In focus: UK – First to hike, last to pause and pivot

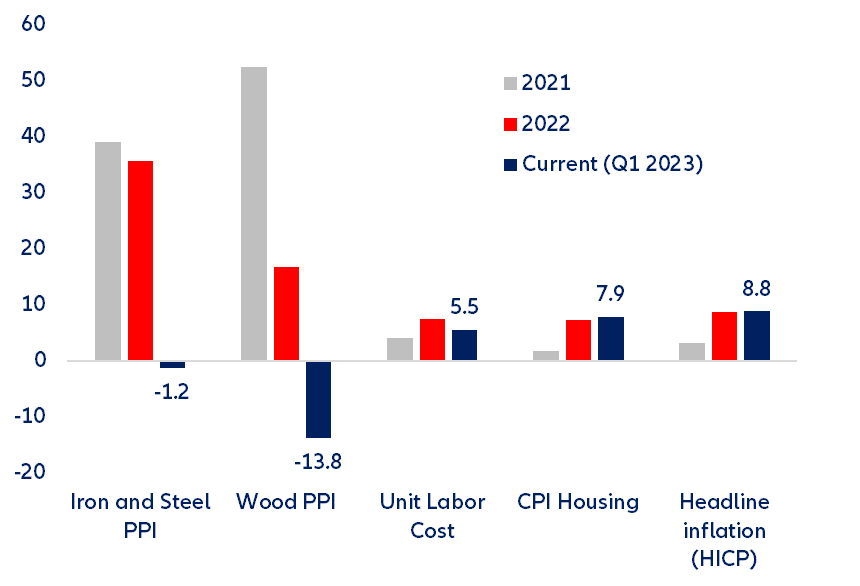

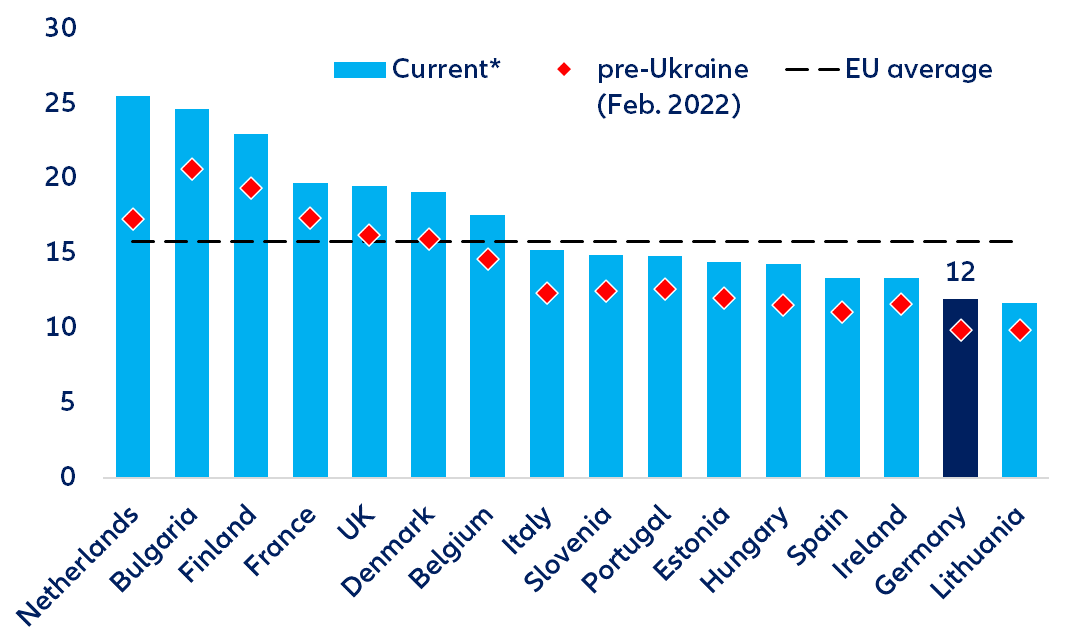

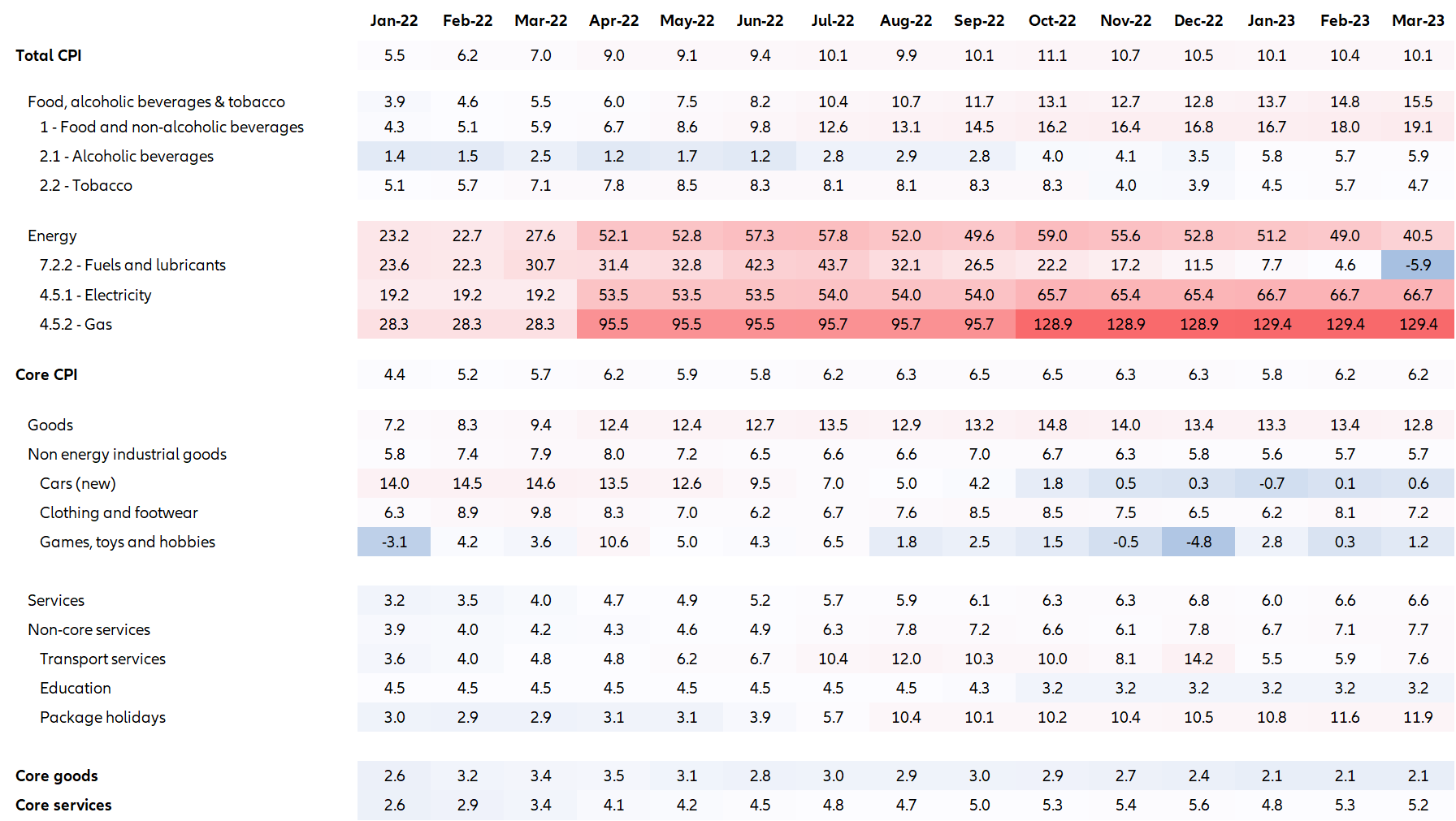

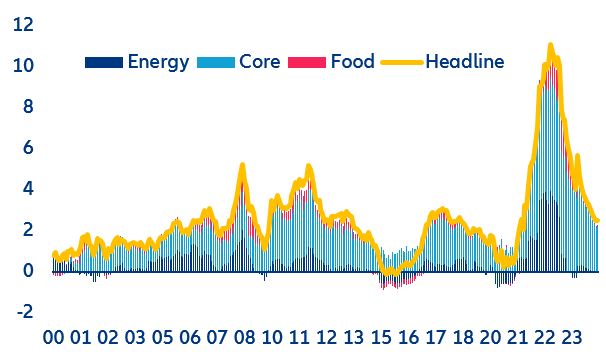

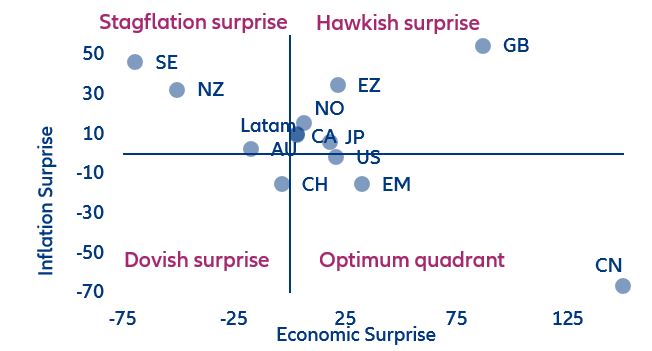

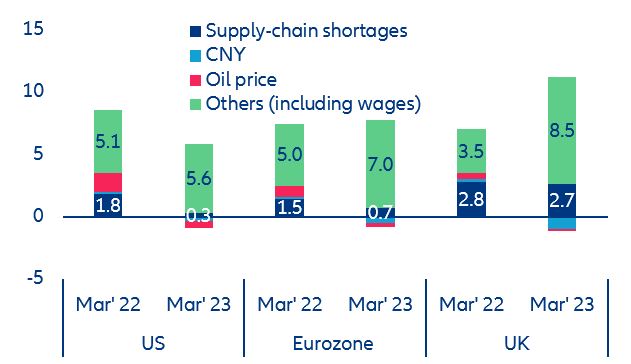

- As expected, the Bank of England increased interest rates by +25bps today, but it will have to contend with stickier-than-expected inflation ahead. In March, inflation hit 10.1% in the UK, higher than in all other Western European countries, as well as the US. Easing food prices and normalizing supply chains, as well as negative base effects from energy prices, will bring inflation down to 4% by Q4 2023. By end-2024, we expect inflation at 2.5% y/y but this will still be 0.5% higher than the level in the US.

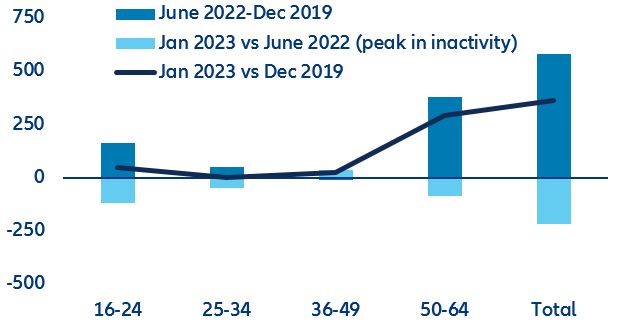

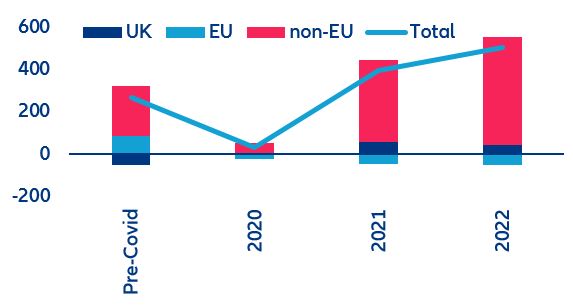

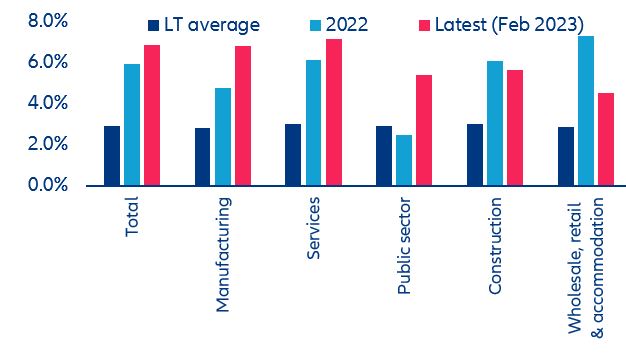

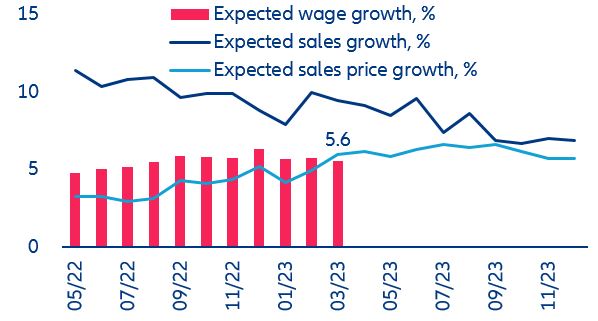

- A wage-price loop is the biggest concern. The share of inflation explained by wages has more than doubled in one year, much larger than in other Western European countries. We expect wage growth to stay close to 5% by end-2024 as slack in the labor market will be difficult to reduce, mainly due to Brexit and the high inactivity rate.

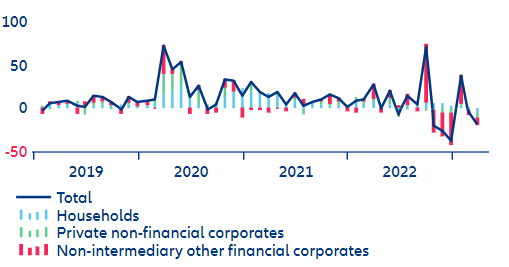

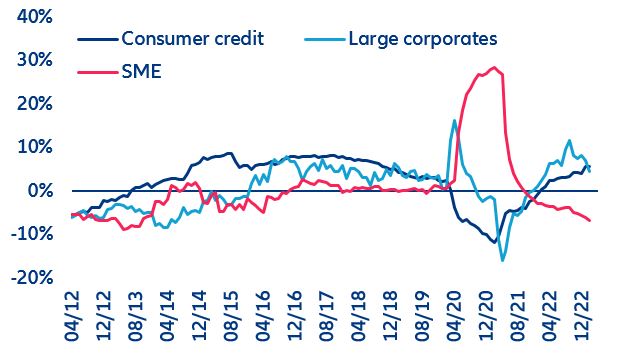

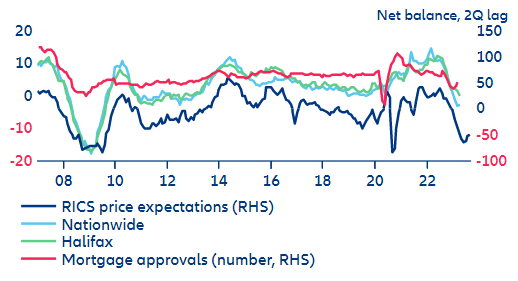

- The UK economy will start to show more signs of liquidity strains. Compared to past cycles, the transmission time from higher interest rates to the real economy has likely doubled from around seven months to more than one year. The resilient services sector has delayed the recession but banks’ credit conditions should start tightening in the coming months. Credit growth to SMEs is already contracting as much as seen during 2012-2013 but we expect this contraction to start to extend to households.

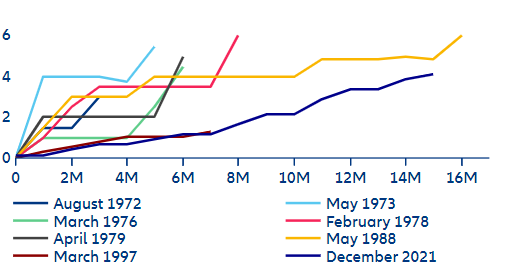

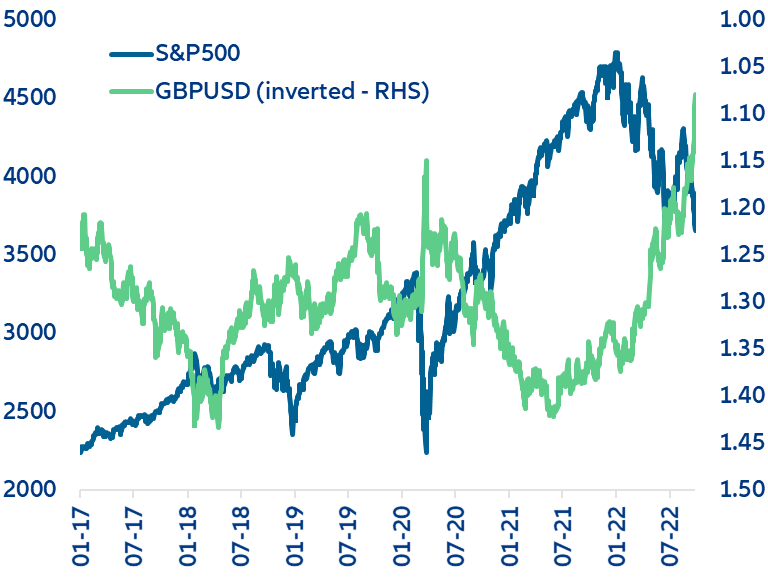

- Inflation remaining higher than in other advanced economies, rising global financial risks and the housing-market adjustment will push the Bank of England towards baby steps for longer. This means the bank rate will peak at 5% after three additional 25bps hikes by year-end and pivot only in Spring 2024, making it the longest hiking cycle in history. Overall, we do not think the Bank of England will cut interest rates by more than 100bps in 2024 as the housing-market adjustment will remain more moderate compared to the US (around -10% by end-2024). The inflation differential also bodes well for a 75bps rate differential for the US (expected at 3.25%) and should support a relatively stronger GBP (1.30 vs USD). Hence, UK rates will remain considerably above the neutral rate estimated between 1.25% and 2.5%.