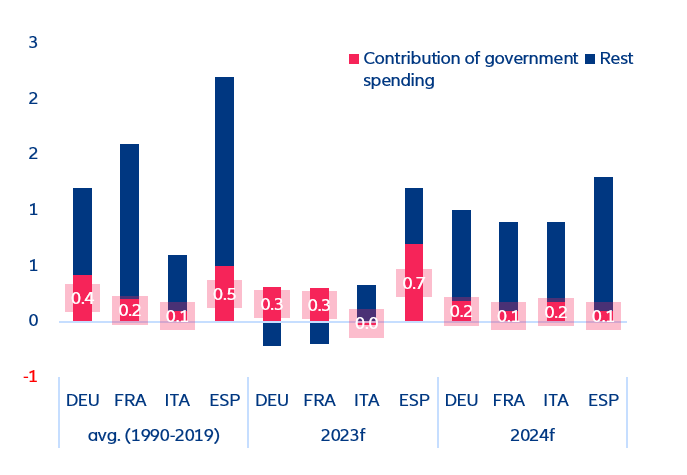

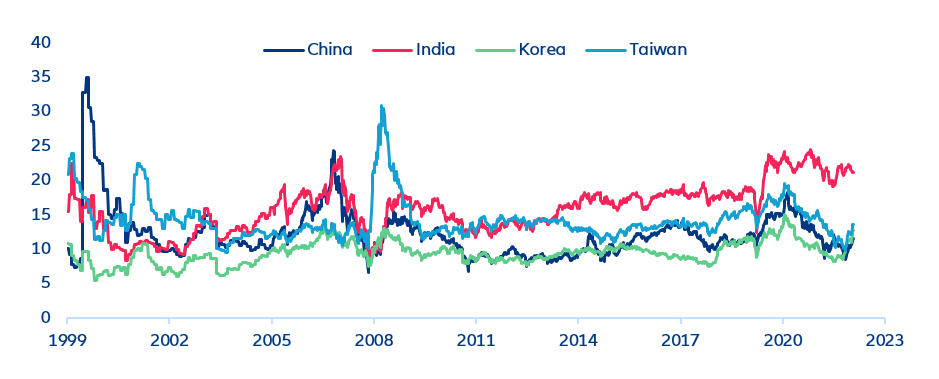

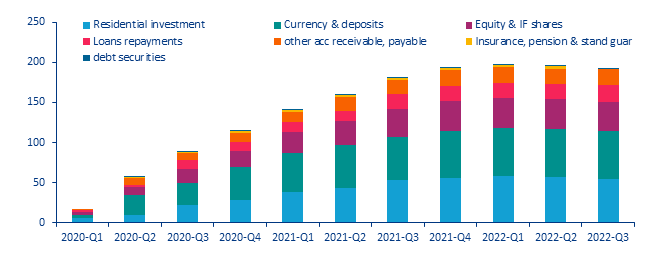

The turmoil around one of India’s largest conglomerates has shaken country’s financial markets, and it is a reminder of the need for structural reforms. Indian equity markets proved resilient against the severe global correction in 2022 – in part thanks to the country’s different exposure to the China-US tensions compared to other regional competitors for financial flows. This has in fact lead to an overvaluation of its assets vs. that of other emerging markets, but the turmoil around the conglomerate threatens to reverse this. As such, the challenges that the Indian financial markets face are multiple: increased scrutiny over the country’s capacity to orderly absorb large flows, the stress test to the financial system should liquidity problems arise, comparatively expensive ratios (Figure 6) and the downward pressures coming from the macroeconomic outlook.

The correction will only get worse. While the initial market sell-off (more than 20% in the affected stocks and around 3% in the broad market) seems to have halted, there is more to come. Even as Indian conglomerates are almost guaranteed financial aid, given their strategic role in the economy, Indian financial authorities are likely to tighten their grip to tackle the unwanted consequences of the expansion and increasing complexity of the financial market. Investors will also reassess their investments in the country. According to our calculations, markets could fall another -8% this year as expectations adjust to the long-term trend. But inaction could bring even harsher consequences: If authorities ignore the challenges that the internationalization of financial markets brings, the potential damage in the medium term will be larger.

The recently released Union Budget could help cushion the cyclical downward pressures coming from slowing private consumption and exports; however, India needs further reforms to reach its long-term potential. On 1 February, finance minister Sitharaman presented the budget for fiscal year (FY) 2023-24. Ahead of the upcoming national election in mid-2024, the budget aims for fiscal consolidation while protecting growth and lower-income populations, targeting a deficit of 5.9% of GDP in FY2023-24, down from 6.4% the previous year. It also aims for a large jump in capital spending (+33%), with a continued focus on infrastructure (including the energy transition). Beyond the short-term, higher infrastructure spending should continue to attract foreign investors to India. Policymakers have also put in place incentive measures in recent years (e.g. Make in India, Production Linked Incentive schemes) to develop the country as a manufacturing hub and competitive exporter in the long run. Indeed, India was one of the countries that benefited from the 2018-2021 trade tensions between the US and China and stands to benefit again, especially as China’s population is shrinking. However, further structural reforms are still necessary, including to improve financial stability and the labor market, and to reduce bureaucratic red tape.

Figure 6: 12M Forward PE ratios of selected Asian equity indexes