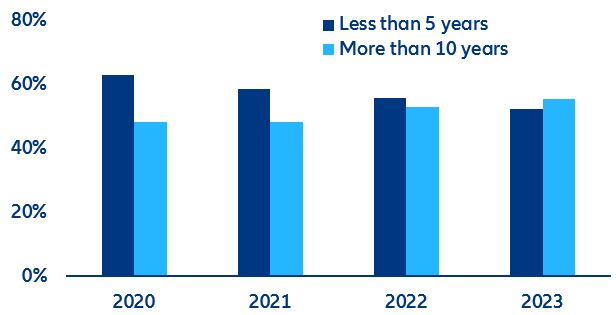

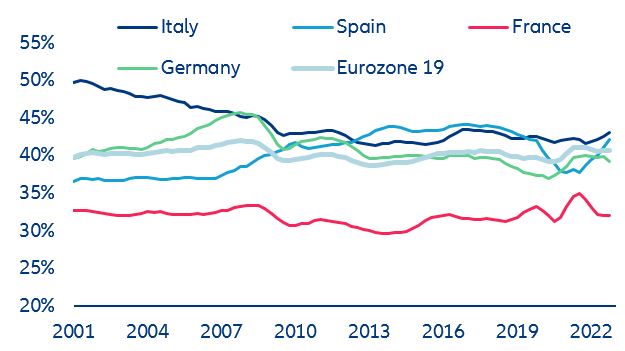

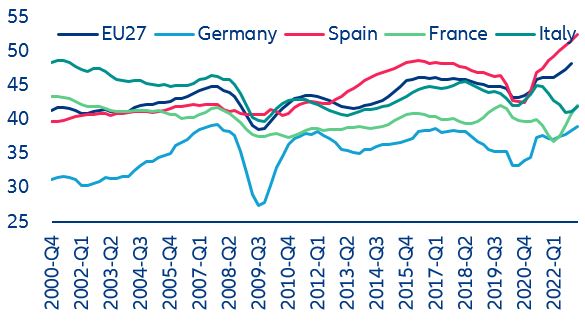

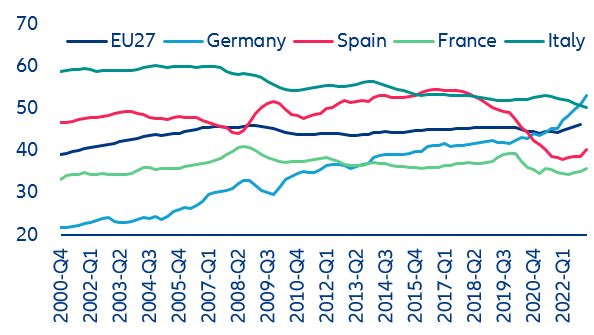

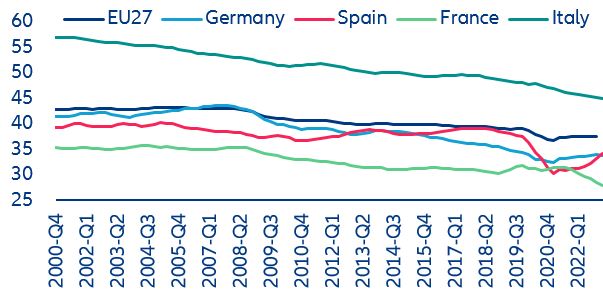

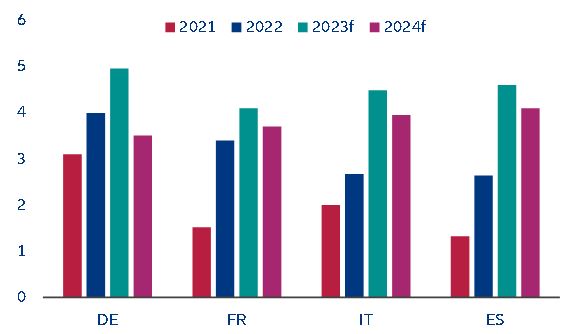

- Eurozone corporate profit margins reached 40.8% of gross value-added at end-2022 (+0.6pp above the long-term average). But the devil is in the details. Italy and Spain seem better positioned compared to Germany and France, notably in the manufacturing sector. However, excluding sectors with strong pricing power (such as transportation services and energy), margins are much lower and hit their lowest level since the mid-1980s in Q1 2023 in France.

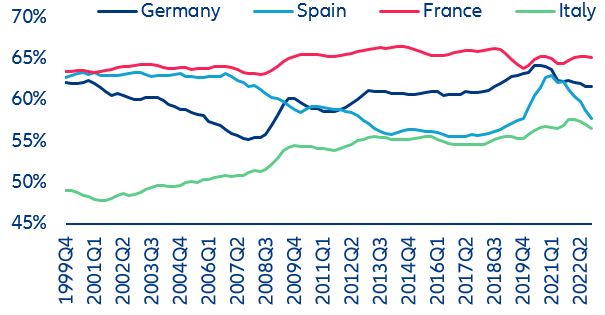

- Margins remain well below the pre-pandemic average in consumer services, with France being worst positioned (28% vs 37% in the EU and 45% in Italy). Despite resilient demand for services, companies face stiff competition, rapid wage increases and negative productivity growth (since the pandemic), limiting the extent to which they can increase their selling prices above input costs.

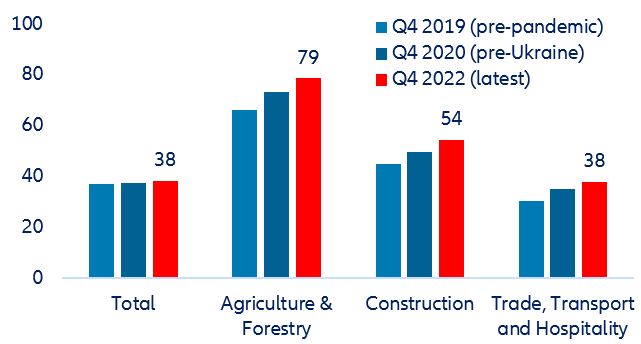

- German companies appear best in class in terms of profitability in the agriculture and construction sectors. Construction companies in particular have used the general upward trend in prices to significantly expand their profits to reach 53% of gross value added – even compared to other large European economies (36% in France, for example).

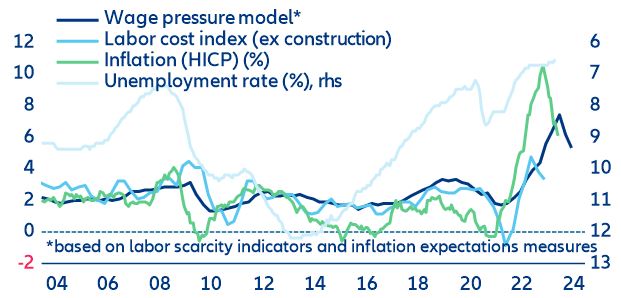

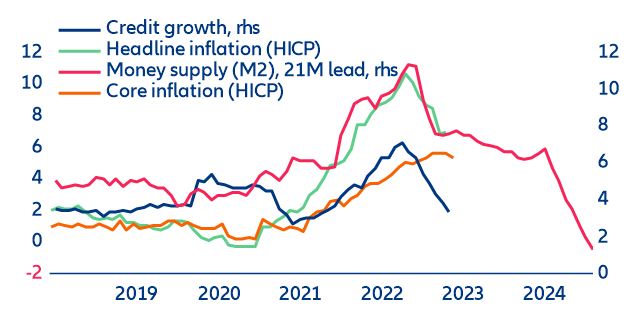

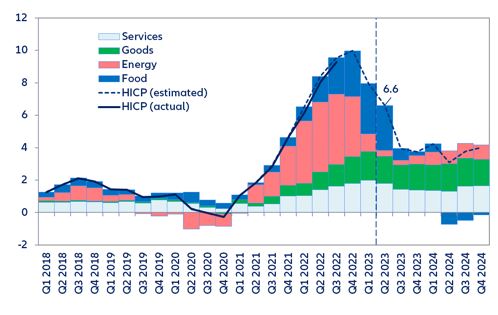

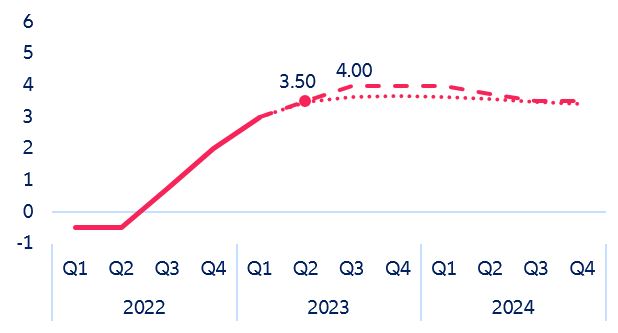

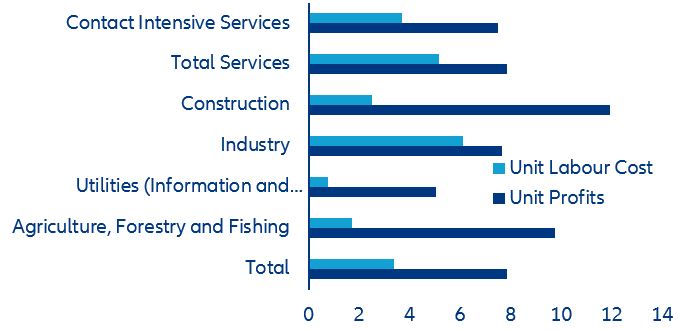

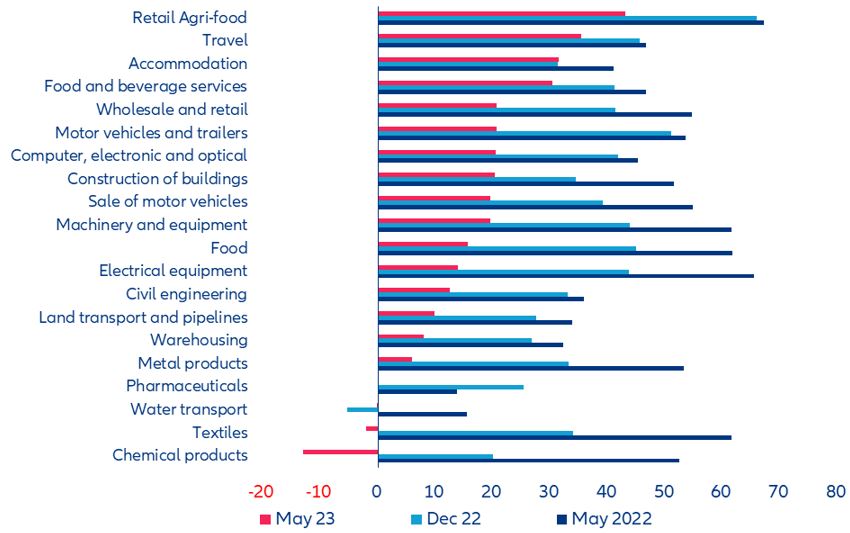

- Corporate profits should be past the peak amid strong wage pressures and diminishing pricing power (and even deflationary forces in metals, chemicals). While producer prices are decelerating strongly amid lower commodity prices, normalizing supply chains and growing deflationary fears in China, wage growth will remain high at least until early next year, which will contribute to squeezing corporate margins. The exception will be the services sector, which will delay the fall in service price inflation.