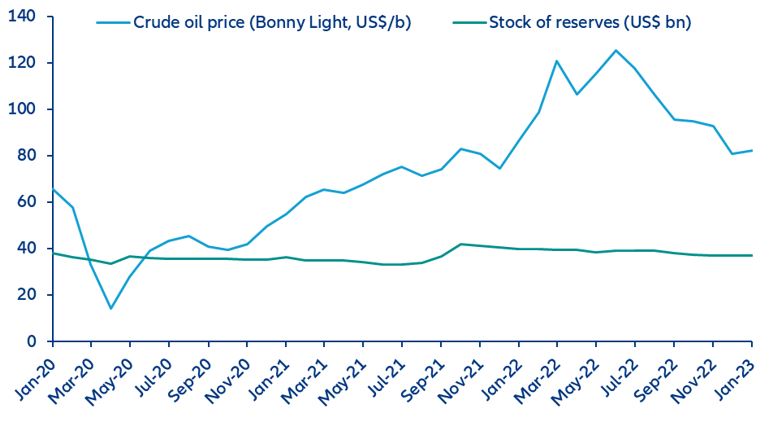

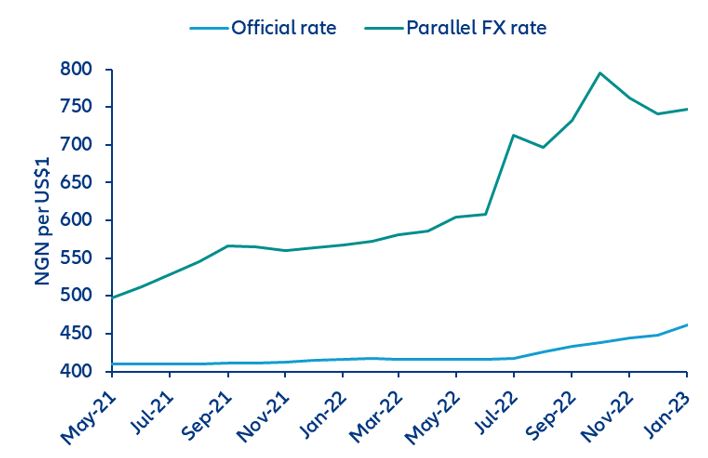

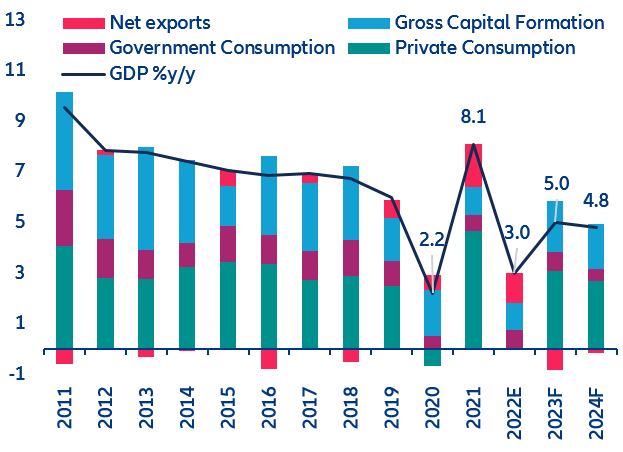

- Nigeria – Beyond the election transition. As Nigeria heads to the polls on 25 February, economic headwinds are intensifying. The next government will need to address falling purchasing power and demonstrate how the continent’s largest economy will keep up with the societal and green transitions.

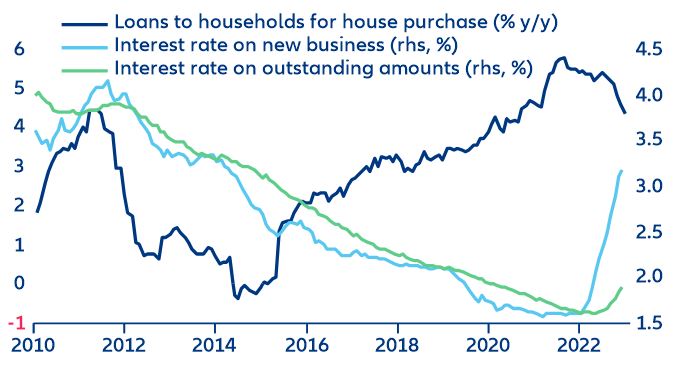

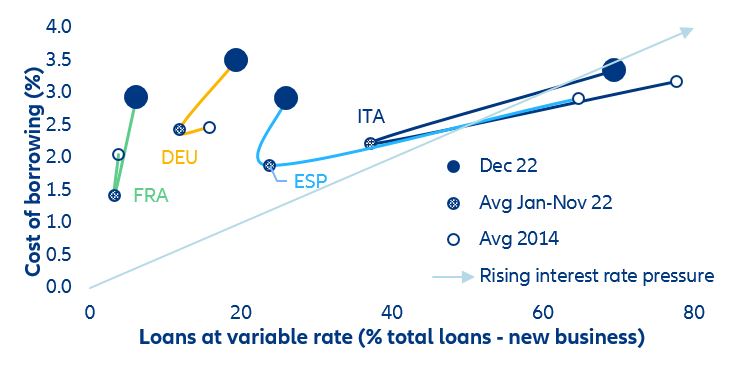

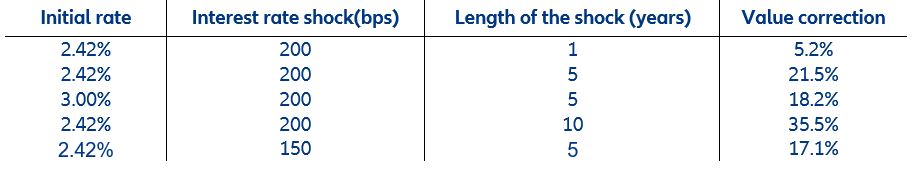

- Eurozone mortgages – Looking forward to the ECB pivot. Households are shifting to variable-rate mortgages, hoping for a quick return to lower interest rates. The first effects of higher borrowing costs are emerging.

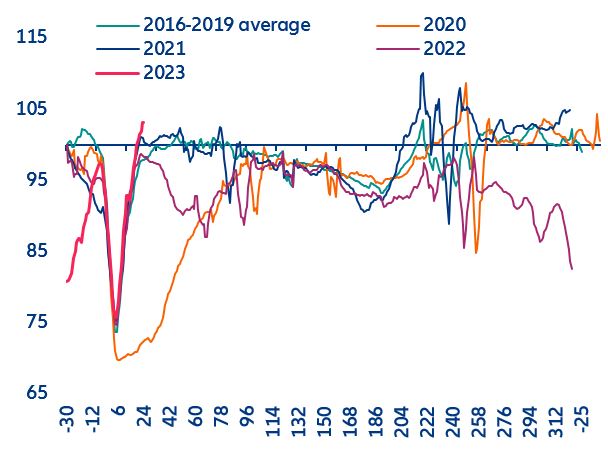

- China – The reopening is going well but don’t get too excited yet. Mobility has shot up in cities but other indicators suggest that all is not back to normal yet.

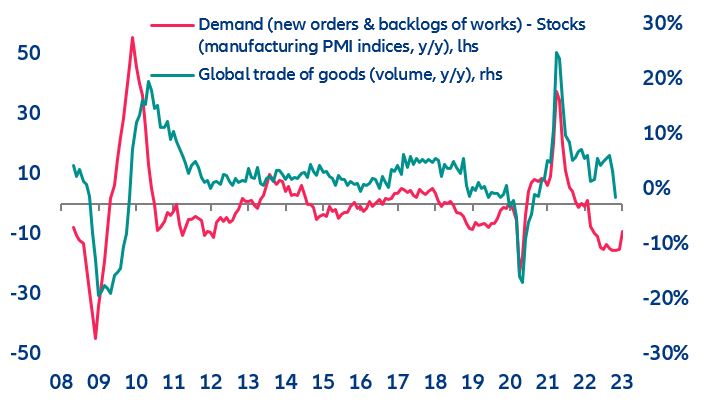

In focus – The silver lining amid muted global trade: normalizing supply chains

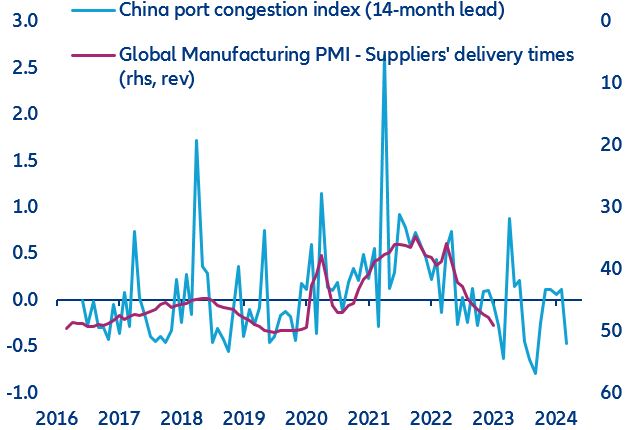

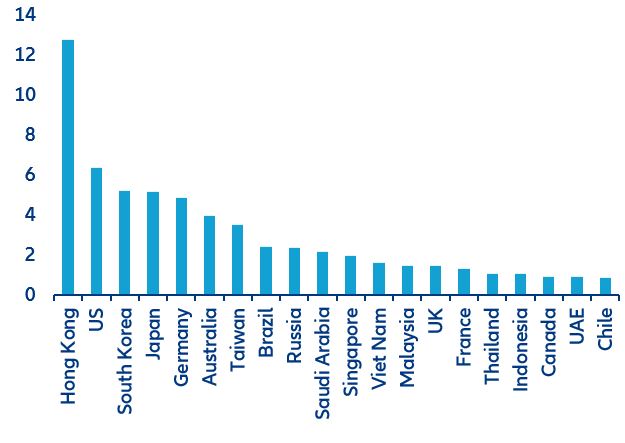

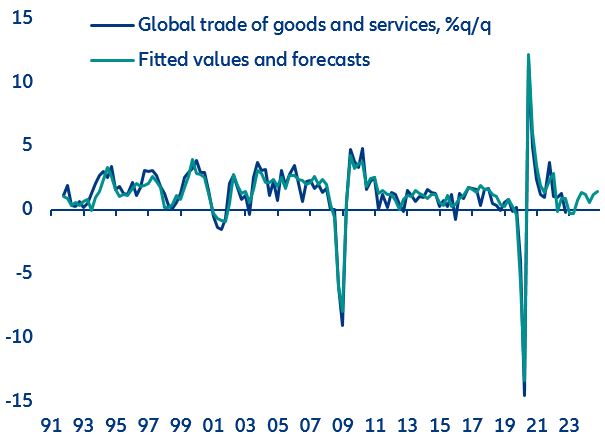

- After resilient performance in the first half of 2022, global trade deteriorated in the second half of the year and is likely to remain muted in 2023. However, China’s reopening reduces the risk of sudden stops in global supply chains, while moderately supporting global demand.

- We are revising slightly on the upside our forecast for global trade growth in volume in 2023, from +0.7% to +0.9%. Price effects should still be negative, resulting in a yearly contraction of global trade in value terms in 2023.

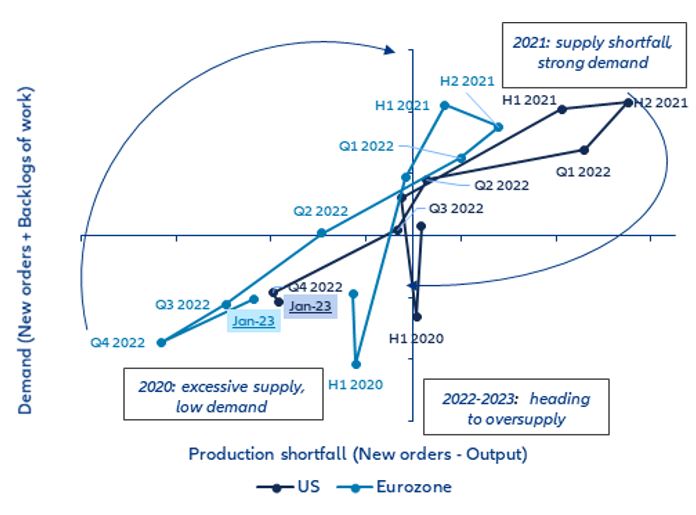

- For inventory management and supply chains, lessons have been learnt from the Covid-19 and post-Covid shortages. In fact, oversupply is likely to prevail in 2023 amid weakening demand, replenished inventories, increased capex and normalizing shipping conditions.

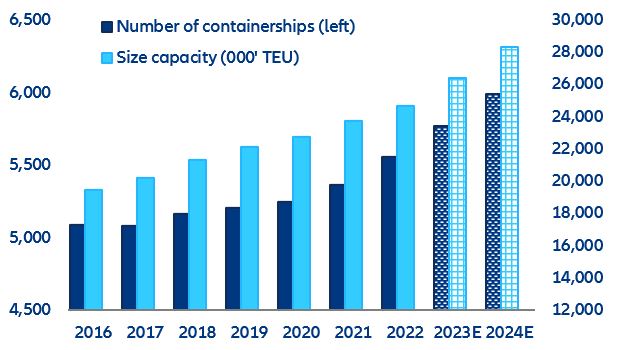

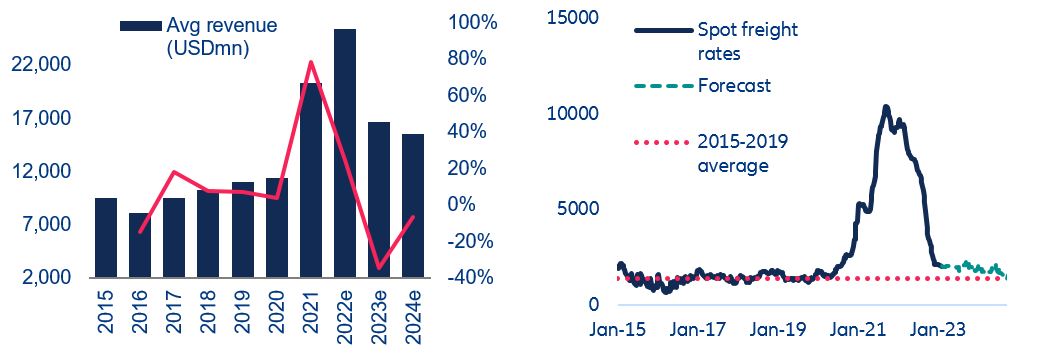

- Today’s oversupply has also been exacerbated by the expansion of ocean carriers’ fleets in 2022 (+4% y/y in number of vessels) using the excess cash generated by record-high shipping rates in 2021. In this environment, shipping costs are returning to their pre-pandemic levels.

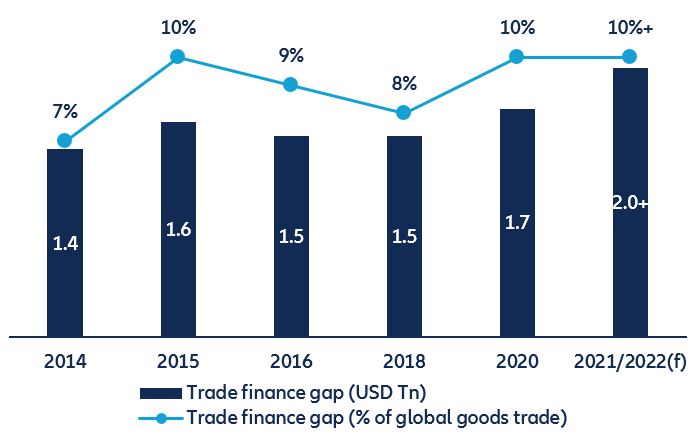

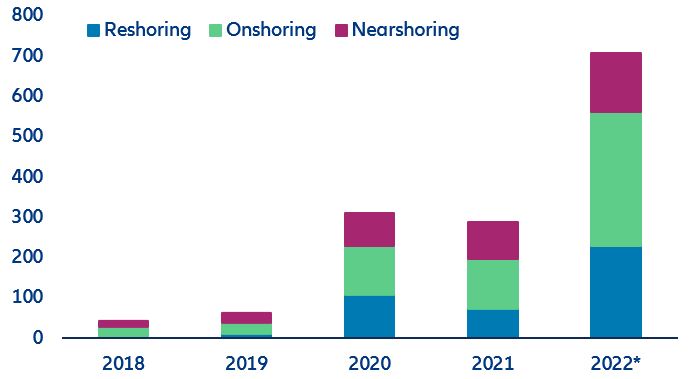

- While cyclical conditions reduced supply-chain disruptions, we are not fully rid of the risk of shortages, given a widening trade finance gap, the need for better and more infrastructure and geopolitical tensions.