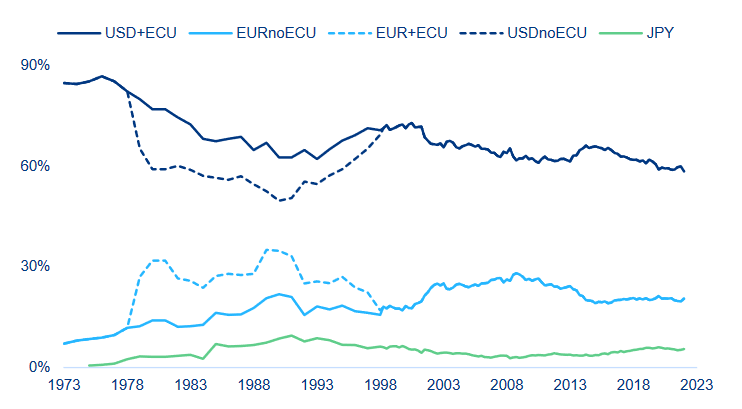

In focus – De-dollarization of FX reserves? Not so fast…

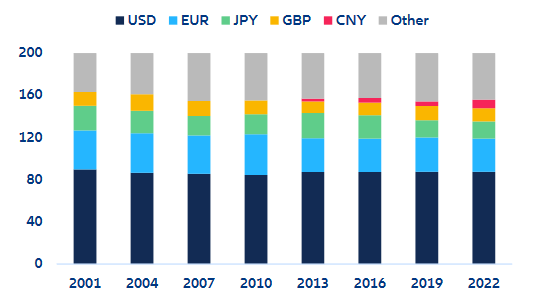

- Recent efforts by some emerging market (EM) countries to diversify their currency reserves away from the US dollar have raised questions about the beginning of the end of USD dominance. However, the dynamics affecting the US dollar’s role as reserve currency are far more intricate than official statistics suggest and any material decline in the role of the US dollar in global finance will take much longer than current headline news on de-dollarization insinuate.

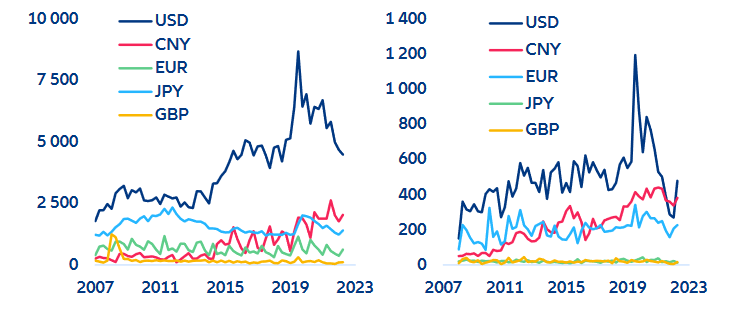

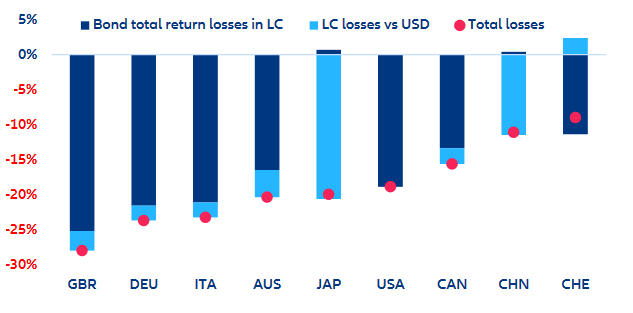

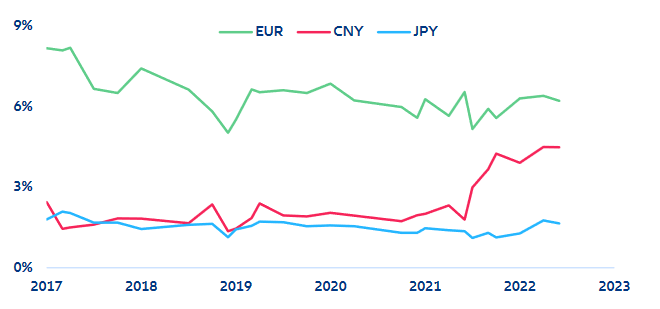

- The private sector’s use of the US dollar for trade and investment rather than the portfolio allocation choice of central banks will shape the currency’s status. The role of the USD in private sector transactions has remained virtually unchanged, with only slight adjustments based on FX turnover, bond issuance by non-financial corporates and SWIFT payments. In addition, reserves are predominantly invested in safe and liquid assets, but the non-US dollar investment universe remains too small and fragmented to absorb reserves demand, especially in those EM countries that have been most critical of their US dollar dependence.

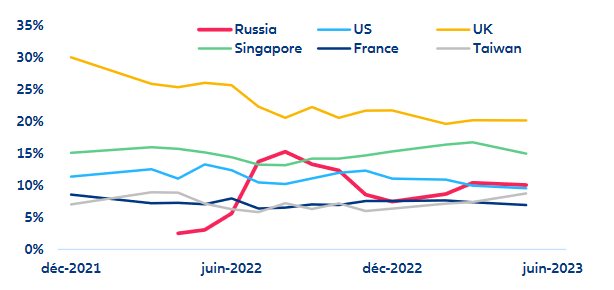

- Over the long term, the incipient fragmentation of global trade and more diversified oil demand – if persistent – are bound to strengthen the case for USD alternatives. The Gulf countries, which play a crucial role in supporting the USD (e.g. via oil prices and large USD reserves to maintain the peg), are increasingly looking towards China due to the structural changes in the oil market. Similarly, slowing globalization, driven by events like the Covid-19 pandemic and the war in Ukraine, has prompted – among other things – some countries to use non-USD currencies for bilateral trade, which will chip away at the share of USD in total reserves globally – but any significant change will take a long time.