A standard set of rules for every transaction

First, a definition: Incoterms, or International Commercial Terms, are a series of pre-defined terms for international transactions. Set by the International Chamber of Commerce (ICC), applicable anywhere in the world and widely used by exporters in every sector, Incoterms enable businesses to determine which party will be liable for the costs and risks associated with an export. They all cover the same events and steps, including shipment, ground and air transportation, customs clearance and insurance (accounting for the value of the goods, distance and modes of transportation) from when the goods leave the seller’s factory and until the buyer has received and paid for them. In short, Incoterms define whether the buyer or seller is responsible for goods and liabilities at every stage of the shipping process.

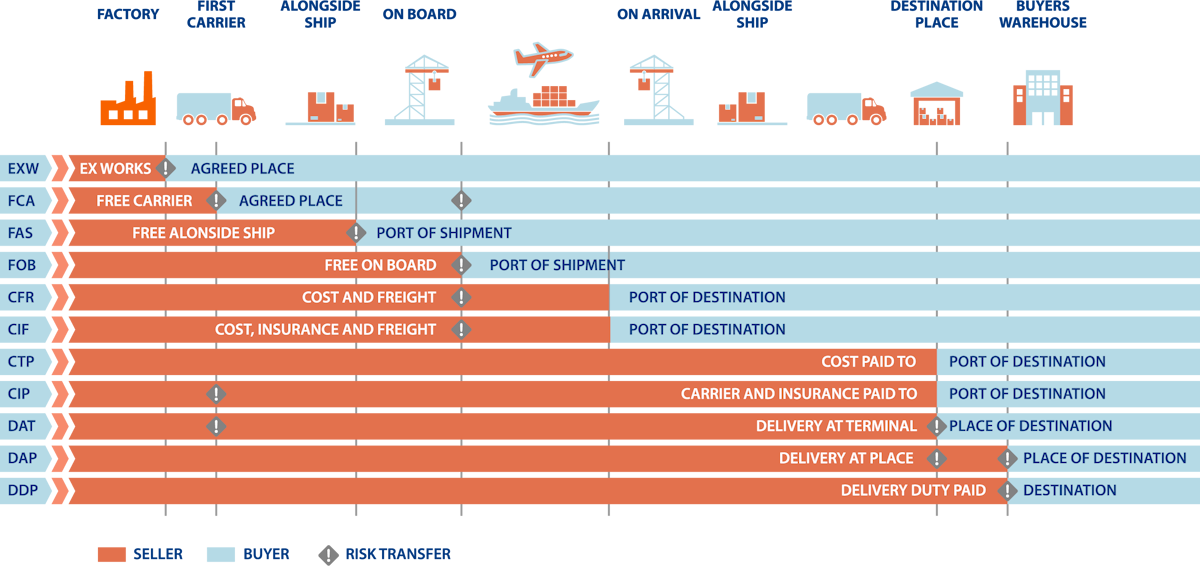

There are 11 types of Incoterms, broadly on a “sliding scale” of responsibility between the buyer and seller on the transportation and delivery of goods from the seller’s location to the buyer’s . In 10 out of the 11, paying import duties falls on the buyer (the only one where this is not the case is “Delivery Duty Paid”, or DDP.) Incoterms are updated every decade or so to account for changing commercial patterns and emerging risks; the most recent edition was issued in 2020 to account for geopolitical challenges, clarify obligations related to security requirements, and re-define “place of delivery”.

While it can seem quite technical, Incoterms give every commercial transaction a recognized framework, and are designed to remove ambiguity or room for (mis)interpretation. What’s more, because they define when goods and risks are transferred from the seller to the buyer, Incoterms can be used to maximize working capital and improve inventory management. This is especially useful in industries with narrow margins, or when companies need to increase working capital and secure cash flow (say ahead of an investment, or when costs might rise.)

So, what does this mean in practice? Say you are a producer of specialized electrical components used in consumer appliances. Your factories are in Japan, and one of your biggest customers is in Germany. The most convenient terms for you might be Ex Works, in which your customer would collect the electrical components from your sites and your liability ends as soon as they leave your premises. However, your customer might not want to take on all the costs of transporting the goods (which includes insurance and customs duties) – they might prefer Delivered at Place or Delivery Duty Paid. You might negotiate and meet in the middle – the most widely used Incoterms in B2B trade are Free On Board, and Cost, Insurance & Freight.

Using Incoterms today

In addition to raising costs and diversifying customers and suppliers, the Global Survey revealed one unexpected trend. As companies generally try to push costs onto suppliers, buyers’ Incoterms preferences are moving towards “Delivery Duty Paid.” This means the seller is responsible for managing all logistics and costs, including customs, to the buyer’s location – surprisingly, the Survey found a willingness among sellers to accept DDP. This is especially true in the wholesale and retail sector (where 28% of respondents use the DDP Incoterm the most), and less so in commodities (12%). One possible explanation is that companies are more accustomed to negotiating and sharing costs in B2B transactions. The only exception to this is in the United States, where companies continue to favor “Cost, Insurance & Freight.”

We are also seeing companies negotiating more intensely about the Incoterms governing each transaction. Both exporters and importers can expect this to continue, given ongoing uncertainties in global trade conditions and the tendency towards shifting or sharing risks. The small print in commercial contracts will prove to be ever more important as buyer and sellers try to minimize risk while protecting their relationships and business.

Your partner for global trade insights

In these conditions, having the right partners for global trade that can provide insight into macroeconomic trends as well as local market intelligence can be particularly beneficial to companies. Our team of economists, specialized in sectors and regions, coupled with credit analysts with deep knowledge of local business conditions and insolvency risk, are here to help customers navigate these headwinds, manage credit risk effectively, and protect their business.